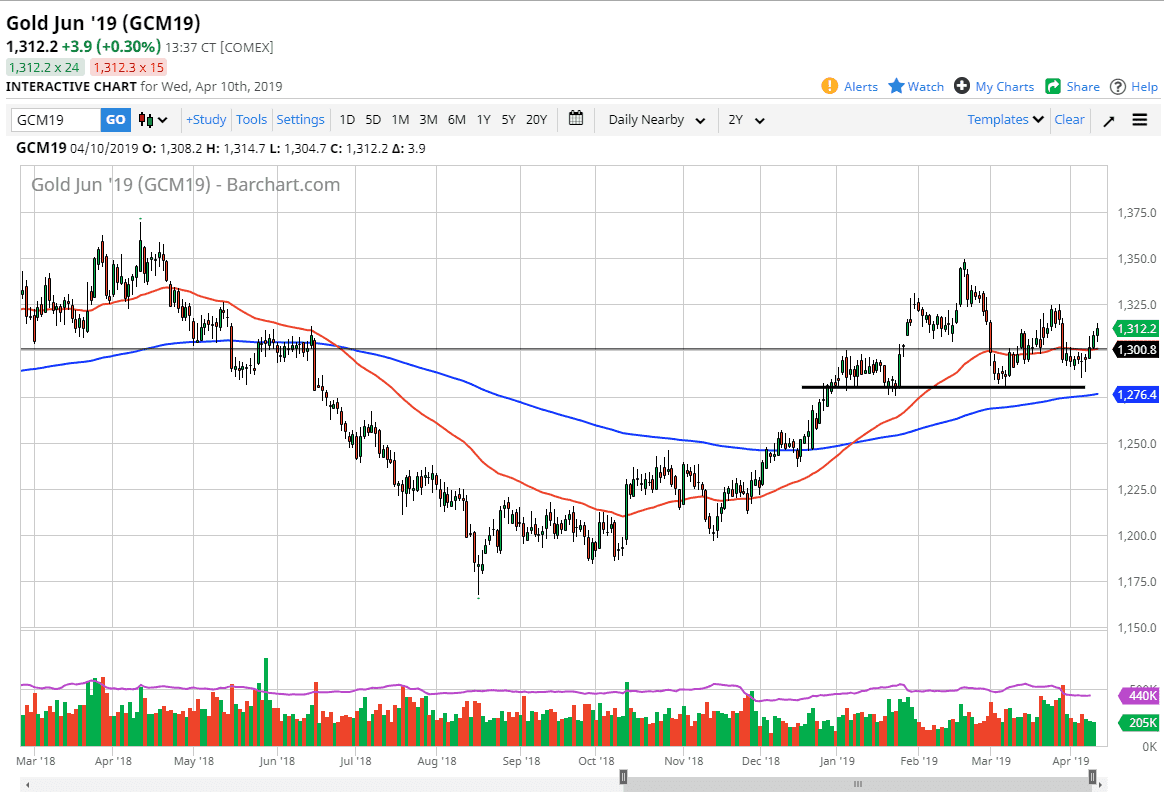

Gold markets rallied a bit during the trading session on Wednesday, after initially dipping. We have obvious support just below though, as well as obvious resistance above. The question now is what comes next?

Gold markets are presently being driven by the US central bank, in the sense that the greenback has been moving due to a lack of interest rates. Overall, I look at this chart in a represent a couple of different possibilities, as we have rallied a bit but each high continues to be successively lower. The question is now what happens going forward? The $1325 level is potential resistance, so in the short term I think we could go to that level. However, it doesn’t take much imagination to draw a bit of a descending triangle at this point as well. In other words, I believe that we have high potential of extreme choppiness.

To the downside, I recognize the $1300 level underneath as support, extending down to the $1280 level. Beyond that, there is the 200 day EMA which is currently trending higher and reaching towards the $1280 level as well. Because of that, I don’t necessarily think that we are going to break down after forming a descending triangle but it is a possibility so it is worth watching. If we can break above the $1325 level, then we will more than likely reach towards the $1350 level, followed by the $1400 level. That being said, you should watch out for both possibilities, and keep an open mind as markets will do what they want to do, regardless of what you think they should do. I’m firmly in that camp right now, and recognize that we simply let the market do what it wants, and follow accordingly.