The strength of the US dollar, along with more risk appetite, translates into heavy losses for yellow metal, one of the most important safe havens. This is happening now. Gold prices have fallen to $1273 a troy ounce since four months before settling around $1280 at the time of writing. As expected before, we confirm now that the stability of the price below the level of $1300 will increase losses. The US dollar is still strong with positive support for inflation figures; consumer prices and producer prices, and weekly jobless claims fell to their lowest level in 50 years. Investors' optimism has been boosted by the emphasis on negotiating to resolve the biggest trade dispute threatening the future of the global economy. And that a trade deal between the United States and China is now closer than ever.

The announcement by central banks - the European Central Bank and the Federal Reserve - of their monetary policy did not support further gains for gold prices because they confirmed what they announced in previous meetings.

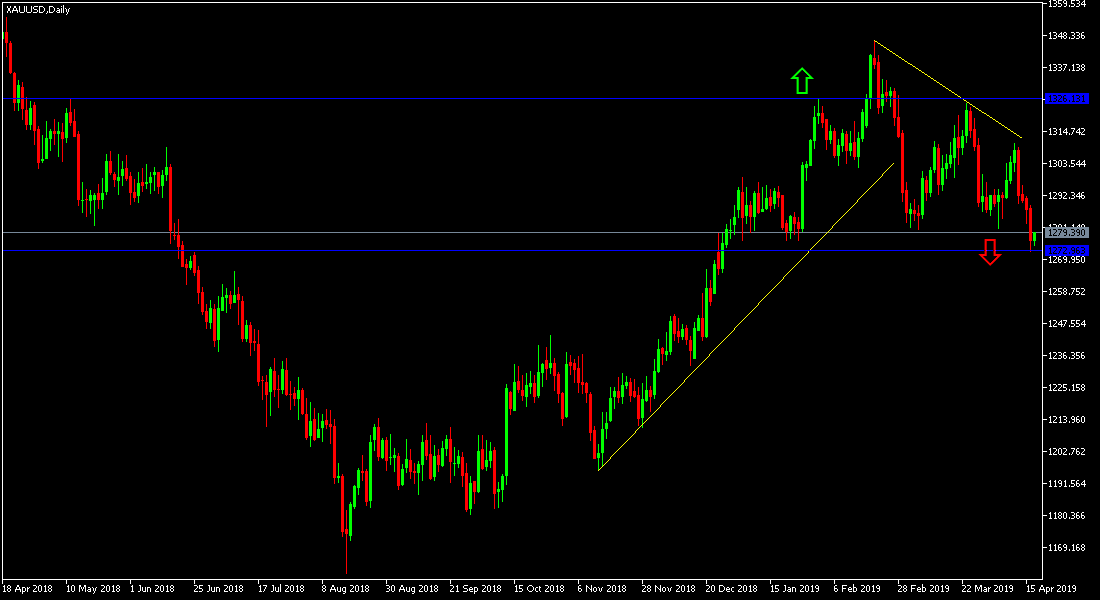

In previous technical analysis, we noted that on the daily chart below it is clear that there is a formation of the head and shoulders of the yellow metal, which threatens new selling pressures. The dollar's strength has contributed to gold losses despite US economic growth slowing in the fourth quarter of 2018 more than expected.

The Federal Reserve Board announced as expected to leave interest rates unchanged. The US central bank's outlook has indicated that interest rates are likely to remain unchanged for the rest of 2019. They also announced that by September, they would not reduce their bond portfolio, a change designed to help keep long-term loan rates down. "It is time to be patient and wait and wait," Powell said, citing the global economic slowdown, not far from the United States and the continuation of trade wars.

Technically: Gold prices today, if stabilized below $1300, will increase the bearish momentum and the nearest support levels will be 1275, 1260 and 1245 respectively, which support the strength of the bearish trend. On the upside, the nearest resistance levels for gold are currently 1288, 1300 and 1315, respectively. We still prefer to buy gold from every bearish bounce.

In terms of economic data: the yellow metal will all focus on the level of the US dollar. Gold will also be affected by investors' risk appetite. Gold is one of the most important safe havens.