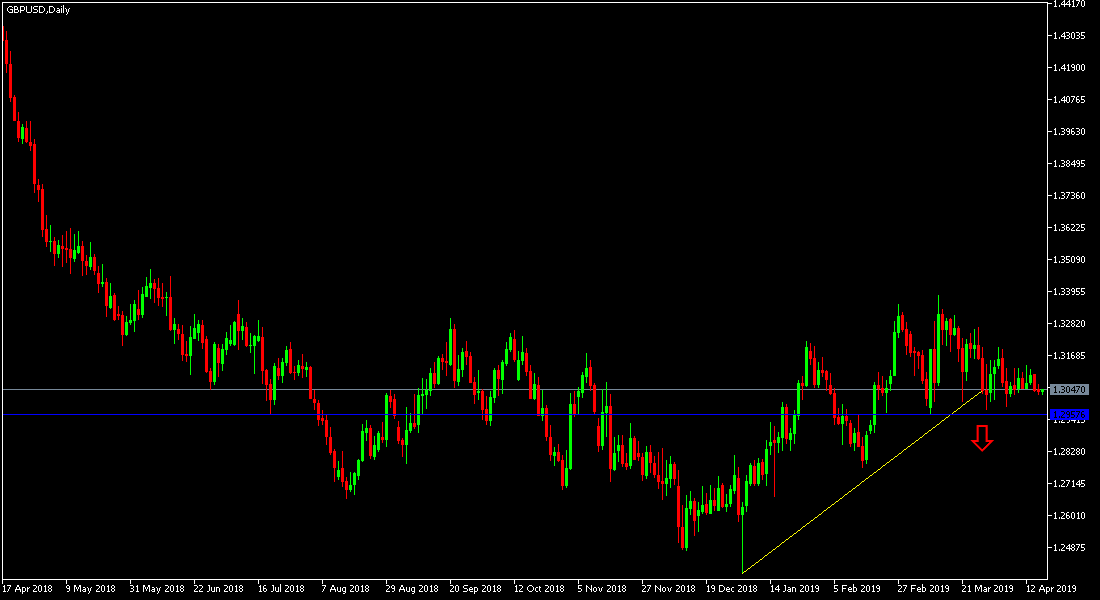

GBP/USD is still stable near 1.3000 psychological support and moving below it will support the strength of the bearish trend. At the beginning of this week's trading, the pair tried to correct above and reached 1.3118 before settling around 1.3035 at the time of writing the analysis. Although the European Union has agreed to postpone Britain's exit from the EU until the end of October, after last week's postponement, but the pair did not care about it and remained stable under downward pressure, because the division within the British House of Commons and even the British government still exists. May continues her attempts to persuade the House to pass her deal to ensure that she does not break out of the union without a deal, which would be catastrophic for the British economy and the pound sterling. Positive US inflation figures have increased the momentum of US dollar gains.

The data showed slowing growth of the British economy as expected, while industrial output improved. From the United States, consumer prices have been boosted by higher energy prices and the minutes of the Fed's latest meeting confirmed that the bank would remain patient if it thought of raising the US interest rate. The record also confirmed that the bank could keep interest rates unchanged in 2019 as trade wars continue Led by Trump.

The pair's attempts to correct upwards will remain weak until the official announcement of any positive development of the Brexit path.

Since the UK vote to exit the EU, we have always recommended selling the pound against other major currencies and that Brexit will not end overnight, and not easily, as some believe, so as not to spread the infection among the rest of the EU. Sterling gains will remain good opportunities to sell.

Brexit developments from time to time will continue to contribute to the volatility of the pair's performance.

Technically: The GBP/USD testing the 1.3000 psychological support and stabilizing below it will increase the bearish momentum and the trend will reverse and the pair will begin a new bearish move to support levels at 1.2950, 1.2825 and 1.2660, respectively. On the upside, unless the pair returns to stability above 1.3300, the upside correction will not be strong and at the same time its strong gains may be in the wind for any negative development of the Brexit’s future.

On the economic front: the economic calendar today will focus on the announcement of British retail sales. And from the United States it will be retail sales, the industrial index of Philadelphia and the claims of the unemployed.