Before the UK payroll and job numbers are announced, the GBP/JPY stands at 146.72 at the time of writing. The pound did not react very much with the EU agreeing to postpone Brexit to the end of October instead of the previous postponement date, because Britain's internal political division may hinder May's efforts to get the Brexit deal approved to ensure that the country does not leave the union without an agreement, which will be catastrophic for the British economy and the pound sterling. The pair's recent gains supported by risk aversion and the abandonment of safe haven led by the Japanese yen amid growing optimism that the US-China deal is close to ending their fierce trade war.

Britain's economic growth slowed down, while the manufacturing sector rebounded. So far, May government has not been able to obtain parliamentary approval for the Brexit deal. For the third time in a row, the British House of Commons rejected the Brexitt deal even after it was amended, adding to pressure on May and her government. British gross domestic product (GDP), unchanged as expected. In contrast, the Japanese TANKAN survey data confirm the Japanese economy's vulnerability to the US-China global trade war.

GBP’s losses because Brexit's developments are many, successive and contradictory. It was normal for the pound to depreciate against other major currencies.

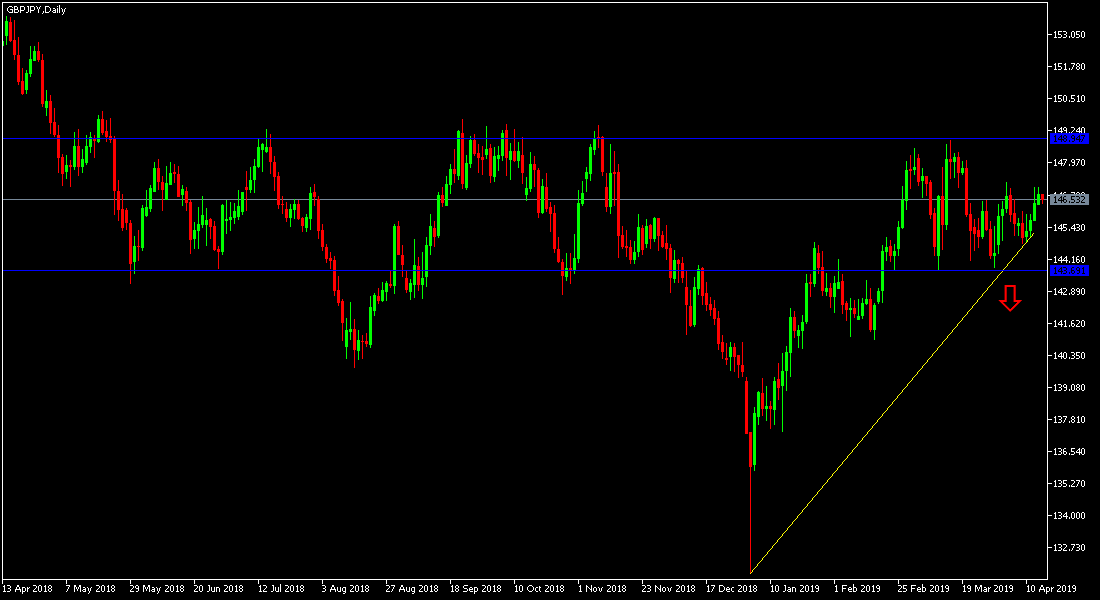

Technically: GBP/JPY correction and stability above 140.00 psychological resistance will support the continuation of the pair's upward trend, and the pair have tested all the levels we have anticipated in the previous analysis. Currently, the nearest resistance areas are 146.50, 147.80 and 150.00 respectively. On the downside, the nearest support levels are 145.45, 144.20 and 143.00 respectively. It remains best to sell this pair at every rebound as the Pound’s future remains uncertain as Brexit negotiations continues.

In today's economic data: The pair will monitor the results of British data on average wages, changes in job numbers and unemployment rate. The pair will be in a state of anticipation and waiting for Brexit’s negotiations. It will also focus on the uptake of safe havens.