The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 28th April 2019

In my previous piece last week, I forecasted that the best trades would be best trades would be short NZD/USD following a daily close below 0.6677, and short Gold in U.S. Dollar terms. The NZD/USD currency pair is unchanged from the relevant daily close, but Gold ended the week up by 0.82%, so the week produced an averaged loss of 0.41%.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the Australian Dollar. The Australian Dollar was hit hard by data showing there is currently no inflation, as this will probably force the Reserve Bank of Australia into a more dovish monetary policy.

Last week’s market was mixed, yet the overall “risk-on” mode seems to be surviving as stocks have continued to rise, although other risky assets have sold off.

The Forex market has been livelier, with the Australian Dollar in focus while the U.S. Dollar resumed its unlikely advance.

This week will probably be dominated by the U.S. FOMC release and non-farm payrolls data concerning the U.S. Dollar, as well as central bank input from the Bank of England.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar and on global stock markets following the Federal Reserve’s more dovish approach to monetary policy and growth. This can be expected to strengthen the Japanese Yen and Swiss Franc and weaken the commodity currencies. However, the U.S. Dollar and stock market have continued to advance, so either the fundamentals are not affecting sentiment or the fundamentals as I state them are wrong.

Market sentiment is mixed but still at least weakly risk-on.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index printed a relatively small, bullish candlestick within a multi-month area of consolidation. However, the price is up over 3 months and 6 months, indicating a bullish trend. Overall, next week’s direction looks uncertain, although the technical factors still point to a very slight probability in favor of a further rise next week.

EUR/USD

The weekly chart below shows last week produced a relatively large bearish candlestick which closed near its low. This is the lowest weekly close in almost two years. The price is in a clear long-term downwards trend, below its levels from both three months ago and six months ago. The price has not moved much in recent months but there has certainly been a steady drift down, with the price looking heavier and heavier. The price looks likely to fall further over the coming week.

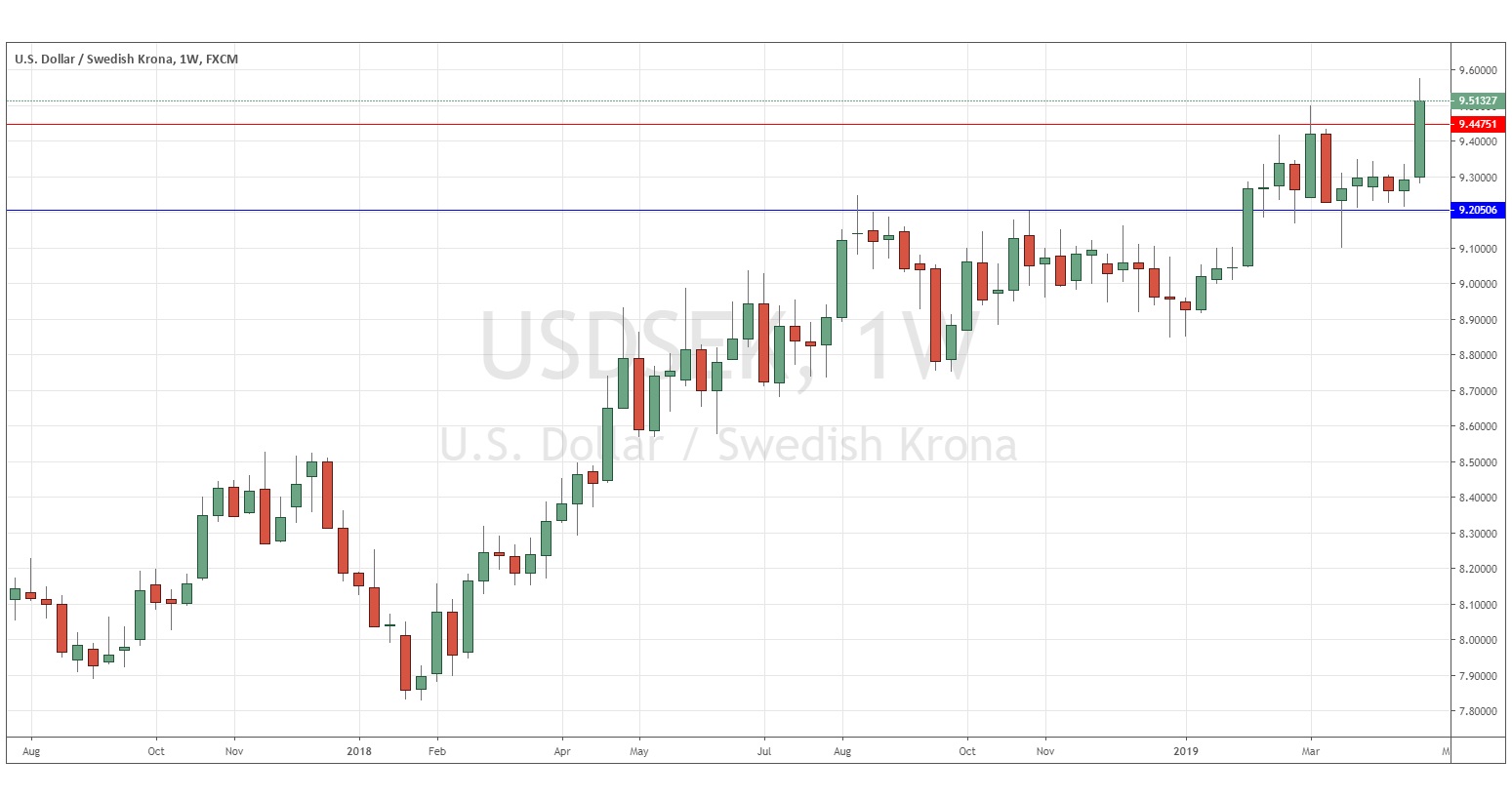

USD/SEK

The weekly chart below shows last week produced a relatively large bullish candlestick which closed just within its top quartile. This is the highest weekly close this pair has ever made, which is a bullish sign. The price is in a clear long-term upwards trend, above its levels from both three months ago and six months ago and rising steadily. The price looks likely to rise further over the coming week.

S&P 500 Index

The weekly chart below shows last week produced a bullish candlestick which closed right on its high. This is the highest weekly close this stock market index has ever made, which is a bullish sign. The price is in a long-term upwards trend, above its levels from both three months ago and six months ago – but we have seen some very large and volatile dips since January 2018. The price looks likely to rise further over the coming week, but the actual all-time high has still not been broken, so I’d still be a little cautious.

Conclusion

This week I forecast the best trades will be short EUR/USD and long USD/SEK and the S&P 500 Index.