The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 21st April 2019

In my previous piece two weeks ago, I forecasted that the best trades would be short EUR/USD below 1.1175 and long WTI Crude Oil. The EUR/USD currency pair never traded below 1.1175 that week, and WTI Crude Oil ended the week up by 0.68%, so the week’s trade was a profitable win overall.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the New Zealand Dollar. However, the movements overall were relatively small.

Last week’s market was mixed, yet the overall “risk-on” mode seems to be surviving as stocks and WTI Crude Oil have continued to rise, although other risky assets have sold off a little.

The Forex market has been relatively quiet and there was no standout item or data which really determined the overall market movement last week. There has been a temporary resolution of Brexit, with a second extension agreed until the end of October 2019. Interestingly, the Pound has been weak following this extension, closing at a multi-week low and looking bearish below 1.3000. I had thought that an extension would cause the Pound to rise somewhat but most likely not by enough to produce a real bullish breakout above the long-term highs.

This week will probably be dominated by regular monthly central bank input concerning the Japanese Yen and the Canadian Dollar, as well as Advance GDP data concerning the U.S. Dollar.

Fundamental Analysis & Market Sentiment

Fundamental analysis has turned more bearish on the U.S. Dollar and on global stock markets following the Federal Reserve’s more dovish approach to monetary policy and growth. This can be expected to strengthen the Japanese Yen and Swiss Franc and weaken the commodity currencies. It does seem that the greenback’s advance has been largely halted, if not reversed, yet it continues to look strong against the truly major currencies.

Market sentiment is mixed but still at least weakly risk-on.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index printed a relatively small, bullish candlestick within a multi-month area of consolidation. However, the price is up over 3 months and 6 months, indicating a bullish trend. Overall, next week’s direction looks uncertain, although the technical factors still point to a very slight probability in favor of a further rise next week.

EUR/USD

The weekly chart below shows last week produced a relatively small bearish candlestick. The price is in a clear long-term downwards trend, although there have been a few lower weekly closes over recent weeks. The price has not moved much in recent months but there has certainly been a steady drift down, with the price looking heavier and heavier. An important break below these long-term low prices looks possible and may indicate a stronger breakdown.

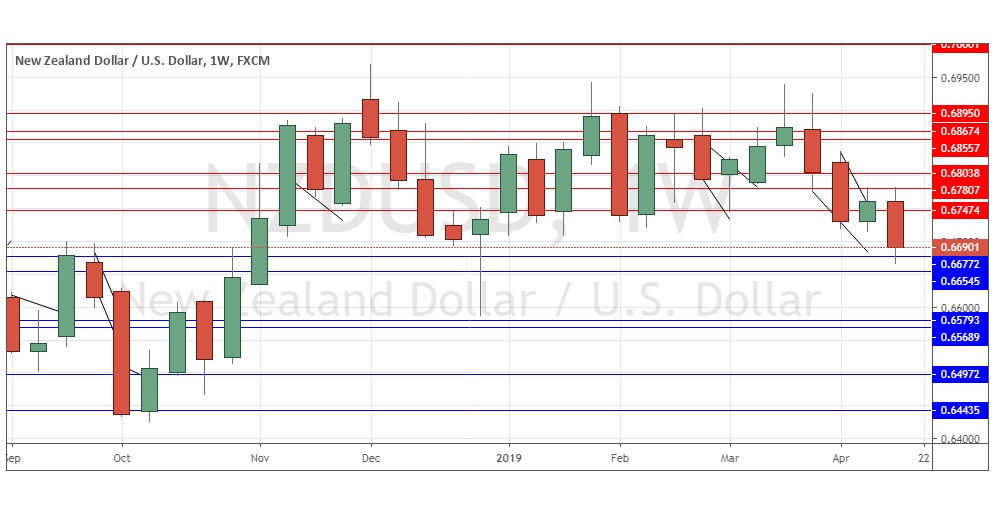

NZD/USD

The weekly chart below shows last week produced a bearish engulfing candlestick closing at a near 6-month weekly low. The price is in a clear long-term downwards trend, following a period of consolidation. The price has not moved much in recent months but has certainly begun looking heavier and heavier. An important break below the support levels above 0.6650 looks possible and may indicate a stronger breakdown to follow soon.

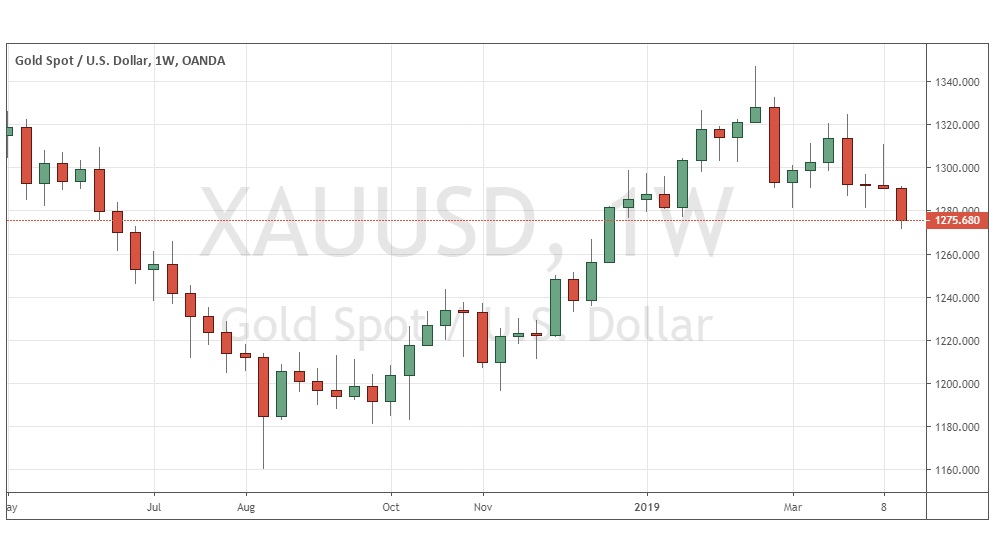

GOLD (XAU/USD)

This commodity has fallen quite heavily over the past two weeks and is trading near 3-month lows. The weekly candlestick closed near its low which is a bearish sign. It seems that a long-term bearish turn has happened, and the price looks likely to fall further over the coming week.

Conclusion

This week I forecast the best trades will be short NZD/USD following a daily close below 0.6677, and short Gold in U.S. Dollar terms.