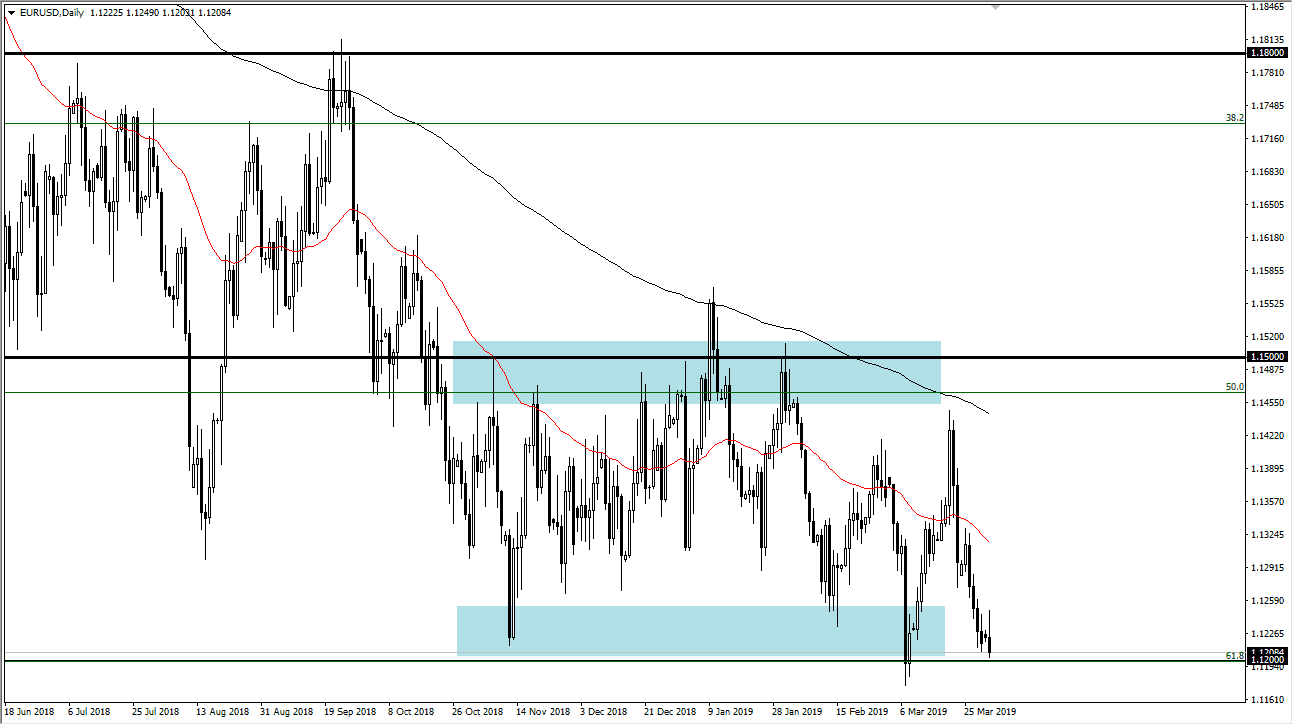

EUR/USD

The EUR/USD pair has initially tried to rally during the trading session on Monday but has given back most of the gains in order to form a very ugly candlestick. This suggests that what we are looking at is a serious test of a major support level in the form of the 1.12 level. If we were to break down below that level, we could send this market much lower, perhaps crashing into the 1.12 handle. The alternate scenario of course is that the support holds, as it has for so long. After all, it is the 61.8% Fibonacci retracement level from previous trading, so a break at the highs from the Monday session is indeed a signal that were going to go higher. In general, this is a market that I think continues to be very choppy in this region.

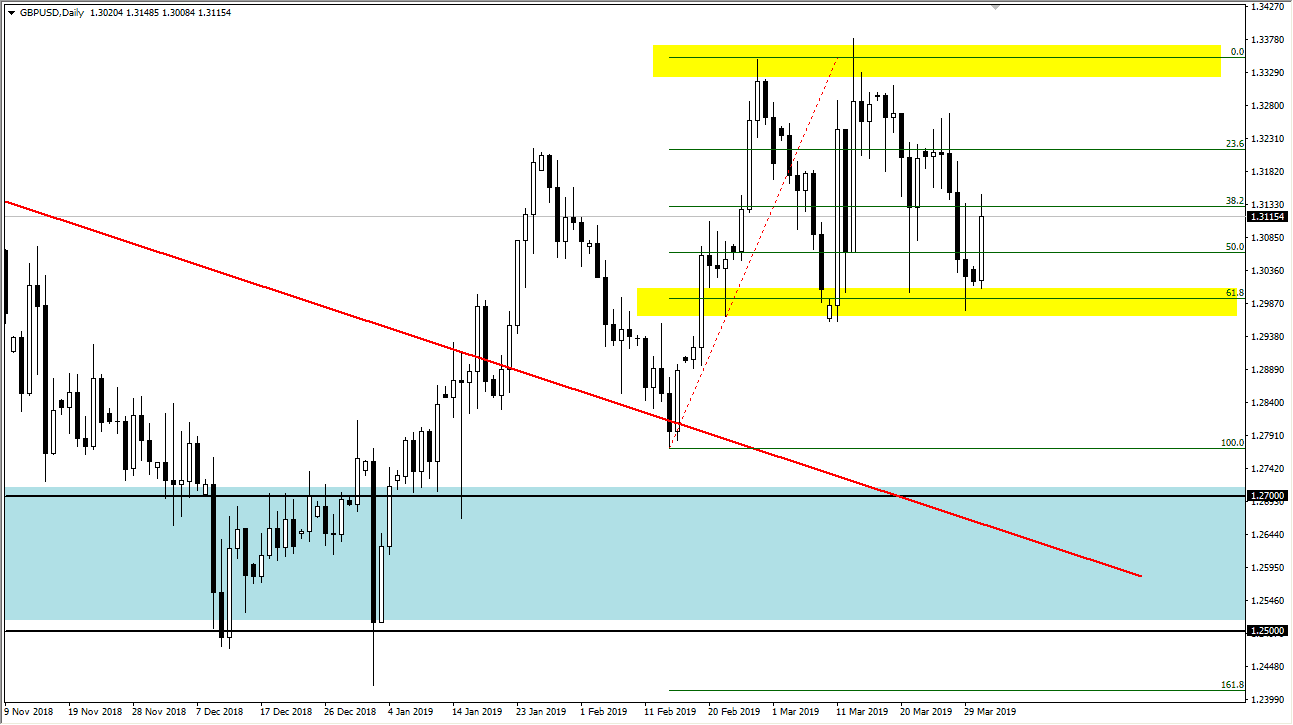

GBP/USD

The British pound has rallied significantly during the trading session on Monday, crashing through the 1.31 handle. This is a market that has just eclipsed the highs from the Friday session, so it does look as if we are trying to fight our way higher. With that being the case, were probably going to continue to consolidate between the two yellow boxes that I have on the chart, which is basically the 1.30 level, which is the 61.8% Fibonacci retracement level of the breakout, and the 1.3350 level above which is a major resistance. At this point, I suspect that we stay within this consolidation area but if we were to break down below, the market probably goes down to the 1.28 handle. In general, this is a market that remains in a holding pattern until we get relief from the Brexit headlines.