Expectations are for quiet moves today under an empty economic calendar. Overall, the confirmation of the negotiation parties in resolving the vicious trade dispute between the US and China, that there is a near final agreement to end the strongest trade ware threatening the entire global economic growth. These news increased the optimism among investors for more risk taking and to abandon safe heavens, Yen included, and therefore the EUR/JPY moved upwards to the 126.75 resistance level at the time of writing, the highest level for this pair since almost a month.

The European Central Bank, as expected, kept the interest rates as is, and is still concerned of the continuing slow economy in the Eurozone. The bank promised more stimulates in case economic situations worsen more than the current situation, especially if the American trade wars continued. Therefore, the Euro didn’t receive any significant support from the ECB’s announcement as it only confirmed what was previously announced.

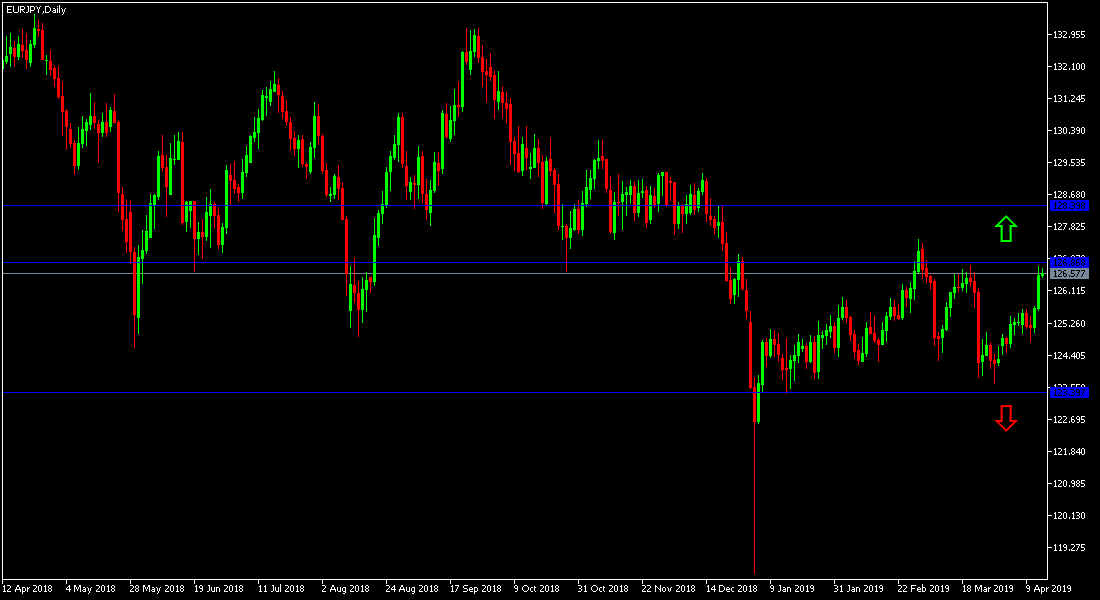

On the daily chart of the pair, it appears clearly the upward correction attempts but within limited ranges due the lack of investors’ confident in the Euro because of the slowing Eurozone economy led by Germany. The pair didn’t benefit from the investors’ risk appetite. Generally speaking, the weak Japanese Yen and the investors’ risk appetite rather than the Euro’s strength is what pushed this pair upwards.

European Central Bank President, Mario Draghi, announced that the bank is willing to take more procedures to aid the economy in case outlooks turned suddenly to the worst. Draghi added that the bank will take "all necessary and appropriate monetary policy measures" in addition to steps taken on March 7 meeting, when they announced the new cheap laons for banks and ruled out near the rate hike.

Technically: The recent EUR/JPY move has been an attempt for an upward correction and will not succeed without moving the pair towards the psychological summit 130.00 and getting established there, and has currently reached the levels we expected in previous analyzes and the nearest resistance levels currently 126.65, 127.30 and 128.45, respectively. On the downside, the nearest support levels for the pair are currently 125.50, 124.75 and 123.50, respectively.

In terms of economic data: the pair does not expect any important data today from the Eurozone or Japan and will watch any developments in the extent of demand for safe havens in case of increased geopolitical fears.