As for the euro in general, investors are still losing confidence as the Euro-Zone economy continues to slow, led by Germany, as US trade wars continue. In the case of the EUR/JPY, the gains were supported by risk aversion amid market optimism as the two negotiating parties work to resolve the fierce trade dispute between the United States and China over the near-final agreement to end the strongest trade war that threatens the future of global economic growth as a whole. The pair gains stable around 126.65 at the time of writing the analysis in waiting for stronger catalysts to complete the correction pace.

The European Central Bank, as expected, kept interest rates as is and remains concerned that the euro-zone economy will continue to slow down and promises more stimulus if economic conditions worsen more than the current situation, especially if US trade wars continue. Therefore, the Euro did not receive any support from the announcement of the bank because it confirmed what was announced in the past.

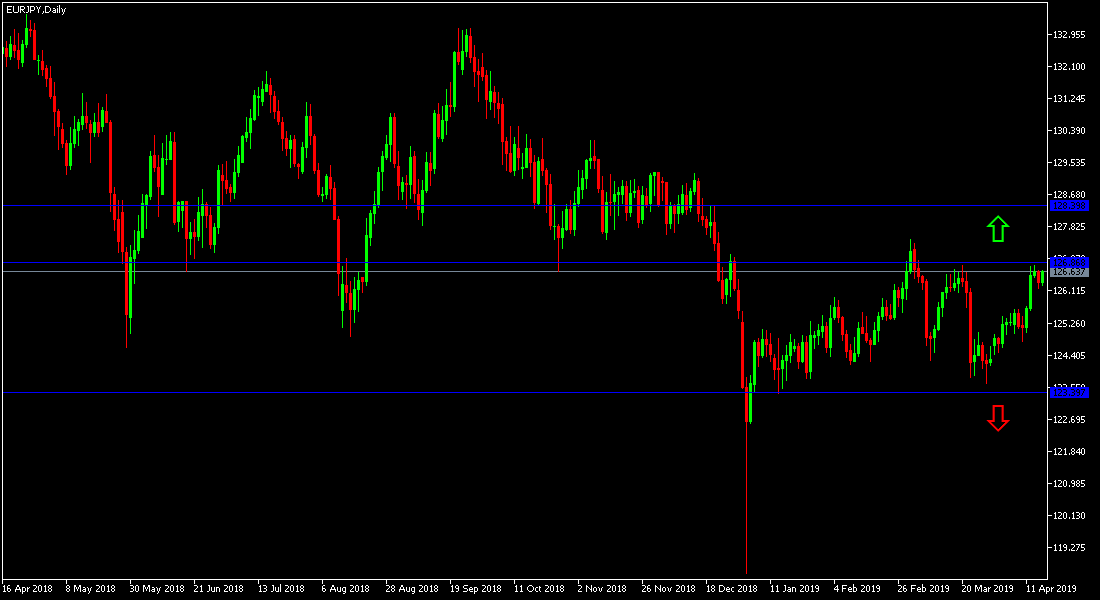

The pair's daily chart shows attempts to correct the pair's upward trend, but in limited ranges due to weak investor confidence in the Euro because of the slowdown of the Euro-Zone economy led by Germany. The pair did not take advantage of risk appetite well. In general, the weakness of the Japanese yen and increased risk appetite rather than the strength of the Euro is what drives the pair to make gains.

European Central Bank President Mario Draghi announced that the ECB is ready to take further action to help the economy if expectations unexpectedly turn to the worst. Draghi said the bank would take "all necessary and appropriate monetary policy measures" in addition to the steps taken at its meeting on March 7, when it announced new cheap loans to banks and ruled out near rate hikes.

Technically: The recent EUR/JPY attempt has been to correct the upside movement and will not succeed without moving the pair towards the psychological summit at 130.00 and to establish above it. Currently has reached the levels we expected in previous analyzes and the nearest resistance levels currently are 126.65, 127.30 and 128.45, respectively. On the downside, the nearest support levels for the pair are currently 125.50, 124.75 and 123.50, respectively.

In terms of economic data: the pair will watch the announcement of consumer prices and trade balance in the Euro Zone. Any developments in the Japanese yen's safe haven will be watched if geopolitical concerns increase.