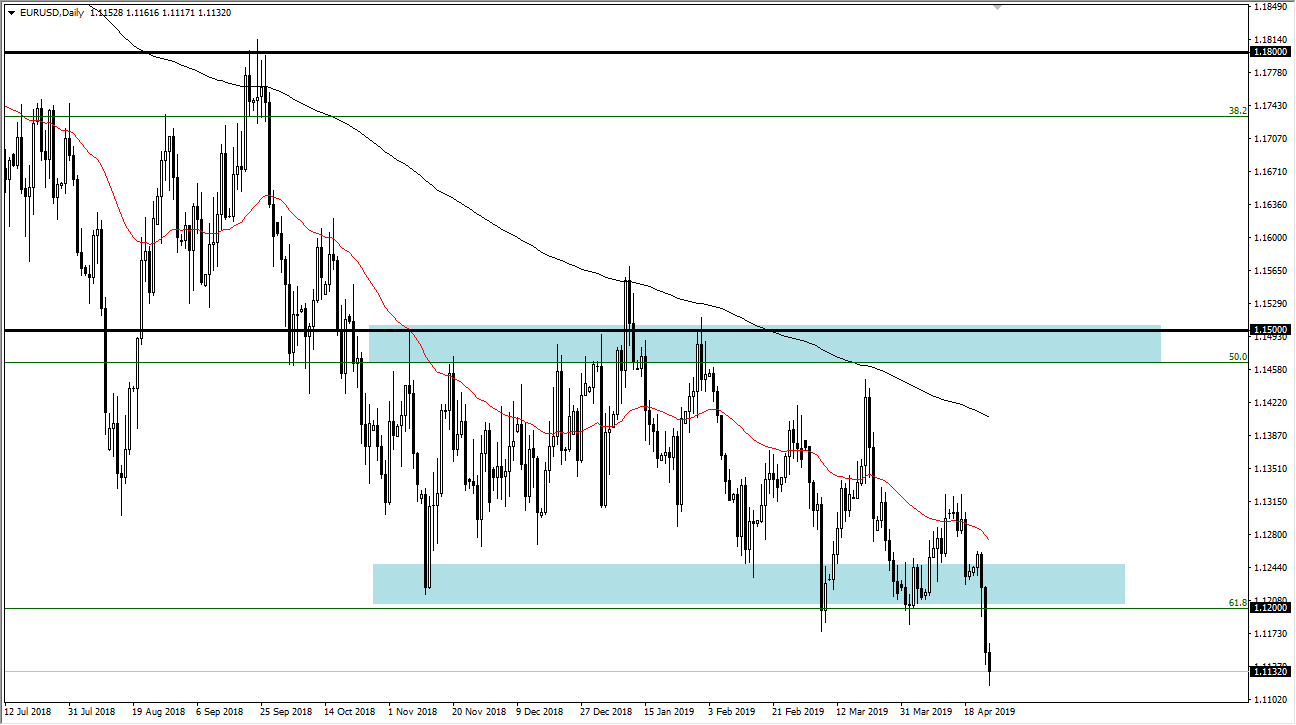

EUR/USD

The Euro fell again during the trading session on Thursday, as we continue to see a lot of US dollar strength overall. It looks as if we are ready to roll over rather significantly, now that we are below the 1.1150 level. With that being the case it’s very likely that we continue to go lower, but we may get a short-term bounce but at this point I think it’s very likely that the sellers will come back in, especially near the 1.12 handle. The alternate scenario is that we break down below the bottom of the candle stick for Thursday, which sends this market even lower, perhaps down to the 1.10 level. The Euro has broken significantly, and the US dollar has shown massive amounts of strength in general. The Euro is the first place traders go to buy US dollars in the Forex world, so this is by far the biggest barometer. As far as buying is concerned, I don’t really have an interest in doing so in the short term.

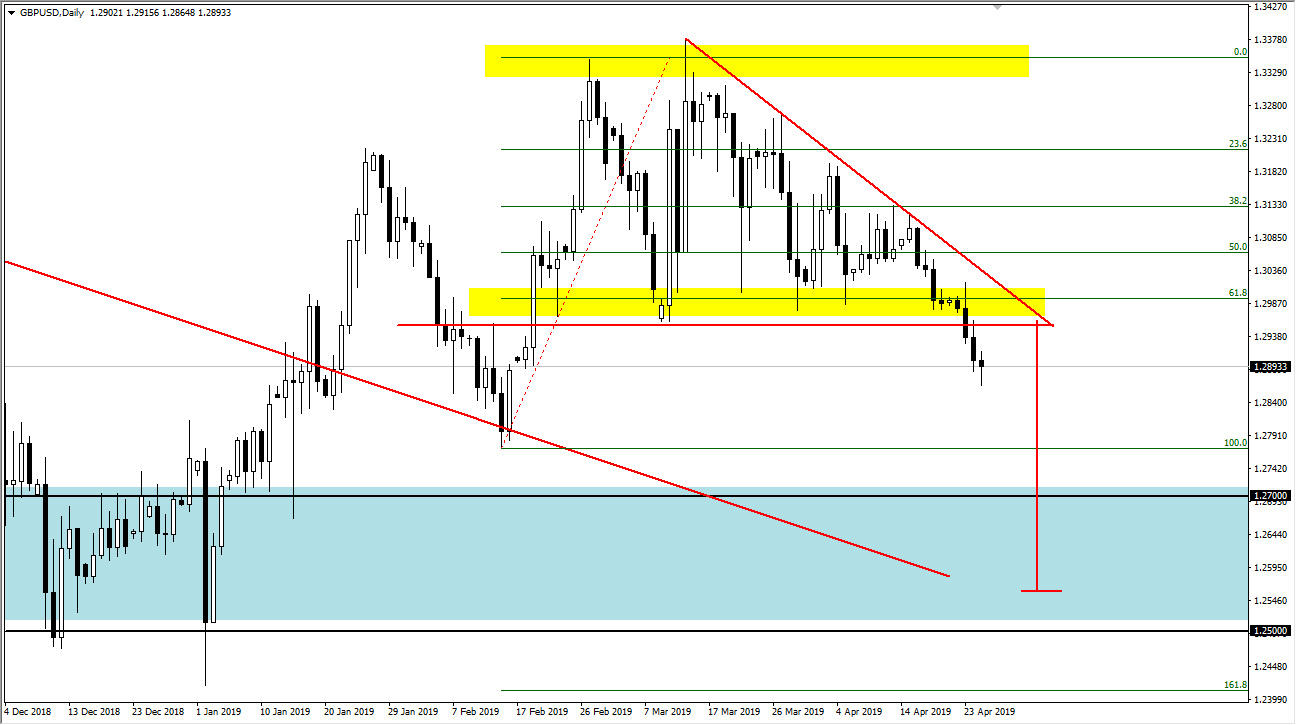

GBP/USD

The British pound went back and forth during the trading session on Thursday, breaking down yet again. However, we turned around of form a bit of a hammer, so at this point I think we could rally a bit, but it’s only a matter time before sellers come back in and squash that rally. The 1.30 level above should be massive resistance, so I think rallies will be looked at as an opportunity to start shorting the Pound again. The British pound struggles to rally mainly because there is the Brexit being pushed back, and as a result there aren’t many headlines out there that are going to pick up the British pound. Selling a break down below the bottom of the hammer for the candle stick during the trading session on Thursday, or a rally that fails below the 1.30 level.