Crypto currency markets continue to be a bit quiet over the last couple of days, but after the explosive move higher that is a good sign. After all, Bitcoin got absolutely slaughtered last year and had left the psyche of the mainstream. Long gone are the days of random suburbanites jumping into the market and buying ”that Bitcoin thing.”

I remember about three weeks before the futures market for Bitcoin opened up, sitting at a restaurant and hearing an elderly gentleman talk about buying Bitcoin because “price was going straight up.” It was at that point that I knew the jig was up: that the Bitcoin market was about to implode. It had all of the symptoms of a massive bubble, which of course is very obvious now. In fact, the absolute top was the day that the futures markets opened.

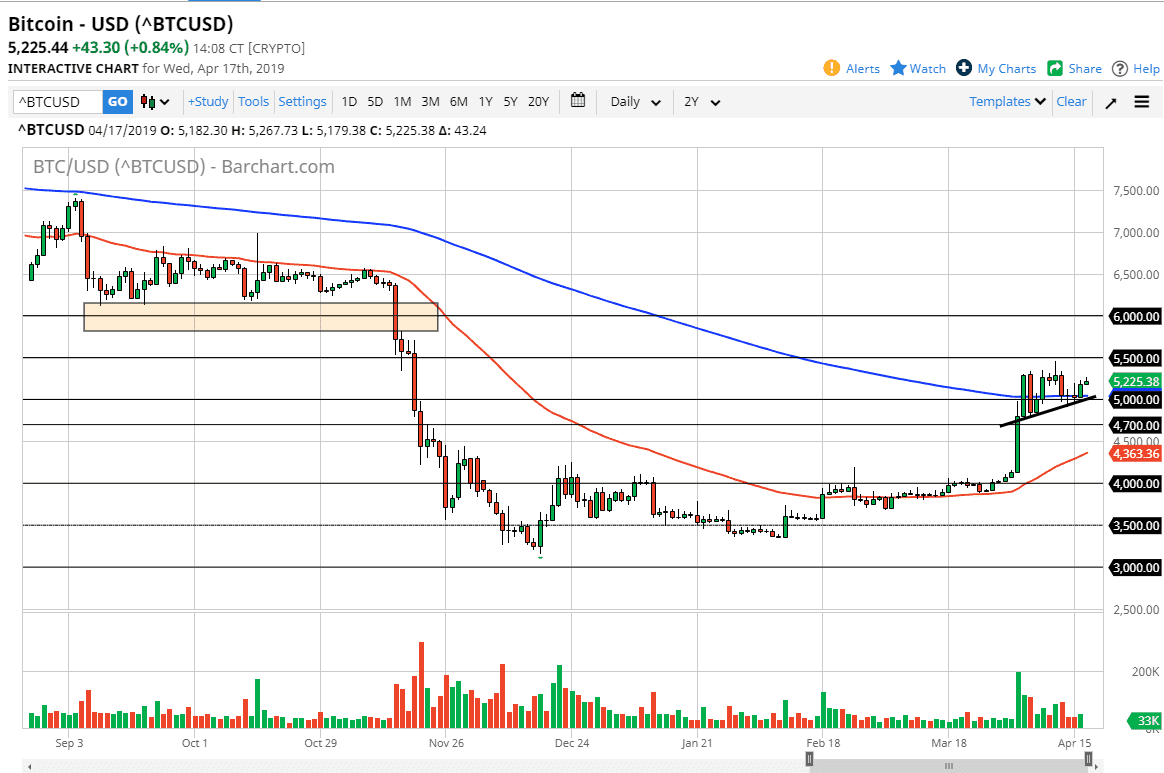

Bubbles are much easier to identify than consolidation and perhaps basing. It takes a bit more experience to realize that the market might be building up momentum to the upside, because it can be very muted at times. This is one of those times. We have broken to the upside so as we continue to grind higher, this shows that the market is building up a little bit more confidence and that’s exactly what it needs right now.

With all that being said, the $5000 level should be supported just as the 200 day EMA is there as well. There is an uptrend line underneath, but quite frankly even if we break down through there it’s not until we break the $4000 level that I would be concerned about Bitcoin. This is exactly what a bottom looks like. That doesn’t mean that we go straight up in the air tomorrow. It also doesn’t mean that we break out tomorrow. What it does mean is that longer-term investors are jumping in.