WTI Crude Oil

The WTI Crude Oil market broke down rather significantly during trading on Friday as the jobs number came out much weaker than anticipated. That being said, this actually started before that as perhaps the poor economic figures coming out of China the night before kicked it off. Trade balance numbers were down coming out of Beijing, but by the time the Americans said they only adding 20,000 jobs during the previous month, that did not help the situation. People are now starting to worry about global growth and by extension global demand.

However, by the end of the session the market had turned around of form a bit of a hammer that the 50 day EMA seems to be supporting. We are back within the trading range now, so it looks as if we are back to even more back and forth trading. That being said, if we break down below the bottom of the candle stick for Friday, that’s going to be trouble.

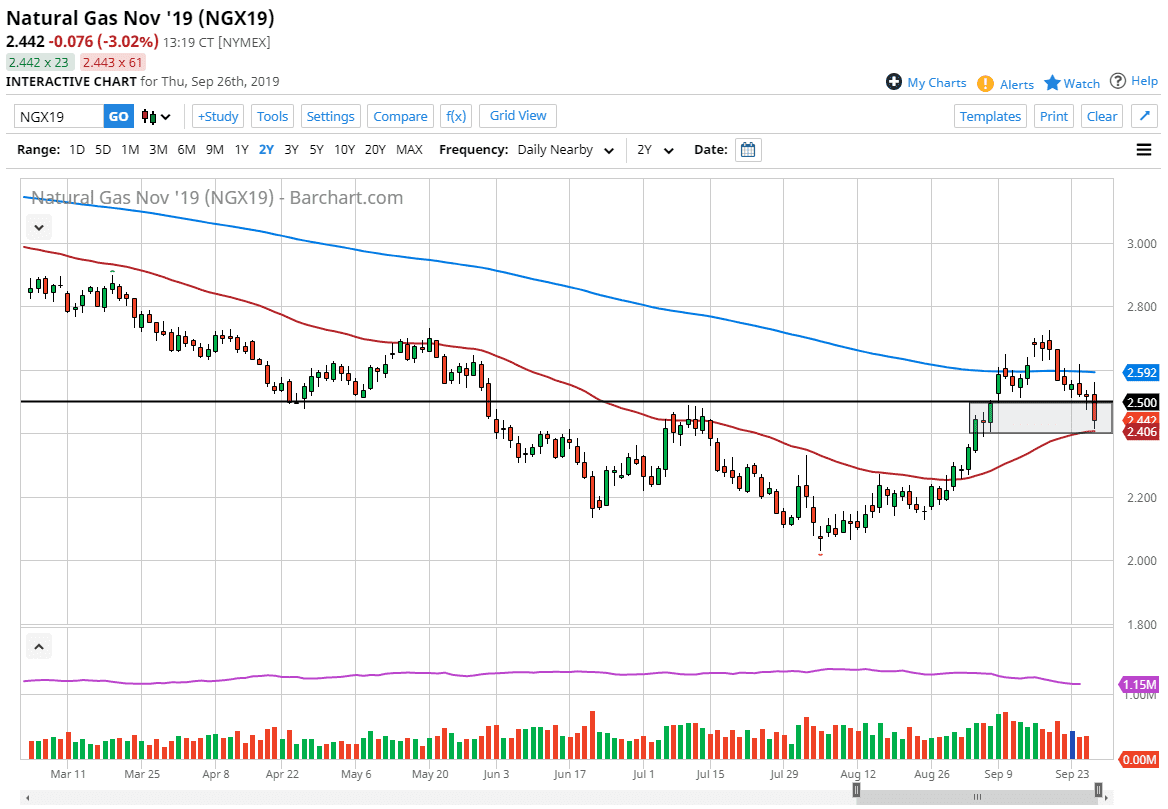

Natural Gas

Natural gas markets tried to rally during the day but ran into some trouble at $2.90. By doing so, the market has rolled over to form a bit of a shooting star and we are approaching a major resistance barrier. I suspect it’s only a matter time before we sell off, but there is a huge gap that is found at roughly $3.00, so we may have a little further to go to the upside. Either way, I’m looking to sell signs of exhaustion as the market struggles to break above there. Natural gas is most certainly an oversupply commodity, so buying it doesn’t even cross my mind. To the downside the initial target would be $2.80, but I think we can get as low as $2.60 with a little bit of effort.