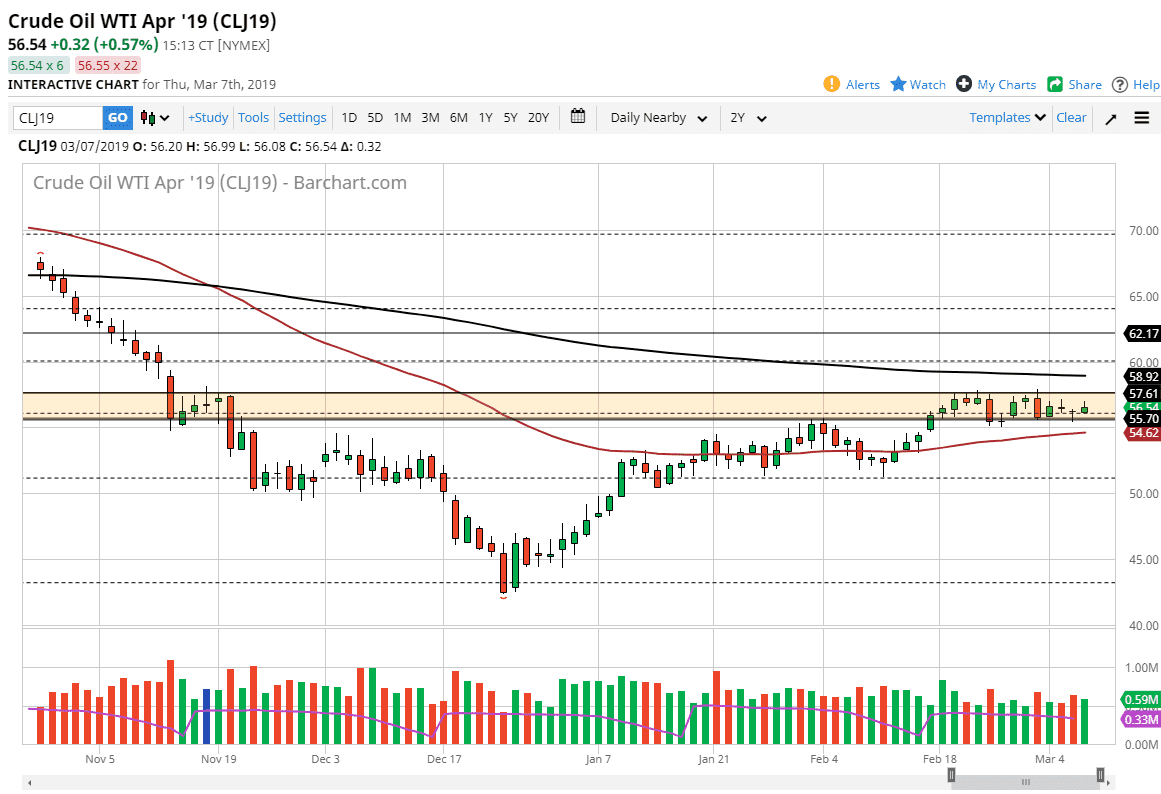

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Thursday but gave back about half the gains as the US dollar picked up strength after the ECB press conference. We remain stuck in the consolidation that we have been in before, so the $55.50 level should be thought of as the beginning of support down to the $55 level. However, to the upside there is a significant amount of resistance at the $57.50 level, extending to the $58 level.

As Friday is the nonfarm payroll, it’s likely that the US dollar will slam around a lot, and people will extrapolate potential demand by that announcement. If we get a strong number, it could have people buying as it could be assigned that we need more energy. However, if the jobs number is rather poor, that could send this market lower. At the end of the day, I think the one thing you can count on is a lot of noise.

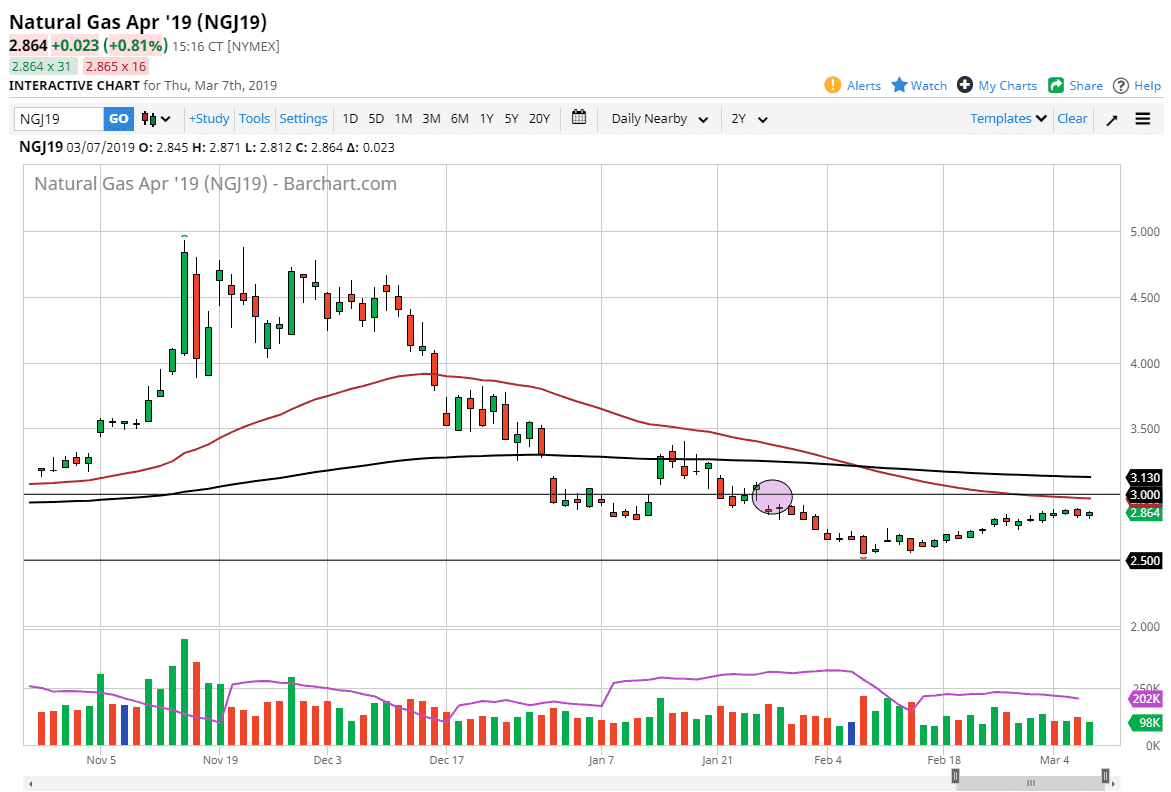

Natural Gas

Natural Gas markets rose slightly during the trading session on Thursday, but at this point we still have a massive amount of resistance above at the $3.00 level. There is a gap, and of course the 50 day EMA. Both of those could be reasons for this market to struggle, not to mention the fact that we are in a downtrend to begin with. I like the idea of fading rallies still, and I think we are a long way away from being able to buy this market. Expect a lot of noise, but eventually we should get a nice selling opportunity to try to reach down towards the $2.60 region.