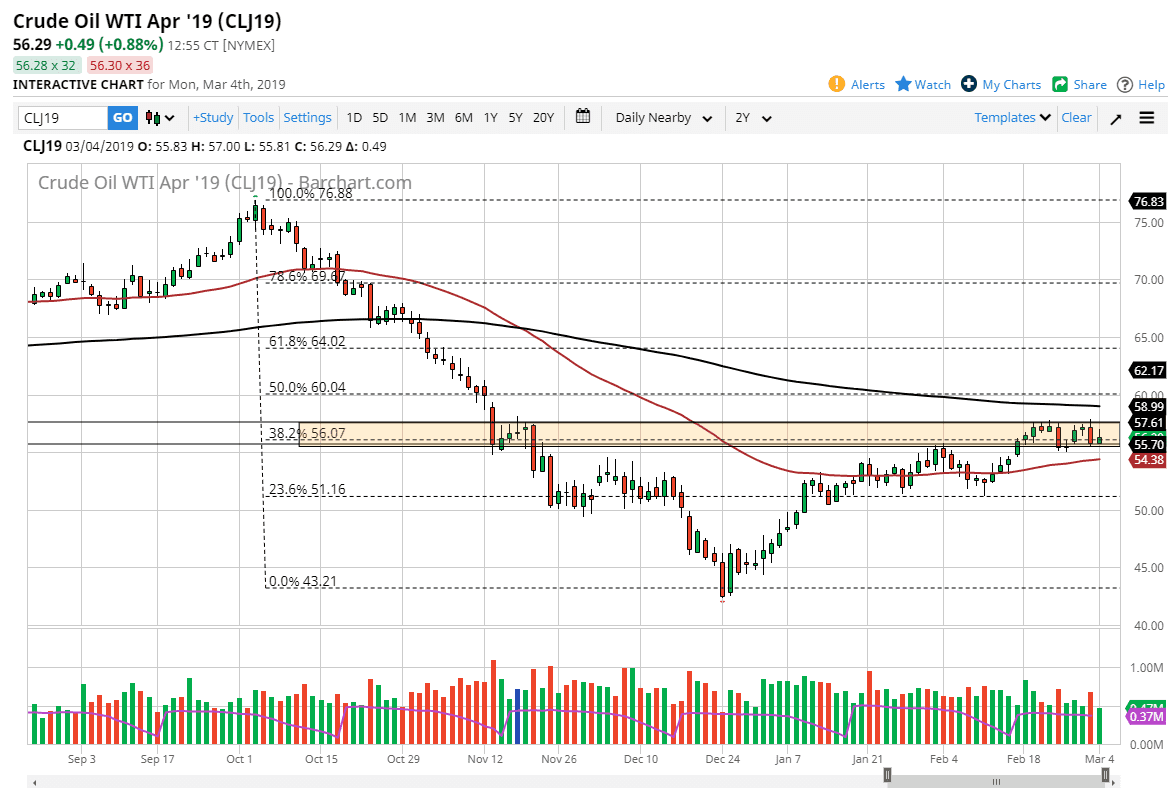

WTI Crude Oil

The WTI Crude Oil market initially shot higher during the course of the trading session on Monday, as we continue to see a lot of optimism about the US/China trade situation. However, we sold off later in the day, and it now looks as if we are still stuck in the same consolidation that we have been in for some time. At this point, it looks as if the 50 day EMA underneath continues offer support, while the 200 day EMA above is resistance. Look at this chart, I think we continue more of the back and forth short-term action, so day trading the crude oil contract should be good. However, we will eventually break out of the box that I have drawn on the chart, and once we do that should lead to a bigger move.

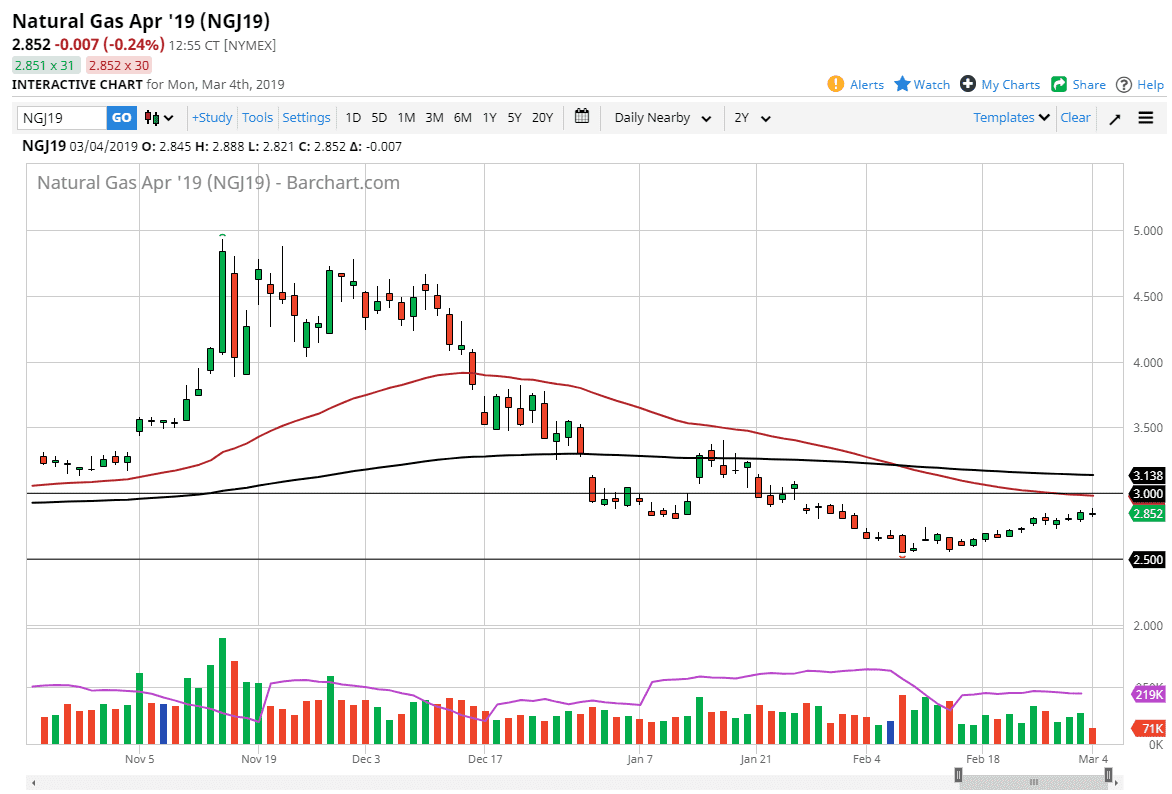

Natural Gas

Natural gas markets tried to rally during the trading session on Monday but gave back the gains to form a bit of a shooting star. At this point though, I still believe that the 50 day EMA is probably where were going to see sellers jump in, especially considering that the gap sits right at a large, round, significant figure in the form of $3.00 above. At this point, it’s very likely that the overall downtrend continues, and I think there is plenty of supply out there to keep this market somewhat negative. However, we are at such low levels that it makes sense that we would gradually rise higher. The 200 day EMA just above the $3.13 level is also an area where I would be looking to sell signs of weakness. Until then, I’m on the sidelines because I certainly don’t want to buy this commodity.