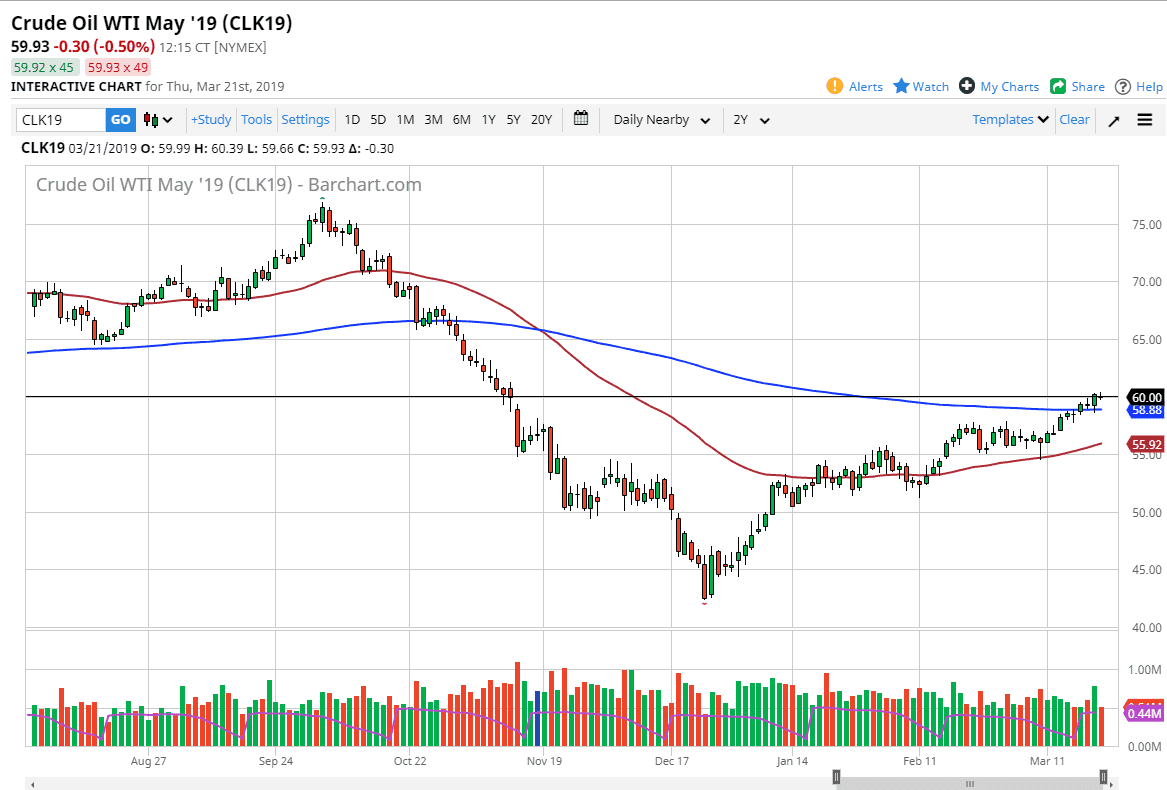

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Thursday, as we continue to hang about the $60 level. However, looking at the longer-term chart you can see clearly that we have been trying to rally for some time. It is because of this that I believe that dips continue to offer buying opportunities, all the way down to at least the 200 day EMA, currently hanging just below the $59 level. Ultimately, if we can break above the top of the candle stick from the Thursday session, that could be a buying opportunity as well. That could send this market looking towards the $65 level but I don’t expect an explosion higher, I think it’s going to be more of a “buy on the dips” type of situation going forward as OPEC doesn’t meet until June, extending production cuts by default.

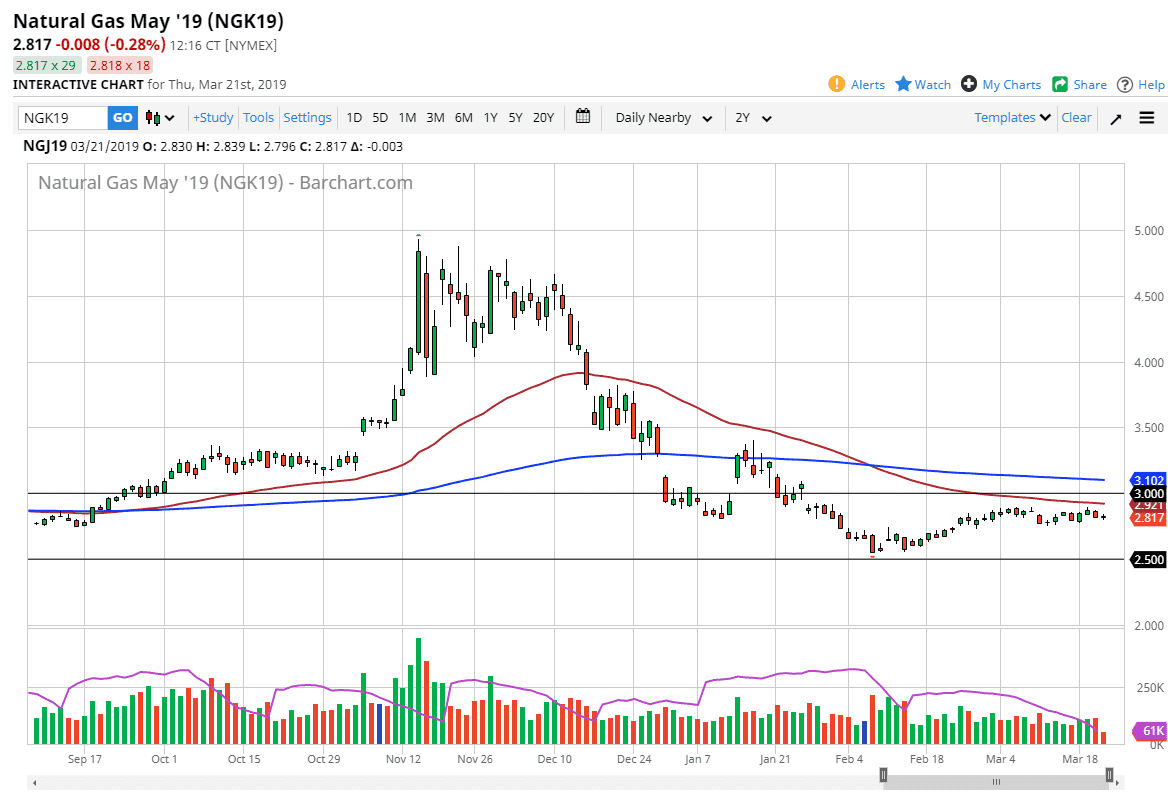

Natural Gas

Natural gas markets have gone back and forth during trading on Thursday as well, reaching towards the $2.80 level. This is a market that continues to selloff on short-term rallies, although we are approaching a minor support level. I think we may get a little bit of a bounce into the weekend but I’m not willing to buy that bounce, but I’m looking to sell at the first signs of trouble, especially near the $2.90 level which could lead to a major resistance zone that extends all the way to the $3.00 level. I like selling exhaustion and have no interest in buying natural gas as it is far oversupplied. Beyond that, we are getting out of the seasonal time of year that is typically strong for nat gas. Because of this, I believe it’s still a one-way trade but in small increments.