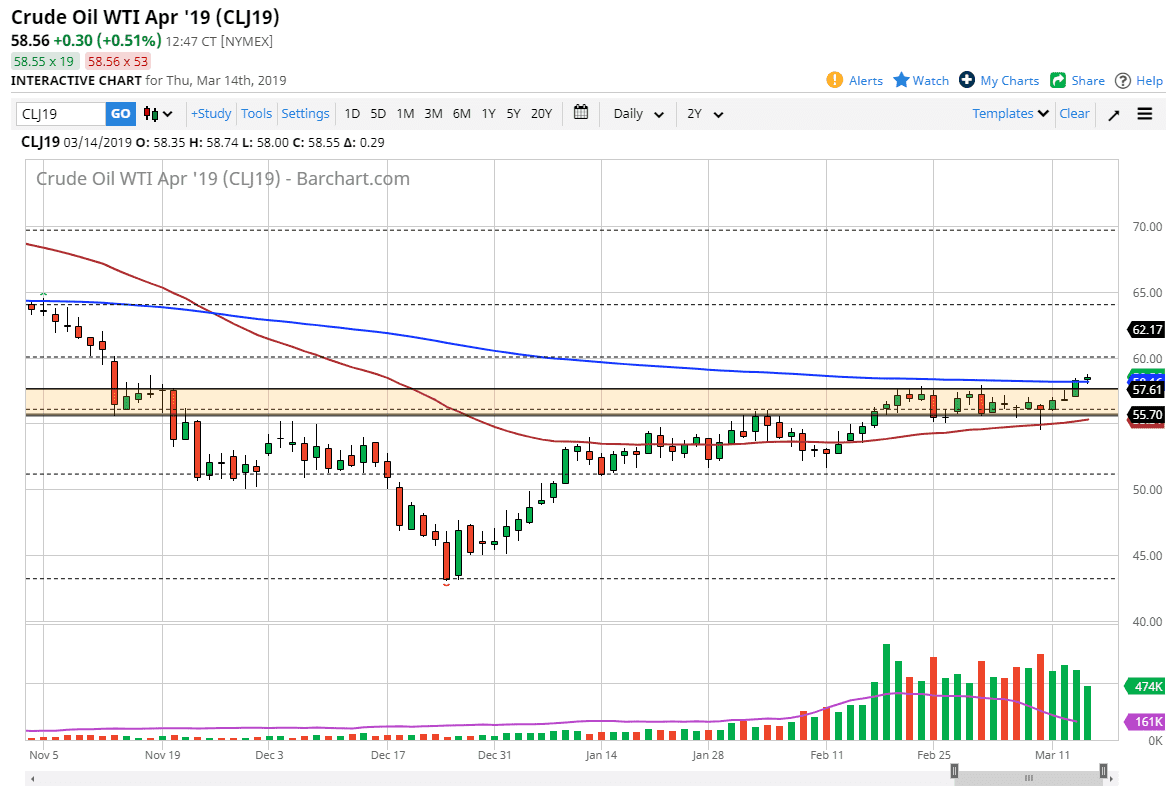

WTI Crude Oil

The WTI Crude Oil market had a choppy session on Thursday, as we have broken above the 200 day EMA. However, we could and pick up a lot of traction so it looks like we are simply grinding to the upside. Short-term pullbacks should be buying opportunities given enough time, but I would be very hesitant to try to sell this market even though I know we will probably see some bearish pressure occasionally. It looks like the buyers are going to be somewhat resilient, and perhaps try to push this market to the $60 handle over the next several days. In fact, I see support all the way down to at least the $56 level, maybe even $55 under there. Simple back and forth buying on the dips tends to be the best way to approach this market on a short-term chart.

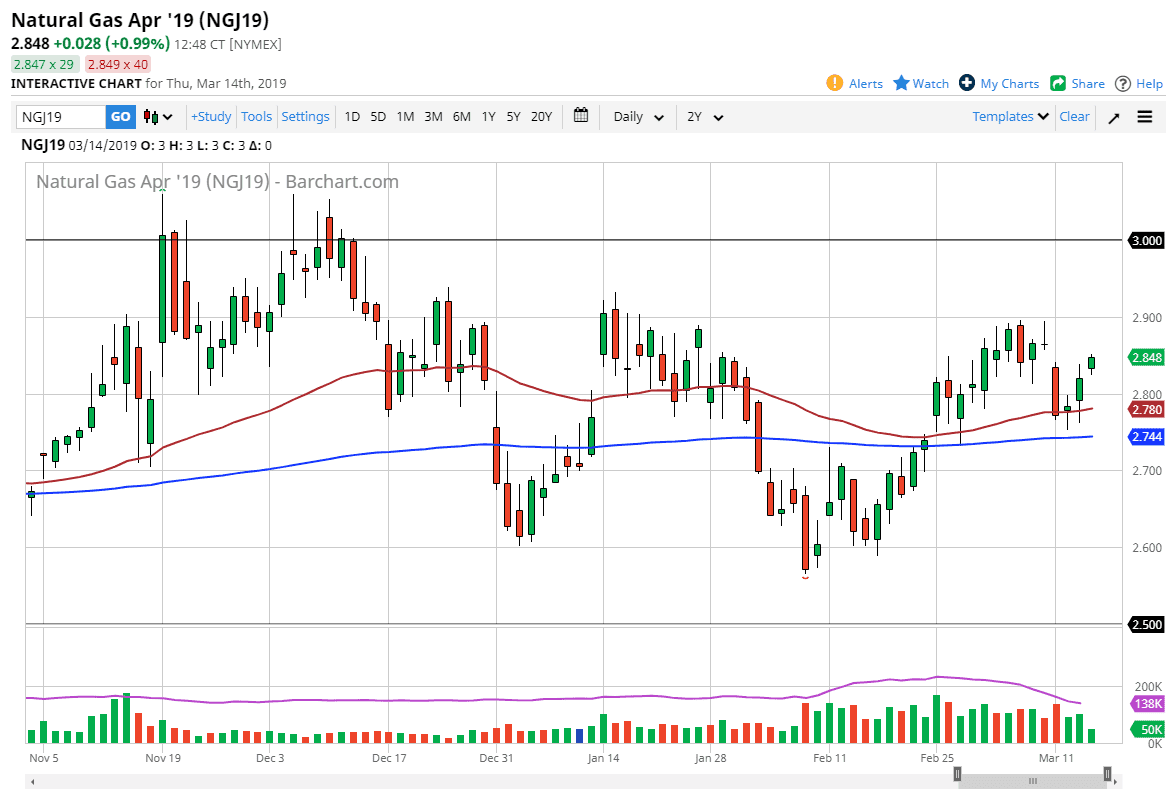

Natural Gas

Natural gas markets rallied a bit during the trading session on Thursday, gapping at the open. However, we are still trying to get to the top of the gap, so I think we may have a little bit of short term bullishness only to see things turn around and start selling off again. I believe that the $2.90 level above is going to continue to be massive resistance, and that it extends all the way to the $3.00 level. I’m looking for signs of exhaustion to start selling and have no interest whatsoever in buying natural gas as it is far too oversupplied. To the downside, I think the market will probably go down to the $2.60 level, possibly even $2.50 given enough time. Expect volatility, but most certainly it seems as if the downside is going to be the best way to play.