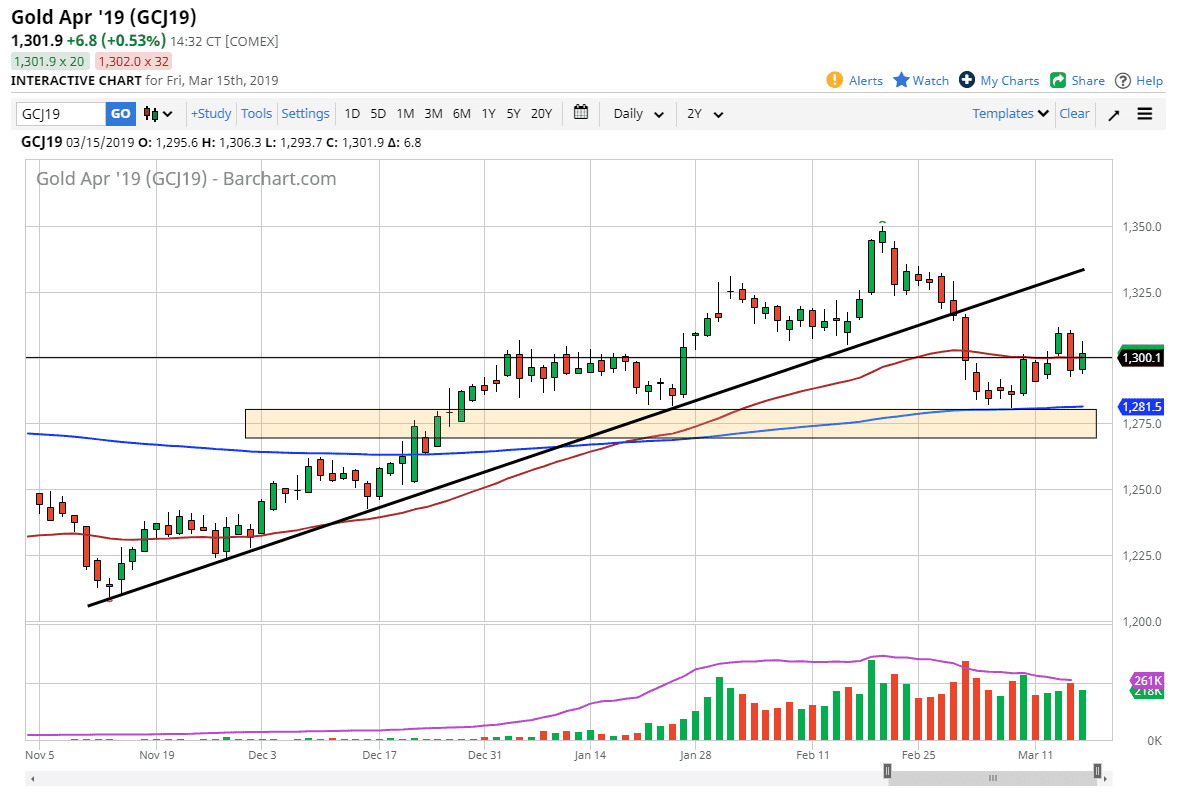

Gold markets rallied on Friday to recapture $1300, an area that of course is rather important. This is a market that is highly sensitive to the US dollar, so if we can get a little bit of greenback weakness we should continue to see Gold markets pick up. The fact that we recaptured the $1300 level is a good sign, and now it looks as if we are still very bullish overall, although we did have a very negative candle stick on Thursday.

Looking at this chart, we will probably go looking towards the $1325 level if we can break above the top of the Thursday session. Alternately, if we break down below the bottom of the Thursday candle, then I think we will go looking towards the 200 day EMA underneath pictured in below. That sits currently at the $1281 level, which is just above a significant support level in the form of the $1275 level.

Central banks around the world are extraordinarily loose with their monetary policy right now, and a lot of are starting to accumulate gold as well. That of course is a very bullish sign for this market and should continue to push gold higher. If we can clear the $1325 level, then I think we could continue to go much higher as it would be the market taking over the previous uptrend line.

To the downside, if we break down below the $1275 level I think it’s very likely that we could continue to go lower, perhaps down to the $1200 level as it is a major floor in the market on the longer-term charts. We have been bouncing around between $1200 on the bottom and $1400 on the top, so it makes sense that we would revisit that level if we drop.