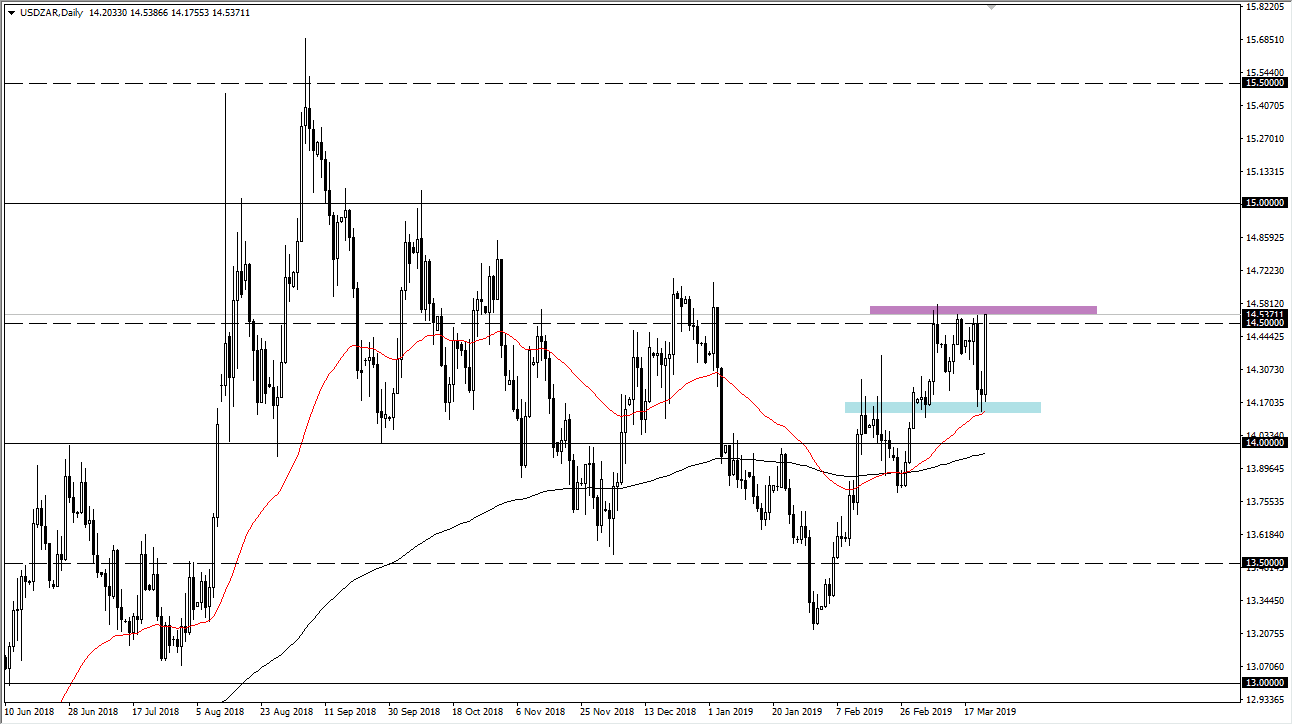

The US dollar rallied significantly against most currencies around the world on Friday as there was a huge “risk off” attitude around the markets. That being the case, it makes sense that the South African Rand got hit. As I had talked about yesterday, there was an area right around 14.15 that was supportive, as we formed a bit of a neutral candle. As soon as we broke above the top of the candle stick, we reached towards the 14.50 level, an area that I suggested could be a bit of a target. The fact that we are closing at the top of that candlestick is also a signal in and of itself.

That being the case, the fact that we are just sitting here I think that we will eventually try to break out. Now the question is whether or not we will simply go to the upside or if will have to pull back initially before going higher? With the recent action, I suspect that pullback should be bought, with an eye on the 14.15 level that should now act pretty much as a floor. If we can break out to the upside, we could break to the 14.75 level, and then eventually the 15 Rand handle.

To the downside, a break down below the 50 day EMA probably opens up the door to the 14 Rand level, an area where we will have to repeat the process and try to settle whether the buyers or sellers are going to be in control. Nonetheless, the fact that we closed at the very top of the candle stick tells me that it’s very likely that we will continue to see South African weakness in this market.