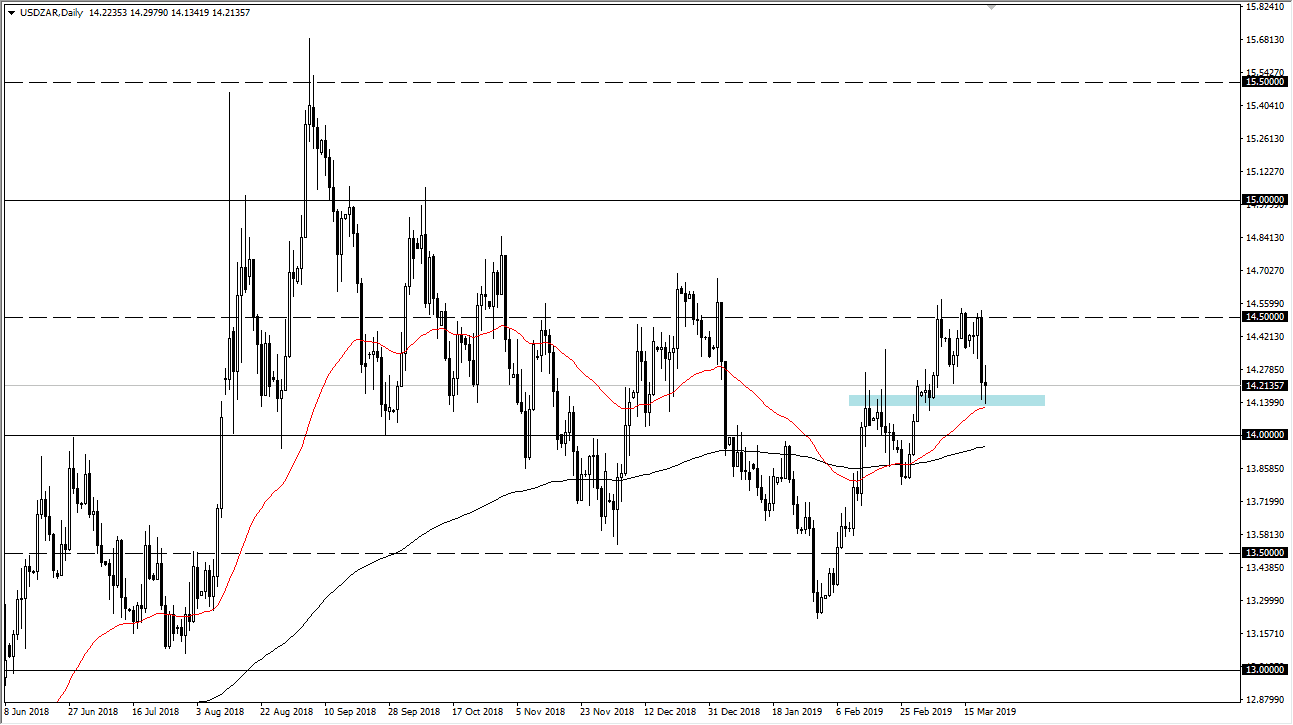

The US dollar went back and forth against the South African Rand during trading on Thursday, which was a bit surprising considering just how strong the selloff against the greenback was during the previous session, not only against the Rand, but against currencies all over the world. Ultimately, the rebirth of the greenback has been rather impressive. With that being the case, it’s very likely that the 50 day EMA just below could cause a bit of support. We also have recently had yet another cross of the 50 day EMA through the 200 day EMA, this time in a bullish sense. This of course is known as the “golden cross”, but I think that is a bit overplayed at times.

Looking at the structural integrity of the market, it appears that we are starting to see a certain amount of buying pressure at the 14.15 Rand level, as seen the last couple of weeks, which also had a lot of resistance. The market sold off rather drastically on Thursday, but it essentially stopped dead in its tracks during the day on Thursday. That tells me a lot, as there was no follow-through.

When I look around throughout the Forex world, I see that the US dollar has done quite well against the Euro, the British pound, the Japanese yen, and many other currencies. As the initial knee-jerk reaction was to run to emerging markets due to the Federal Reserve keeping its stance very loose, it made sense that the South African Rand could gain. However, it looks as if money is flowing right back into the United States, specifically in the treasury markets. If that’s going to be the case it makes a huge move into the US dollar likely. At this point, I suspect we could see a move towards the 14.50 Rand level.