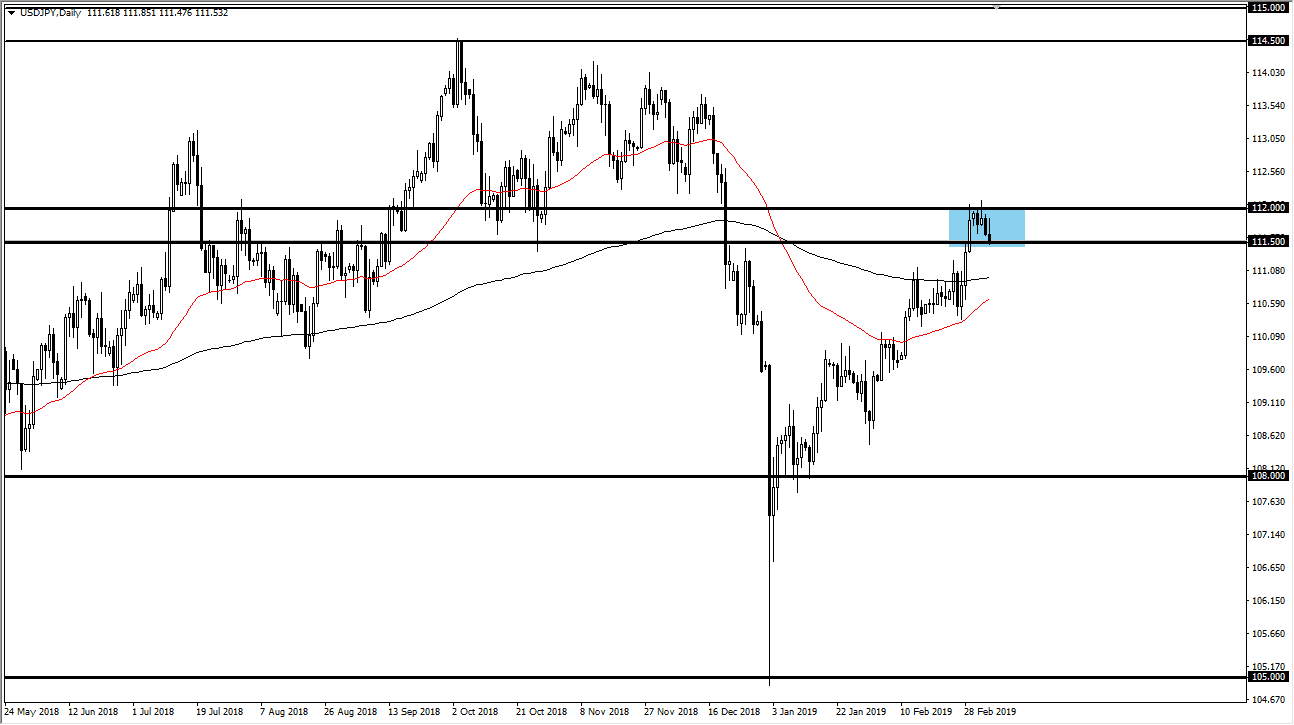

USD/JPY

As Friday is the employment figures coming out of the United States, this will be a very important pair to watch. We have been bouncing around between the ¥111.50 level on the bottom, and the ¥112 level on the top. Once we break out of this range, we could see the market make a reasonable move. Employment figures in the United States tend to move this market rather drastically, so we could see that happen after the announcement. The candle stick for the trading session on Thursday has ended up forming a bit of a shooting star, so if we break down below the bottom of it that probably senses market down to the ¥111 level underneath. Obviously, if we break towards the ¥112 level and then get above there, the market should probably go looking towards ¥112.50, and then the ¥113.50 level.

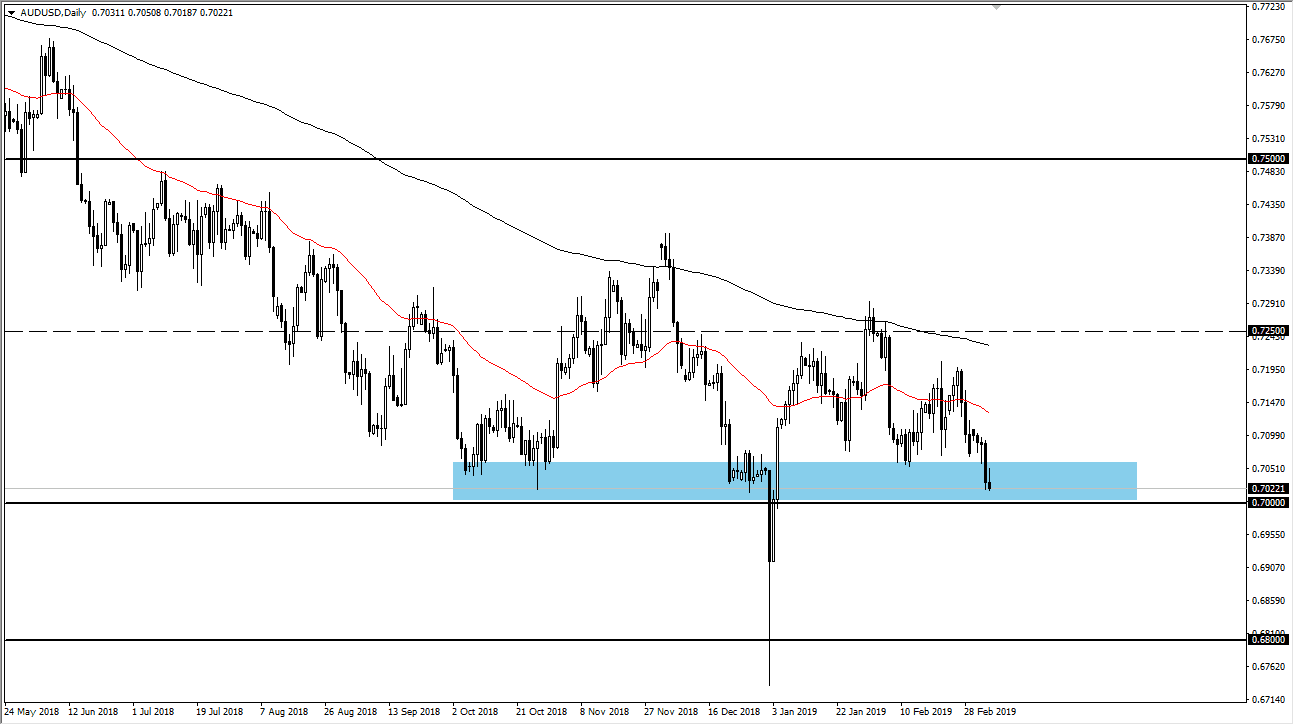

AUD/USD

The Australian dollar has fallen rather hard as the US dollar strengthened during the day, but we still remain over the 0.70 level, so not a lot has changed, because the area just below is massive support on monthly charts. If we rally from here, obviously that will be very difficult to go higher for a longer-term move, but a quick pop is certainly something that you could see.

This pair of course is highly sensitive to the US/China trade issues, so there is that head wind when it comes to the Australian dollar. The 0.7250 level above has the 200 day EMA sitting right around it, so I think that is going to be a very difficult to break above. Once we do, then the market should then go to the 0.75 handle. Ultimately, if we do break down from here it’s not until we get below the 0.68 level that one would have to be concerned.