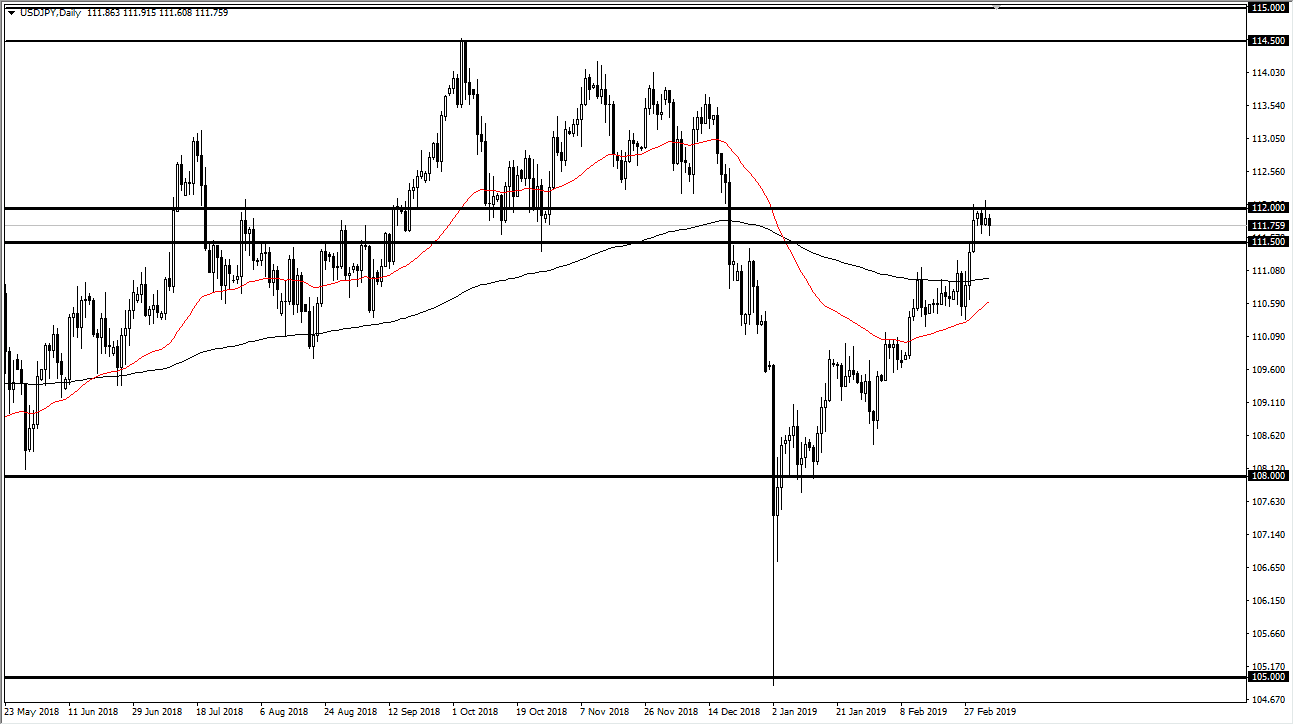

USD/JPY

The US dollar has drifted a bit lower during the trading session on Wednesday but did recover right along with the S&P 500, as we have seen the two markets move lockstep lately. The ¥111.50 level underneath continues offer support, but at the same time the ¥112 level above offers pretty significant resistance. At this point, we are getting close enough to the jobs figure that I believe we won’t see a break out of this range until that comes out, if at all. The market is a bit overextended, so if we do break out to the upside, it’s going to take some type of catalyst. Right now, you have that going on, so short-term scalping in a back-and-forth manner is probably as good as this gets. However, we will eventually get an impulsive daily candle stick that you can follow. If it’s to the upside, it’s likely that we go to the ¥113.50 level. Otherwise, if we break down it’s likely that we go down to the ¥110.50 level underneath.

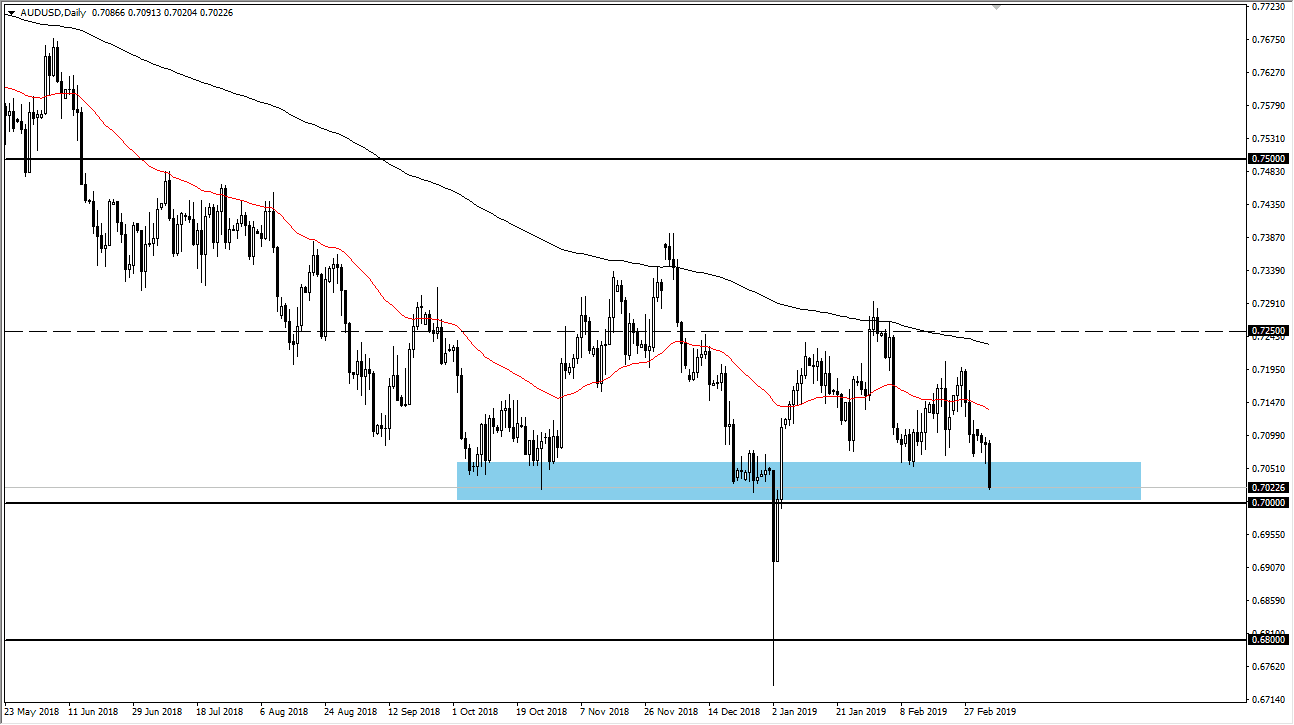

AUD/USD

The Australian dollar has broken down significantly during the day on Wednesday, reaching towards the 0.70 level, an area that I suspect will have a lot of support built into it. If we do break down below that level, it is more than likely only a matter of time before the buyers come back in. After all, this is an area that has been supported on monthly charts for ages now, so it will take a lot to break down below this. The support level extends down to the 0.68 handle, so it’s very unlikely that it will be easy to break through it. I’m looking for a supportive bounce or some type of supportive candle to get long. The US/China trade relations will continue to have a massive influence on this market.