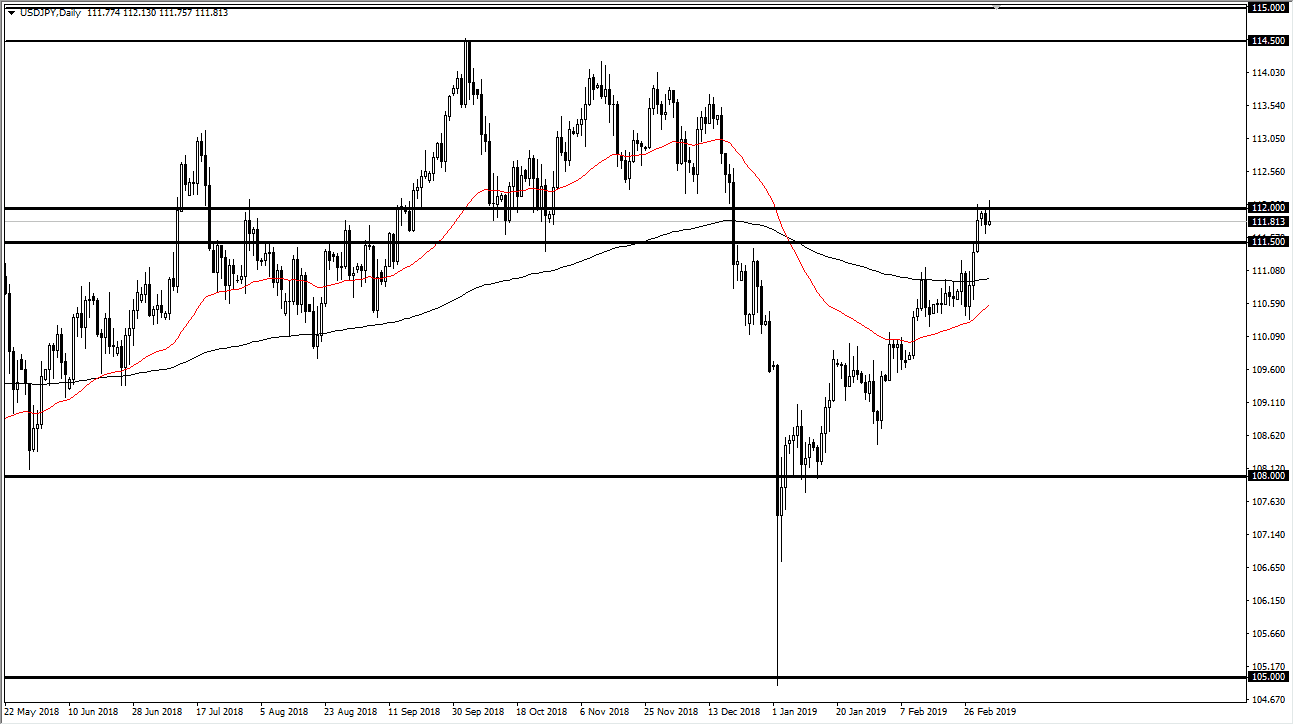

USD/JPY

The US dollar rallied a bit during the trading session on Tuesday but found the area above the ¥112 level to be far too resistive to continue going higher, and as a result we have formed a shooting star. This tells me that there is a lot of resistance above, and the fact that we can close above there tells me we are ready to take out resistance yet. The pair has moved lockstep with the S&P 500, so pay attention to that market as well. If we get a breakout over there, then that should drag this pair higher. Ultimately, if we break down in the S&P 500 and break below the 100 level ¥0.50 level on a daily chart, then I think this pair starts falling. We are at a crucial juncture when it comes to this pair, and I think we are simply trading right along with Wall Street in this market.

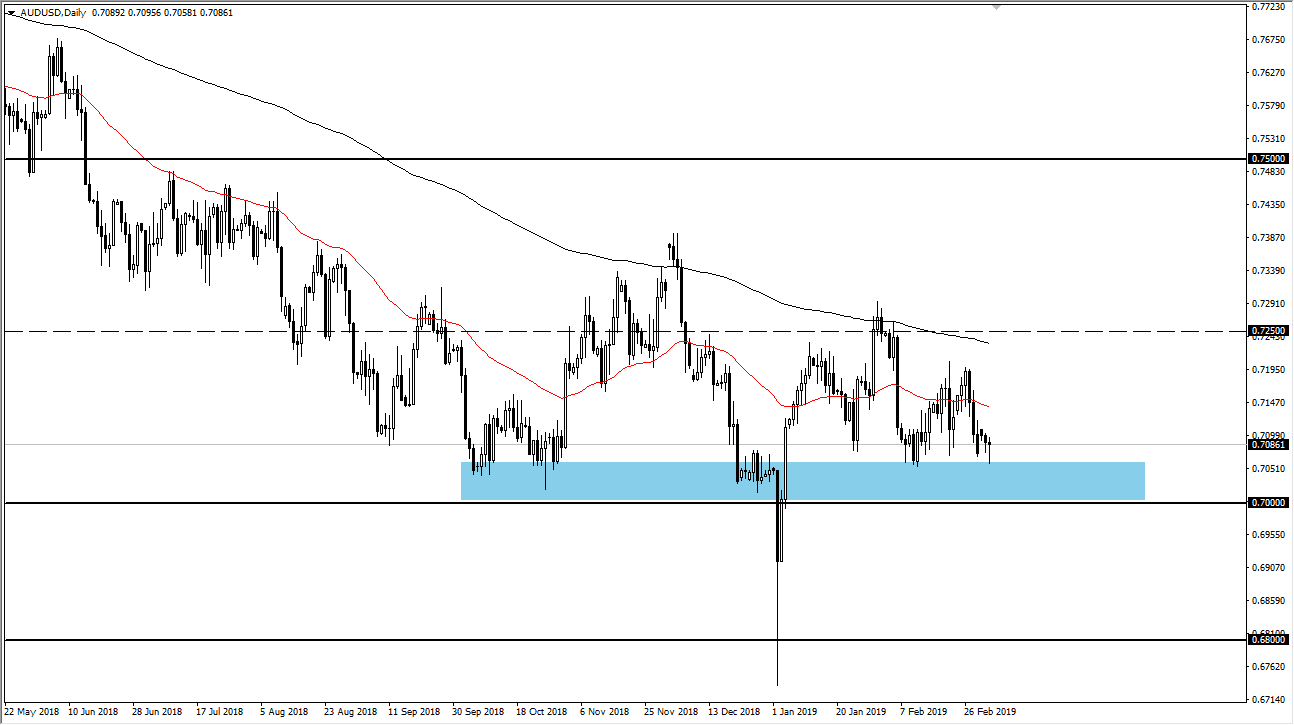

AUD/USD

The Australian dollar initially pulled back a bit during the trading session on Tuesday but found enough support at the 0.7050 level to turn around of form a hammer. This is an area that has been rock solid and reliable, so this point I am more than willing to step in and pick this market up in that region. Not only that, I believe that the region extends all the way down to the 0.68 handle, based upon the monthly charts. With that in mind, I think we are looking at a bit of value building and perhaps accumulation of the Aussie dollar by those who have much bigger accounts.

I have no interest in shorting this market and do believe that eventually we will get the right headlines coming out of either Beijing or Washington DC to send this market towards the 200 day EMA at the 0.7250 region. After that, the next target will be the 0.75 handle.