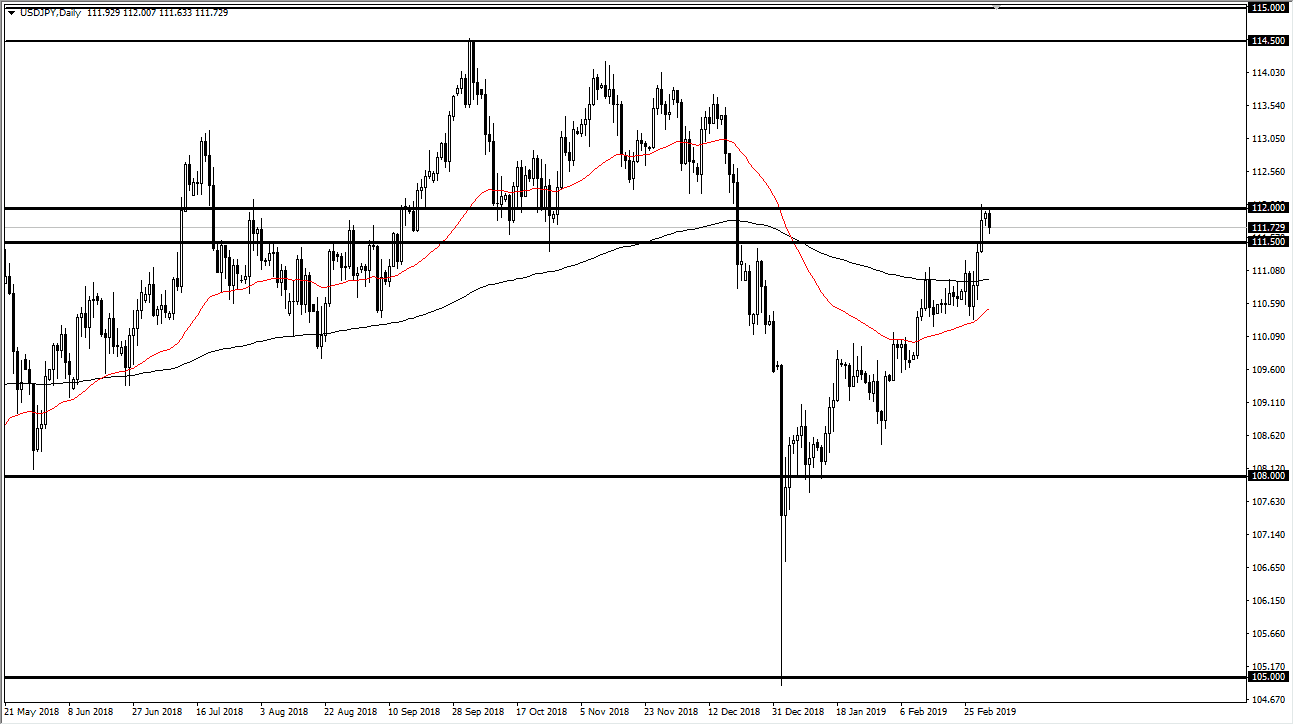

USD/JPY

The US dollar fell against the Japanese yen to start the week on Monday, with the ¥112 level causing major resistance. This is an area that has been extraordinarily resistive, and the fact that we pull back from here should not be a huge surprise. However, we did not break down below the support level at ¥111.50, so we are not necessarily ready to roll over quite yet. At this point, it looks very likely that we simply grind back and forth in this general vicinity. With the jobs number coming late this week, it’s quite possible that we have a couple of very quiet days ahead of us. However, if we get a daily close that is significantly above the ¥112 level, then I’m a buyer. If we get a daily close that is significantly below the ¥111.50 level, then I am a seller.

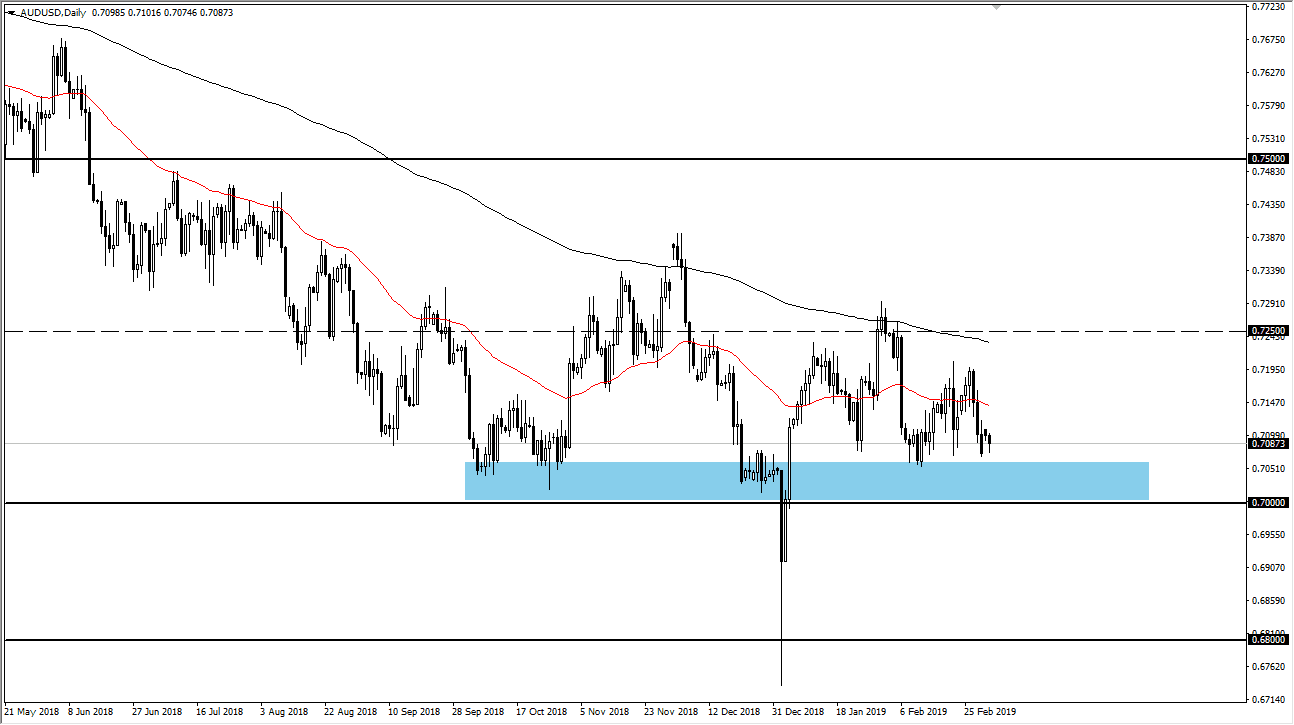

AUD/USD

The Australian dollar pulled back a bit during the trading session on Monday but continues to find support just below. This being the case, it’s very likely that there are a lot of buyers underneath as we have seen the 0.7050 level offer so much in the way of support. I like the idea of buying these dips, but I also recognize that they are short-term trades at best. We could have a very quiet couple of sessions in this pair as well, because we have a lot of unknowns out there when it comes to the US/China trading negotiations, so that being the case it’s likely that the attitude of this pair will continue to be very choppy and indecisive. However, the area down to the 0.68 level is supportive on the monthly charts, so I’m buying on dips and simply collecting small profits.