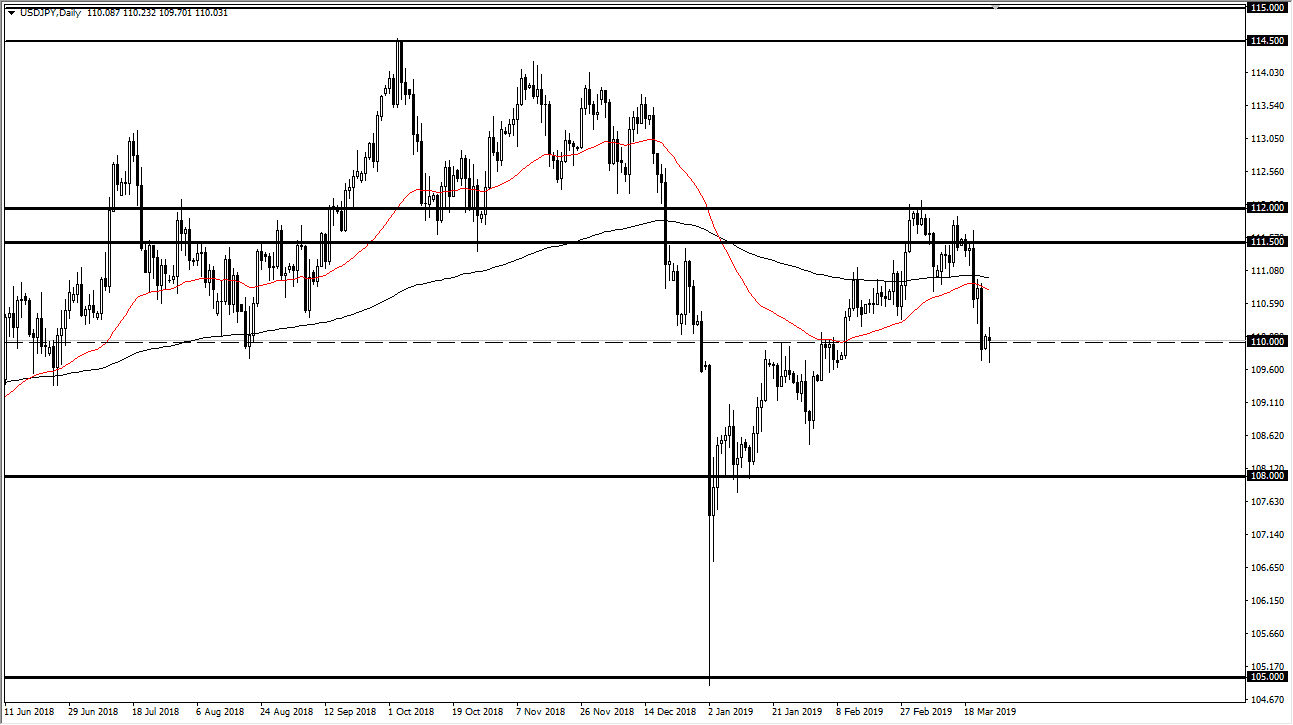

USD/JPY

The US dollar went back and forth during the trading session on Monday, as we continue to dance around the ¥110 level. This is an area that continues to be important, as it was previous resistance. By pulling back there and finding support, it makes quite a bit of sense. The ¥110 level is also a large, round, psychologically significant figure, and therefore it makes sense that we continue to see a lot of choppiness. Beyond that, we also have the S&P 500 bouncing around in a very important level, so the to continue to move in lockstep with each other. With that being the case, pay attention to the risk appetite of other markets, as it could give you an indication as to where we go. Typically, if stock markets rallied this pair rally’s as well. Obviously, the exact opposite can happen. A break above the highs of the trading session on Monday should send this market looking towards the ¥111 level. Breaking down below the lows could open the door to ¥109.

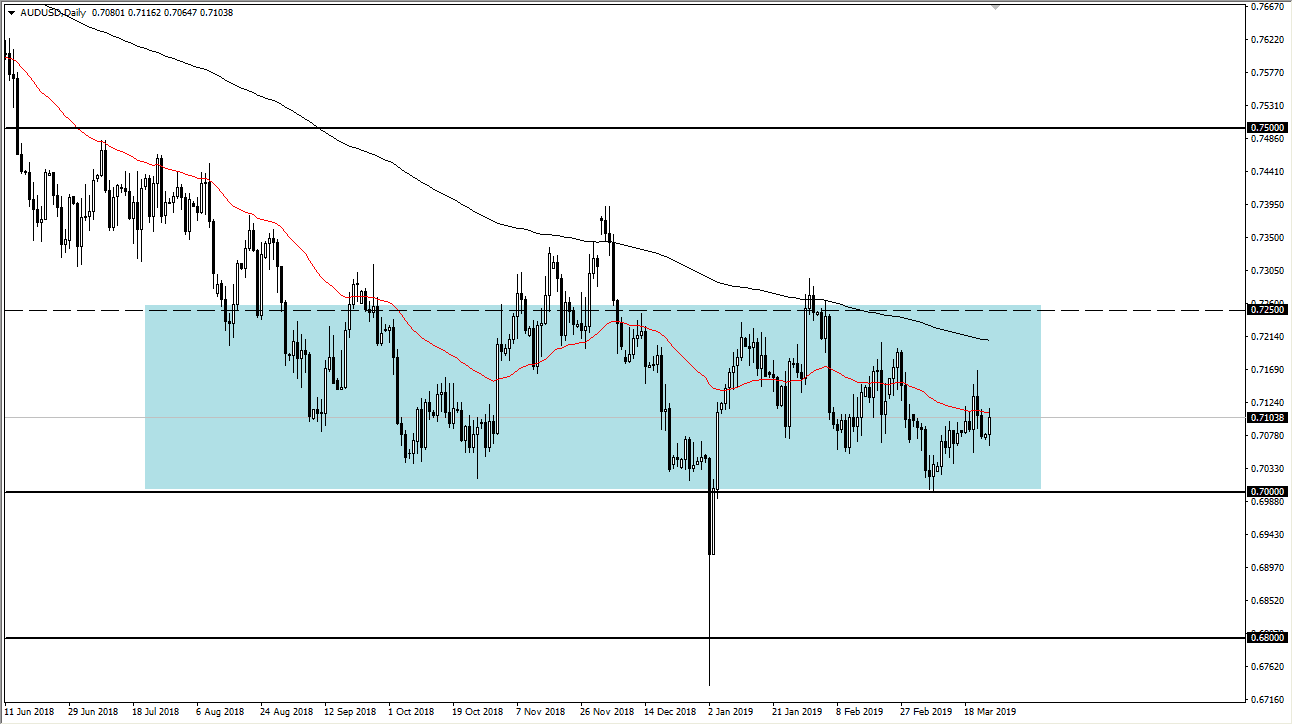

AUD/USD

The Australian dollar has rallied after initially trying to fall on Monday, crashing into the 50 day EMA. The 0.71 level has offered a little bit of resistance, but ultimately I think the way to look at this market is one that you continue to go long every time it dips for small gains. I don’t necessarily want to come into this market with large amounts, I want small short-term buying opportunities. The 0.70 level underneath is massive support and extends all the way down to the 0.68 level. That’s an area that appears on the monthly chart, and therefore I think it’s going to be very difficult to break down through it. I believe we are forming a longer-term base.