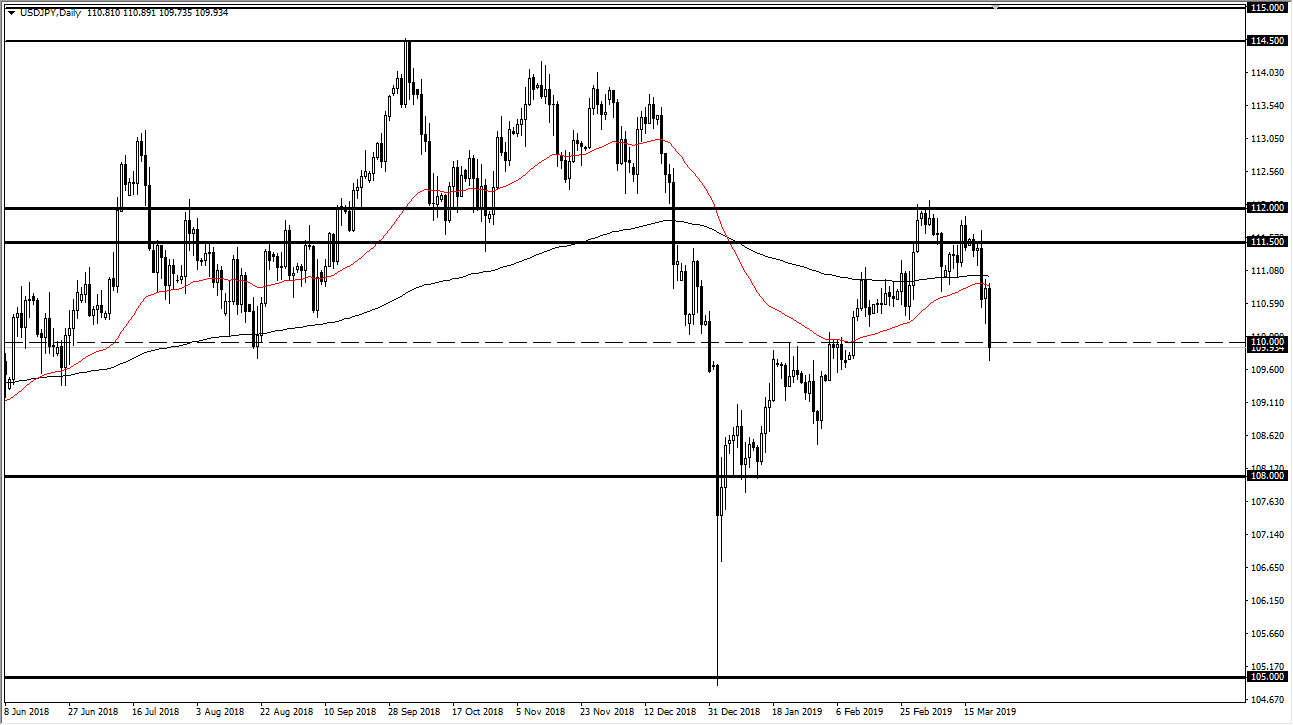

USD/JPY

The US dollar fell rather hard during the trading session on Friday, as we got poor PMI figures coming out of the United States. By doing so, we broke the back of a hammer from the Thursday session which of course is a very negative sign. Beyond that, we cracked below the ¥110 level, which of course is an area that should attract a lot of attention. At this point, if we break down below the candle stick for the Friday session it’s very likely that we will then go to the ¥110.50 level, possibly even the ¥108 level. However, if we do rally from here expect trouble at the ¥111 level, and of course the ¥110.50 level. Remember that this pair is highly sensitive to risk appetite overall as well.

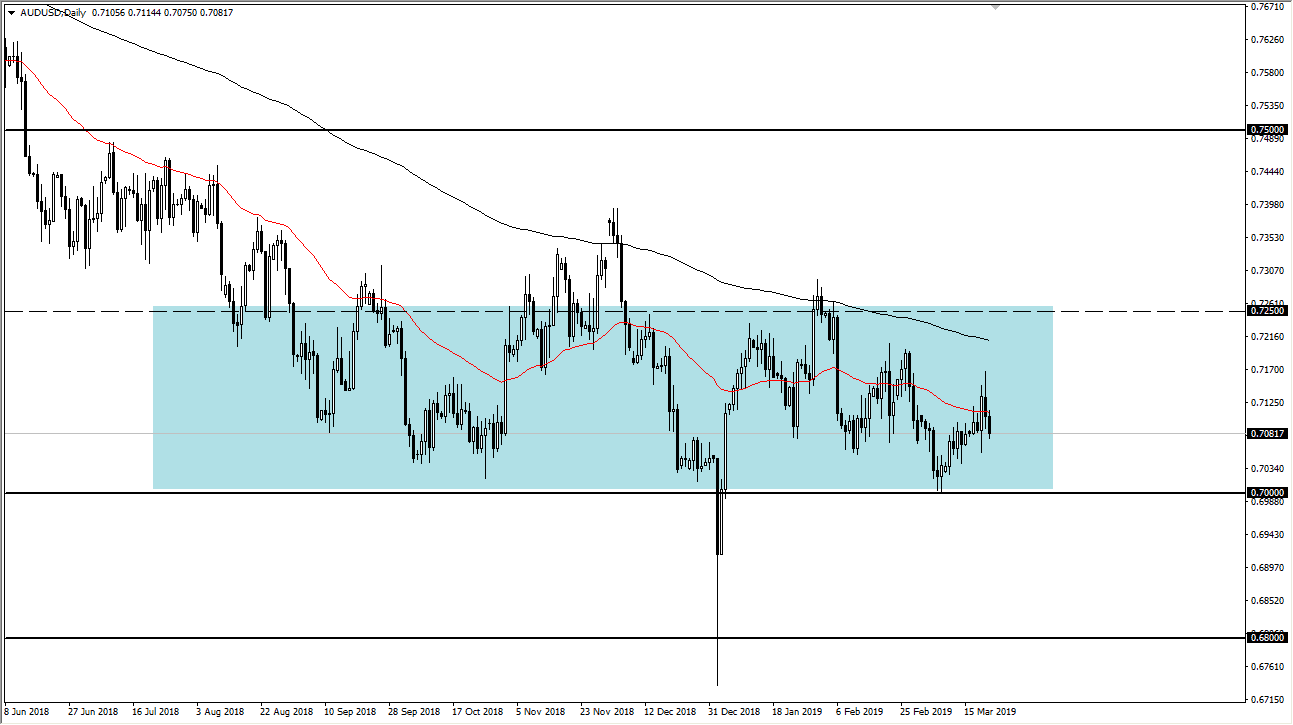

AUD/USD

The Australian dollar fell a bit during the trading session on Friday, as there was more of a “risk off” feel to the markets overall. Looking at the Australian dollar, it appears that we are going to continue to pull back a bit but I also think that there is enough support underneath to make this a possible buying opportunity. The 0.70 level continues to be an area of major support, so therefore it makes sense to take advantage of value when it occurs. Beyond that, the support level runs all the way down to the 0.68 handle, so it seems very unlikely that we will break down for any significant amount of time. With that in mind, I’m more than willing to buy a supportive looking candles on short-term charts closer to the 0.70 handle. I’m not looking for a major move, I’m simply looking to play the bounce as I have been doing for several weeks.