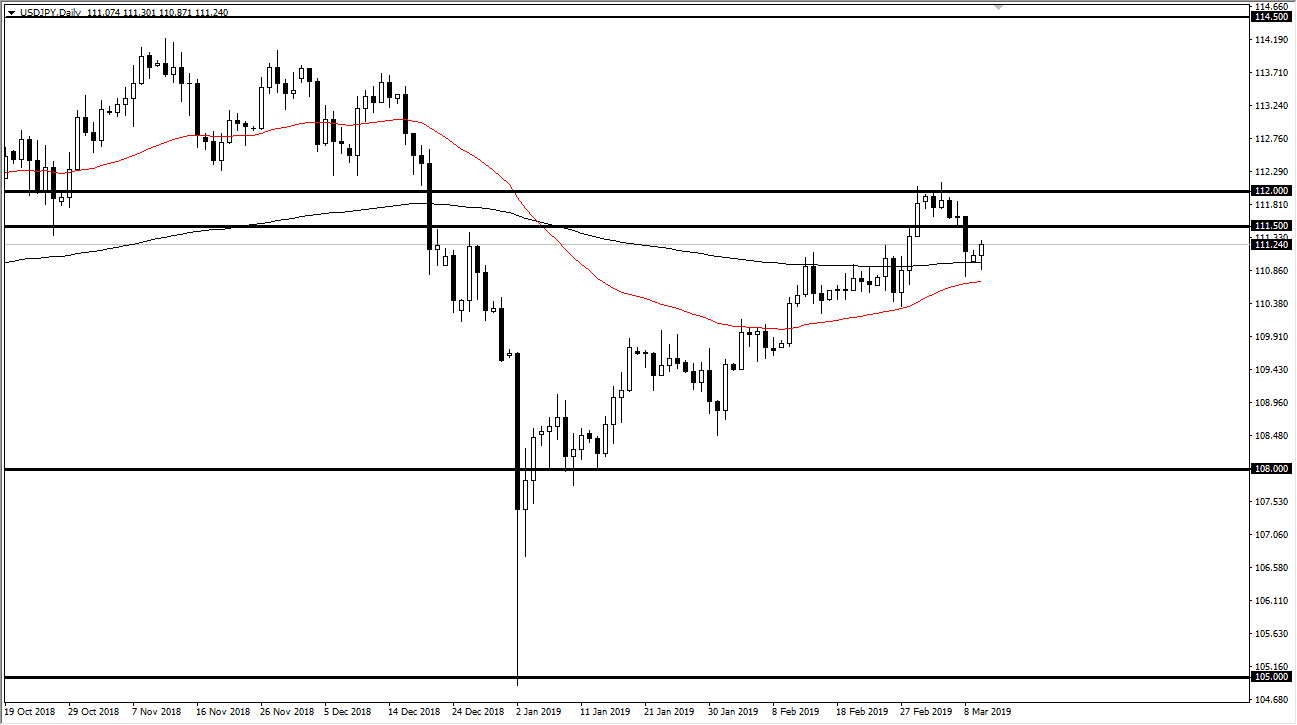

USD/JPY

The US dollar pulled back a bit during the trading session initially on Monday, but then found buyers underneath the crucial 200 day EMA. Ultimately, this is a market that has a lot of support just below, it makes sense that we will continue to see a push towards the upside. Keep in mind that above the ¥111.50 level there is a lot of noise all the way to the ¥112 level. Overall this is a market that looks as if it’s trying to break out, and it is highly levered and correlated to the S&P 500. As the S&P 500 has struggled to break out to the upside, so has the USD/JPY pair. If the other one does, that will drive this pair right along with it. Otherwise, if we break down below the red 50 day EMA, the market could drop down to the ¥108 level.

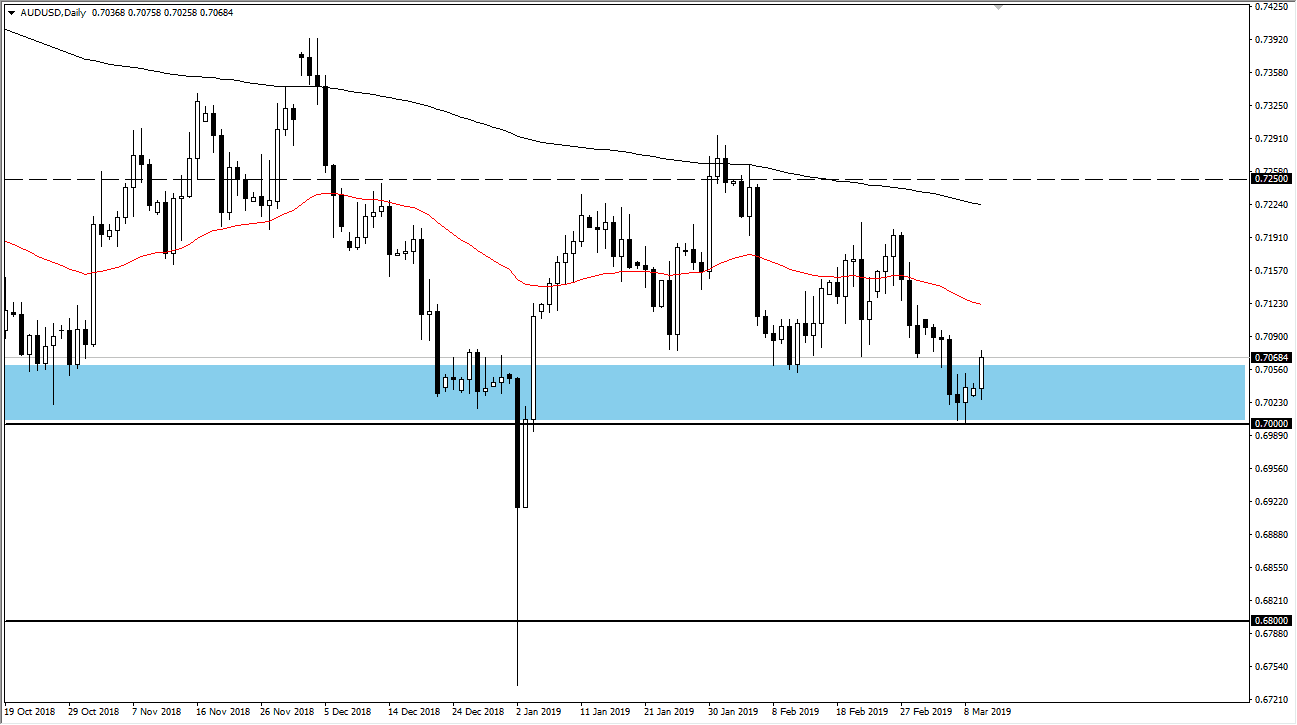

AUD/USD

The Australian dollar initially pulled back during the trading session on Monday, but then took off to the upside to clear the 0.7050 level. There is a significant amount of resistance above the 0.71 handle, but that is going to be a minor resistance barrier. Eventually we will break out to the upside, reaching towards the 0.72 handle. The action on Monday is very impressive, as the 0.70 level is a major support barrier. I think that support barrier extends down to the 0.68 handle, so at this point I have no interest in shorting.

Keep in mind that the Aussie is highly sensitive to the US/China trade talks and all things Asia. So if we can get a bit of buying pressure coinciding with good news coming out of the US/China trade talks, that should continue to propel this market much higher.