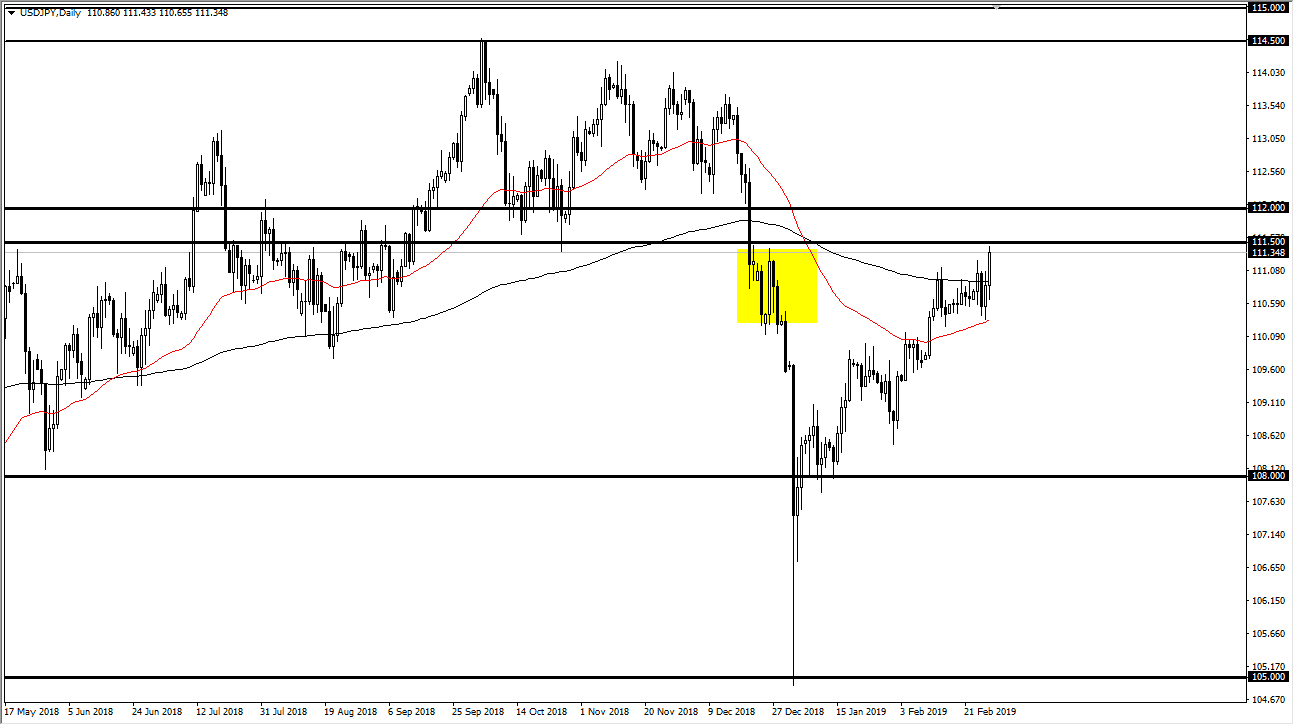

USD/JPY

The US dollar pulled back initially against the Japanese yen during trading on Thursday, but then rallied rather significantly as the greenback picked up a lot of buying pressure. Ultimately, the ¥111.50 level has offered resistance, and this is an area where you would expect it to show up. However, the market is testing the very top part of resistance and has shown a significant amount of tenacity. Because of this, it isn’t necessarily a foregone conclusion that we are going to hold here. However, I recognize that it is going to take a significant amount of bullish pressure to break out to the upside, and I would not be a buyer until we clear the ¥112 level. Otherwise, I would fully anticipate some type of pullback during the day on Friday, although a meltdown seems very unlikely.

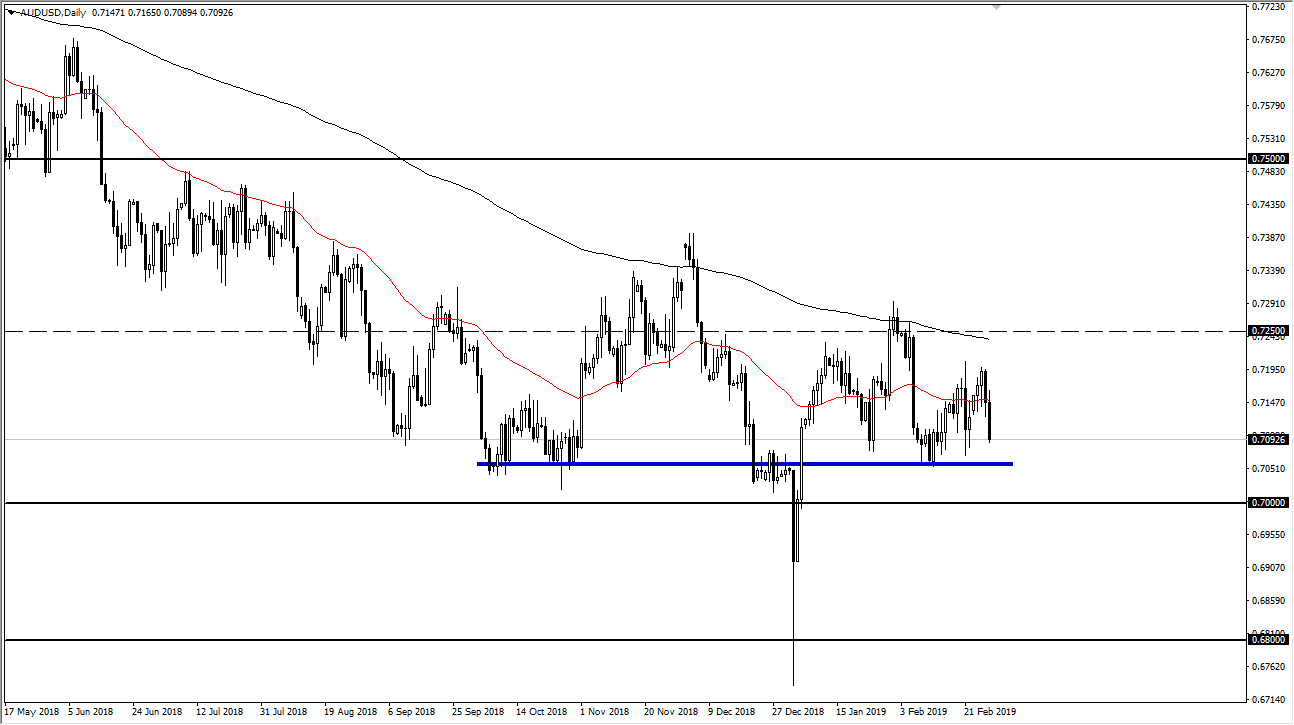

AUD/USD

The Australian dollar initially tried to rally during the trading session on Thursday but then broke down significantly to start searching for support underneath. The 0.7050 level underneath offers a lot of buying pressure, and therefore I think it would not be overly surprising to see the buyers come back in and push this market to the upside. There is a massive support level all the way down to the 0.68 level, so I don’t want to short this Australian dollar anytime soon. Once we get a bit of a bounce, then I think we could probably go back to the 0.72 level, possibly even the 0.7250 level after that.

The Gold markets do look a bit stretched at the moment, so that could work against the value of the Aussie as well. Regardless, I think that the buyers will come back rather soon, as the massive amount of buying pressure underneath will eventually make itself felt.