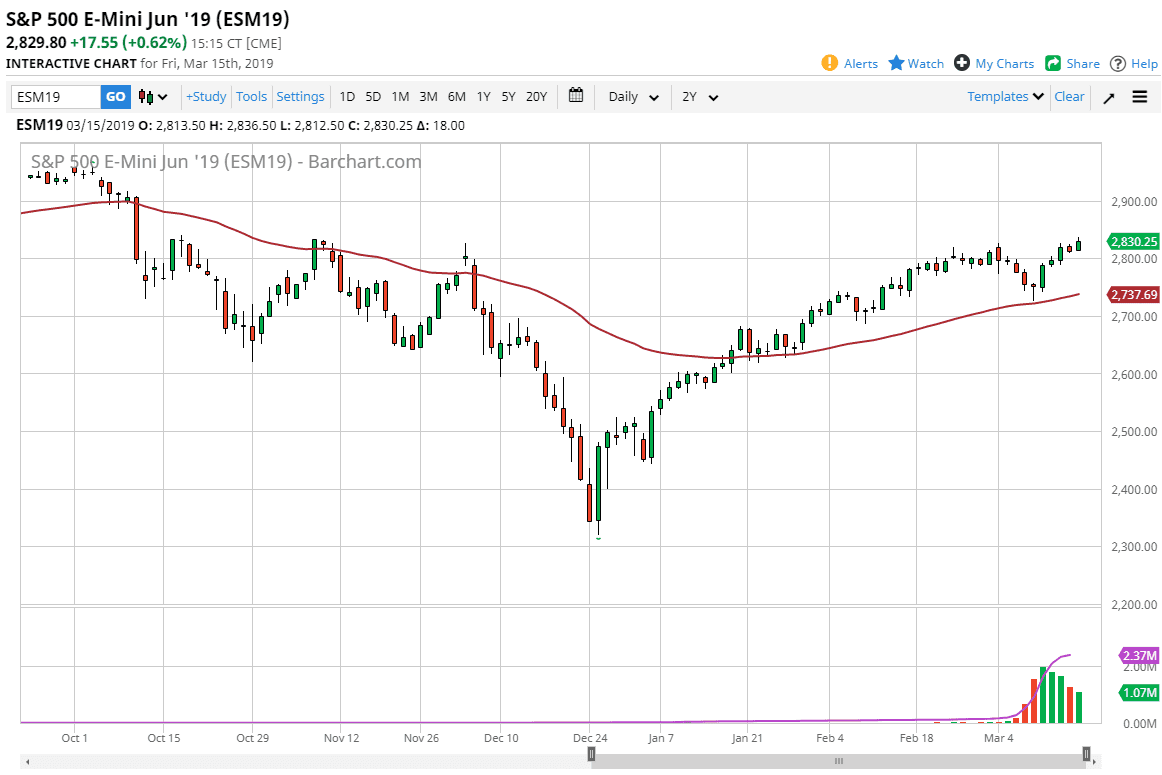

S&P 500

The S&P 500 rallied a bit during the trading session on Friday, reaching towards the 2830 level. This is a very bullish sign, and it looks likely that pullbacks will continue to be picked up based upon value, as it looks like we are ready to continue going much higher. I like the idea of buying dips as the S&P 500 clearly has a lot of momentum underneath it, and with the Federal Reserve on the sidelines it’s likely that we will continue to see a lot of equity buying. Beyond that, yields in the bond market are horribly low so we are in a bit of a sweet spot right now. I think that the 2800 level now is essentially the “short-term floor” in this market as we continue to see the market move from lower left upper right.

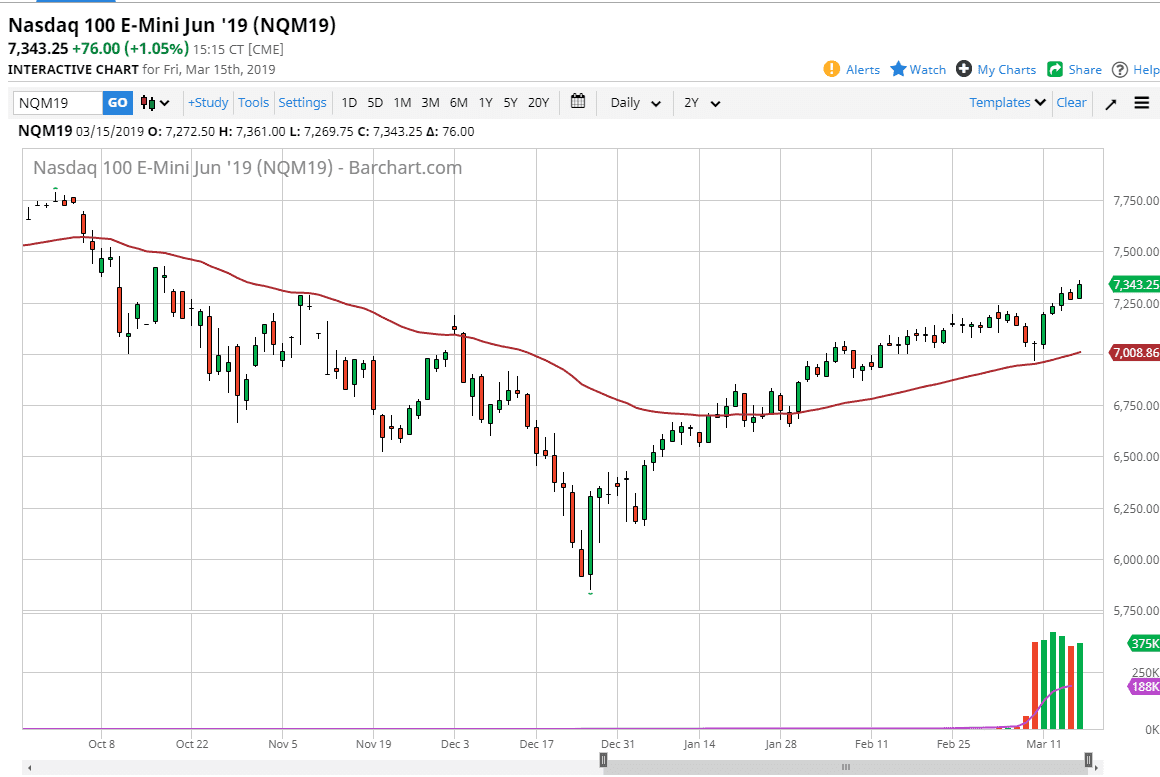

NASDAQ 100

The NASDAQ 100 has lead the way, as we have seen tech companies lead the way overall. The 7250 level is support now, as we have seen over the last couple of days. I think that short-term pullbacks will continue to be buying opportunities in the NASDAQ 100, as we have plenty of reasons to go higher, reaching towards the overall, I have no interest in shorting the NASDAQ 100, especially if the major companies of the index continue to rise such as Apple, Alphabet, Facebook and many of the others. Looking at this chart, it’s not until we break down below the 7000 handle that I think the trend will change, and we most certainly have a nice tilt to the upside with the 50 day EMA. This continues to be one of the major factors of why I’m so bullish, as selloffs are simply turned around.