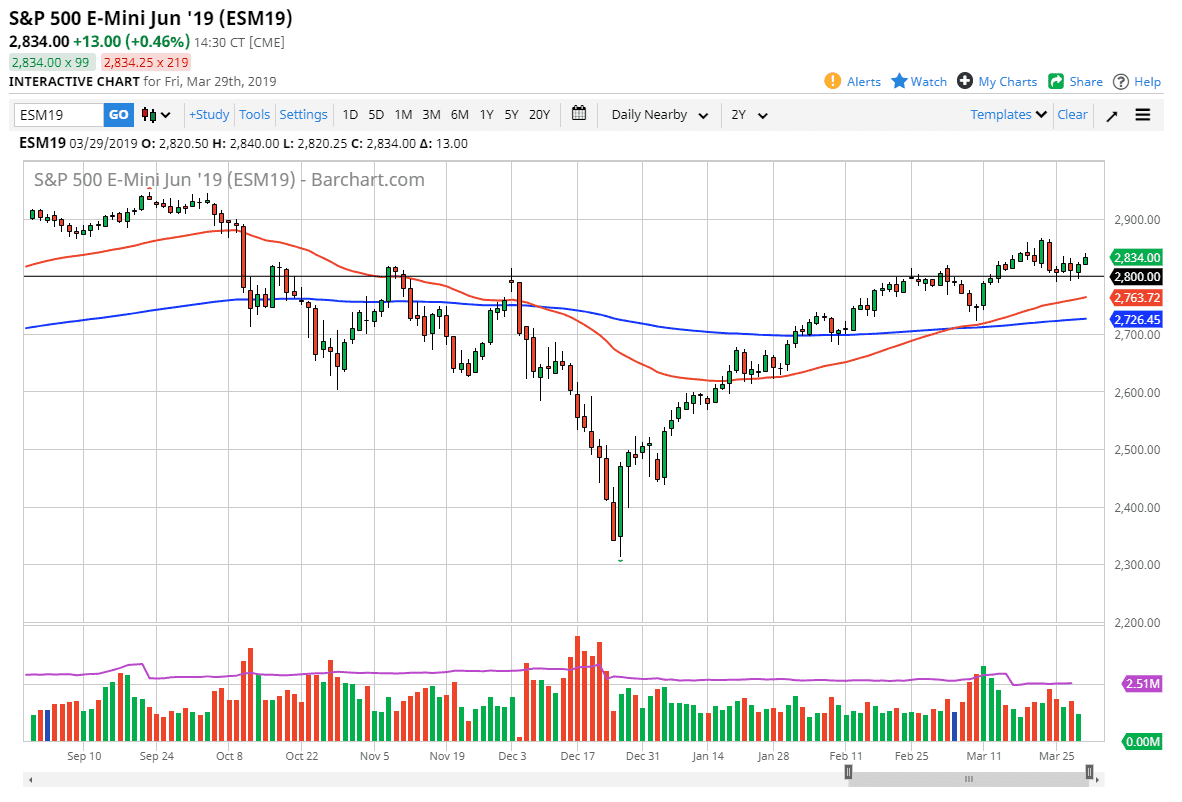

S&P 500

The S&P 500 continues to show strength as although it wasn’t an explosive day, Friday was positive. This shows that the sellers simply do not have the ability at this point to break the market down. 2790 underneath is massive support, when looked at through the lens of short-term charts. Overall, this is a market that has been rallying for some time, reaching towards the highs again. Overall, I look at the 2860 level above as resistance, and if we can break above there it’s likely that we could go to the 2900 level. Short-term pullbacks should be buying opportunities, based upon short-term charts. However, if we were to break down through the 2790 level, that could send the market looking down towards the 50 day EMA which is pictured in red on the chart. The strength of the market continues to be relentless, so at this point it’s very difficult to start shorting.

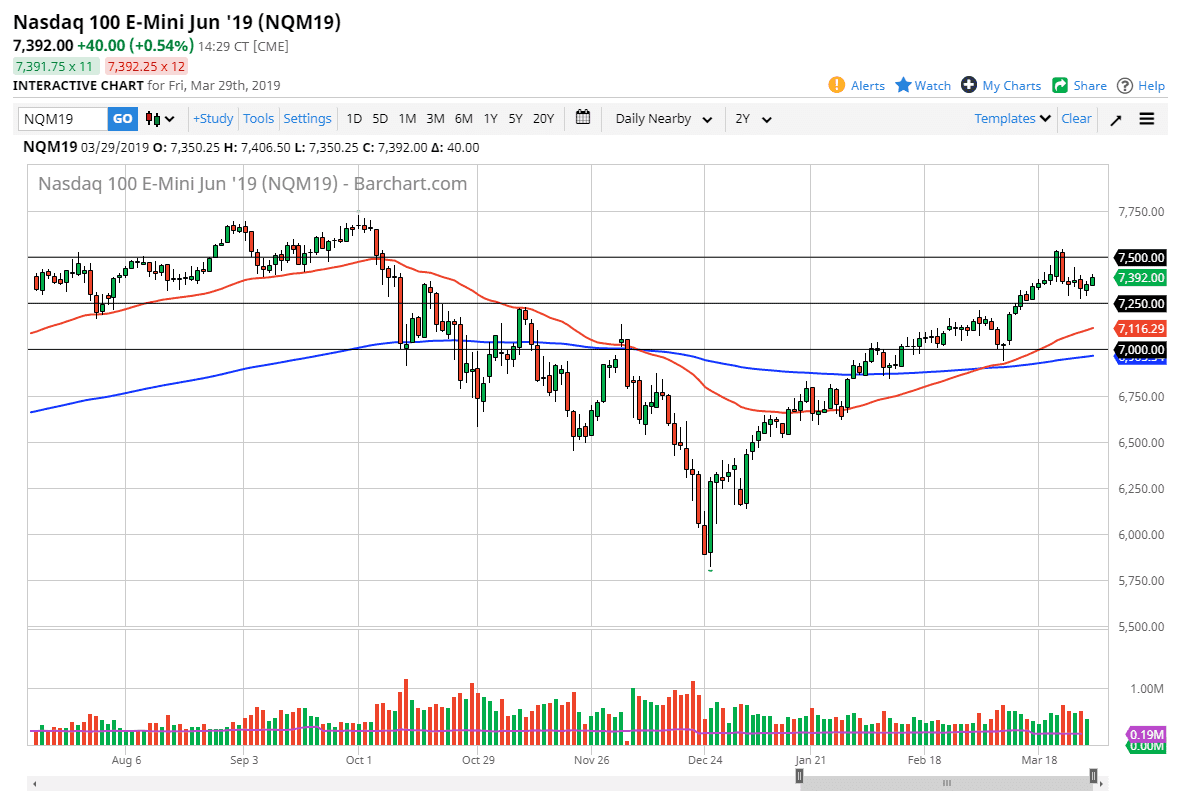

NASDAQ 100

The NASDAQ market rallied during the trading session on Friday, breaking above the top of the candle stick from Thursday, which of course is very bullish. Short-term pullbacks are buying opportunities that we can look to on short-term charts, and then eventually perhaps breaking towards the 7500 level. At this point, it’s likely that the 7250 level underneath is essentially the “floor” in the market, and therefore I like the idea of picking up value on dips as the NASDAQ 100 has been very strong. Beyond that, the NASDAQ 100 has been a leader so far, and therefore it’s likely that we will continue to go higher but it’s going to take a lot of momentum to finally break above the 7500 level.