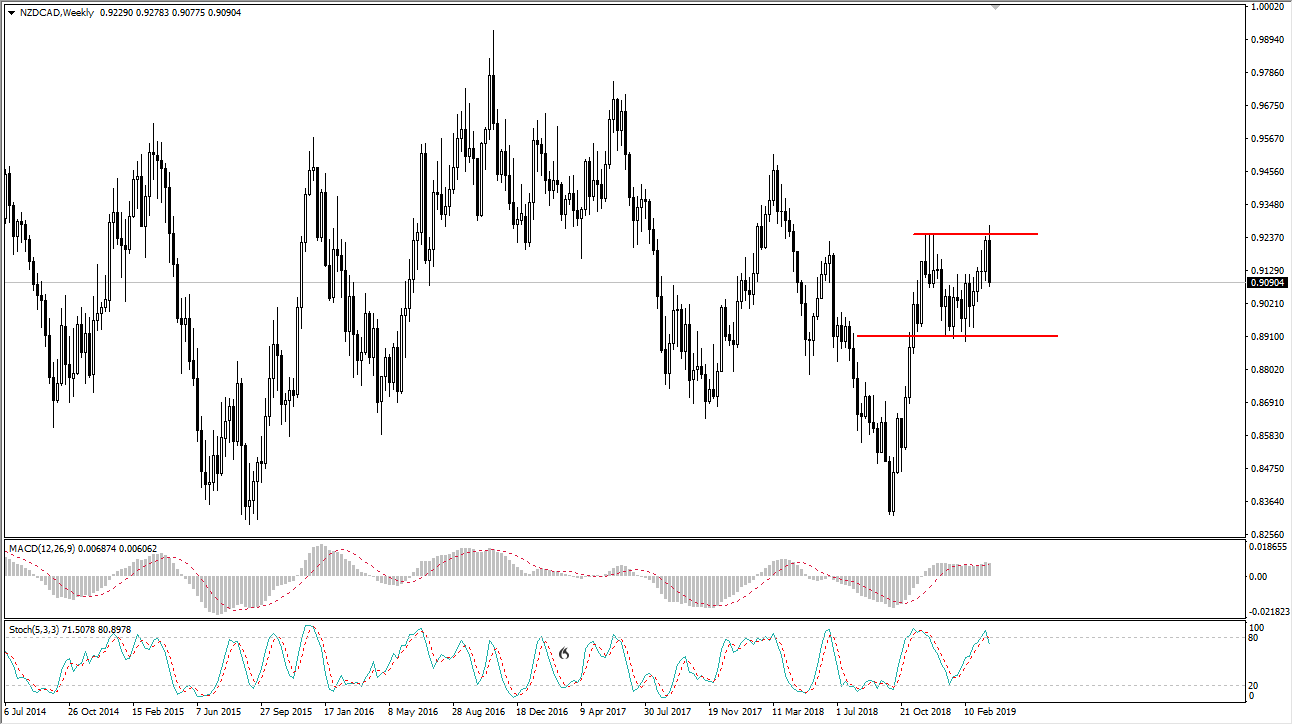

The month of March has been very noisy for the New Zealand dollar overall, but as Forex traders we need to go to where the action is. The Canadian dollar of course has been very noisy as well, so it’s very interesting to watch both of these currencies work against each other. In the NZD/CAD pair, it appears that we have started to carve out a nice trading range. With that, we can make trading decisions for the upcoming month based upon just a couple of simple levels.

The 0.89 level underneath is massive support, and I do believe that the buyers will be looking to defend that area as we have seen several times on the weekly chart. To the upside, we have seen several selloffs near the 0.93 level, and there’s no reason to think it’s going to change suddenly. However, as we go back and forth it offers and that wonderful opportunity to simply play obvious levels back and forth.

That being said, I think as we close out the month of March we are essentially in the “fair value range”, meaning we are in the middle of the overall range. I think it would be much easier to simply sell near the 0.93 handle, and by near the 0.89 level. Both of these currencies are based upon the commodity markets, so that of course will make them susceptible to the US dollar weakness or strength, and of course economic figures around the world. As economic figures around the world continue to disappoint, it’s very likely that the currency pair will continue to go back and forth as there’s no reason for them to make a huge move in one direction or the other. Keep in mind that the Royal Bank of New Zealand has recently suggested that they may be looking to cut interest rates in the future. However, the Bank of Canada is very much in the same place. Trade back and forth for the month.