Gold

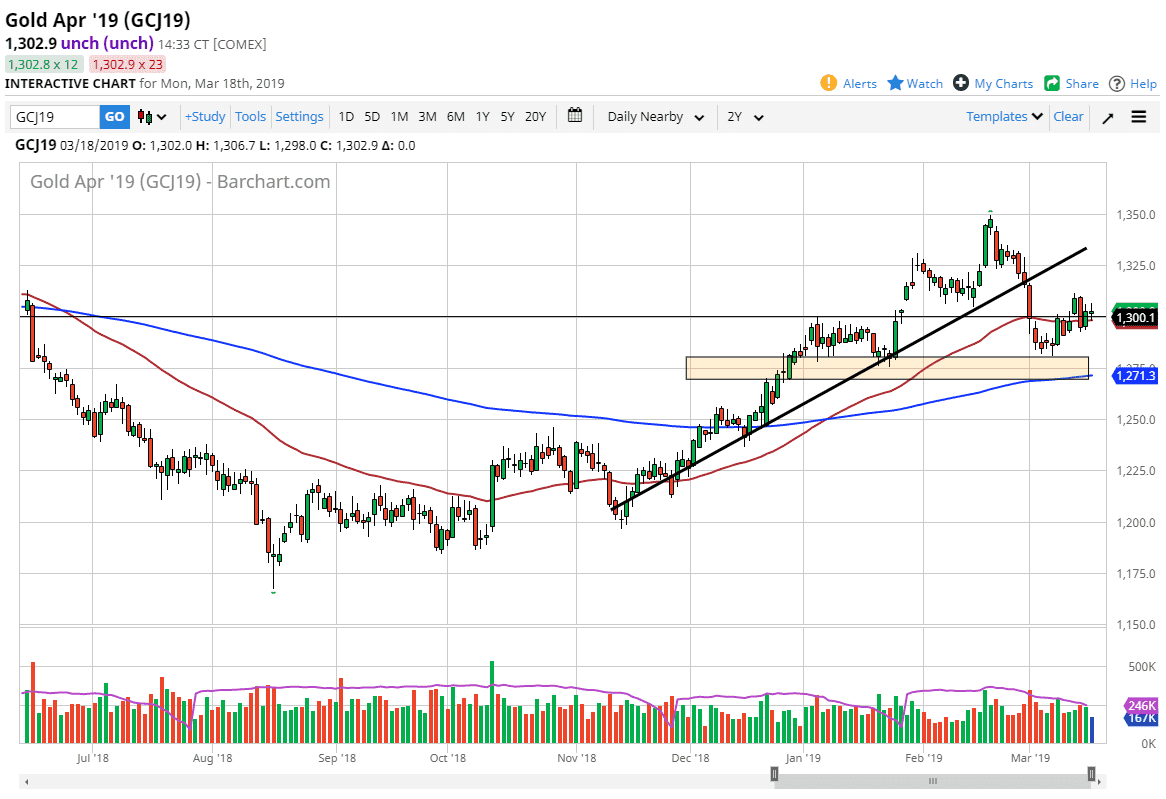

Gold markets went back and forth during the trading session on Monday, as we continue to tread water just above the $1300 level. Overall, this is a market that continues to see a lot of action in this area, but I also notice a couple of other things that matter here. After all, we have the 50 day EMA and previous resistance that is now supported. With that type of market structure in this area, it makes quite a bit of sense that we would continue to find buyers in this region.

Pay attention to the US dollar, it always has a certain amount of influence on gold markets anyway, as the market has seen the US dollar undulate during trading on Monday. Longer-term, one would have to believe that we will more than likely see a lot of fight in this area, but if we can break to the upside I suspect we are looking at a move towards the $1325 level, which is just underneath the previous uptrend line, and should now be resistance. That suggests to me that the market will more than likely try to get to that area. However, if we break down below the $1285 level, we will probably go looking for the $1275 level, which will probably coincide quite nicely with the 200 day EMA just below.

Overall, I do like Gold longer-term but we are at an area that will be a little indecisive at the moment, so it’s likely that we will continue to see volatility and choppiness going forward. With that in mind, pay attention to the US dollar, if it starts to lose value again, it’s very likely that Gold will benefit.