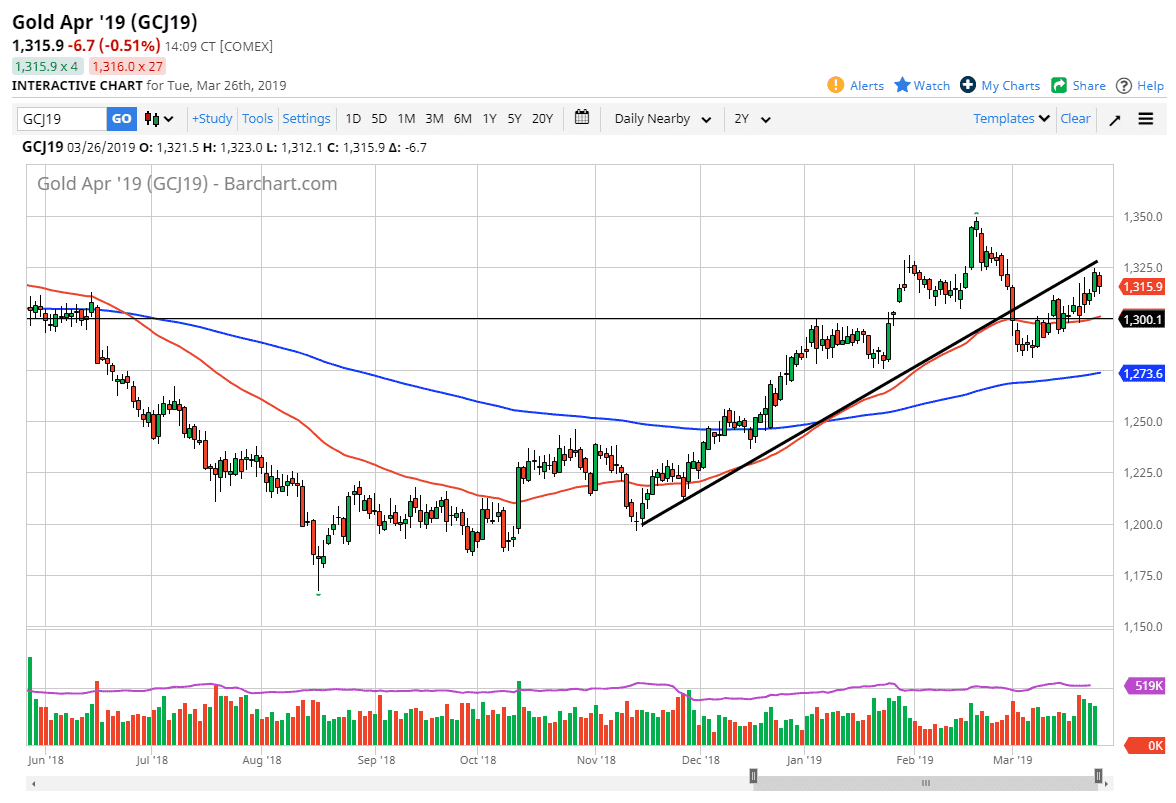

Gold markets initially tried to rally during the trading session on Tuesday but then gave back the gains as we fell towards the $1310 level. Later in the day we did get a little bit of a bounce, and at this point it looks as if we are setting up for some type of shorter-term consolidation area. While I can't guarantee that, I do see that there are a couple of levels from which we are going to be trading off of in the short term.

The $1325 level above is significant resistance, not only because it is a large, round, psychologically significant figure, but it has been structurally important in the past as well. Beyond that, there is the previous uptrend line which should now offer resistance. If we can break above that level, then the market is very likely to go looking towards the $1350 level, which of course was the most recent high going back to February.

To the downside, I see a lot of support at the $1300 level, which is not only a large, round, psychologically significant figure, but it is also where the 50 day EMA is currently sitting. That being the case, it’s very likely that we could just go back and forth in this $25 range. That’s typical for gold, as it does tend to react quite technically to each $25 handle.

However, if you look at the longer-term charts, the $1400 level above is the top of the larger timeframe consolidation area, just as the $1200 level underneath is massive support. That being said, it does seem as if the buyers are trying to make their stand. If we were to break down below the $1300 level, I see the next support level being formed at the $1275 level.