The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 3rd March 2018

In my previous piece last week, I was bullish on the Down Jones Industrial Average stock index. It closed the week down slightly, by 0.38%.

Last week’s Forex market saw the strongest rise in the relative value of the British Pound, and the strongest fall in the relative value of the Japanese Yen.

Last week’s market was generally less active and dominated by a fall in the value of commodities and commodity currencies, although the overall picture is mixed. The U.S. stock market had seemed to be on the verge of becoming a technical bull market again but flopped as it reached the key pivotal point which needed to be passed to achieve this.

This week ahead is likely to be dominated by U.S. Non-Farm Payrolls data, as well as central bank input concerning the Euro, and the Canadian and Australian Dollars.

Fundamental Analysis & Market Sentiment

Fundamental analysis looks quite bullish on the U.S. Dollar. The stock market has continued to recover from its lows and is very close to being in a technical bull market again, with the major indices already trading above their respective 200-day moving averages. There are fears over the seeming high sensitivity of the economy to any further rate hikes, as evidenced by the fact that the FOMC appears to have largely given up on its originally planned further rate hikes for 2019. The ongoing trade dispute with China appears to be moving towards a positive resolution, which is a good sign.

Legally, only four weeks remain until the U.K. leaves the European Union, and the default position is that there will be no deal unless one is agreed before that date. The E.U. are still refusing to offer any substantial concessions on their offered terms of a deal, so we can expect continuing political uncertainty and machinations over the next few weeks in the U.K. If Brexit is postponed, which seems increasingly likely, there will be a greater chance of a deal being reached or of Brexit not happening at all, and that will boost the value of the British Pound.

The ECB has recently taken a more dovish line on the Euro and the Euro still looks relatively weak.

Precious metals sold off very strongly towards the end of the week.

Technical Analysis

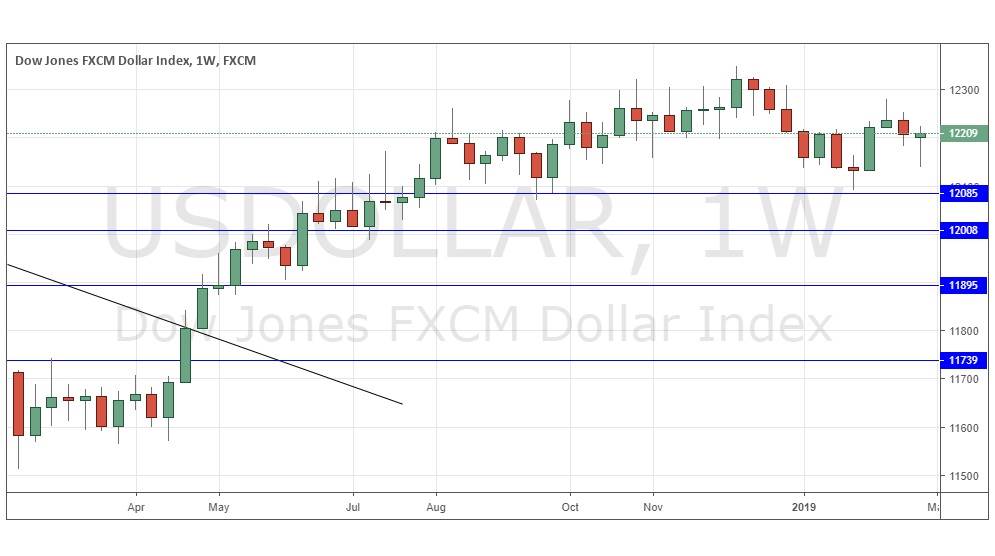

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index rose a little, printing an average-sized bullish pin candlestick with a meaningful lower wick, which suggests a further rise next week. However, as the price is down over 3 months, but up over 6 months, so we have a more mixed wider price action context picture on the Dollar. Overall, next week’s direction again looks uncertain.

GBP/JPY Currency Cross

The weekly chart below shows last week produced a relatively large, strongly bullish candlestick, which reached and closed at its highest close for more than 3 months, within the top quarter of the candlestick. Although the Pound sold off towards the end of the week, the Japanese Yen sold off strongly at the same time. Although the price is not far from a major previous swing high, it looks likely to rise further over the coming days. The Pound will also be boosted as a “no deal” Brexit outcome becomes less and less likely.

Conclusion

This week I am bullish on the British Pound and Bearish on the Japanese Yen.