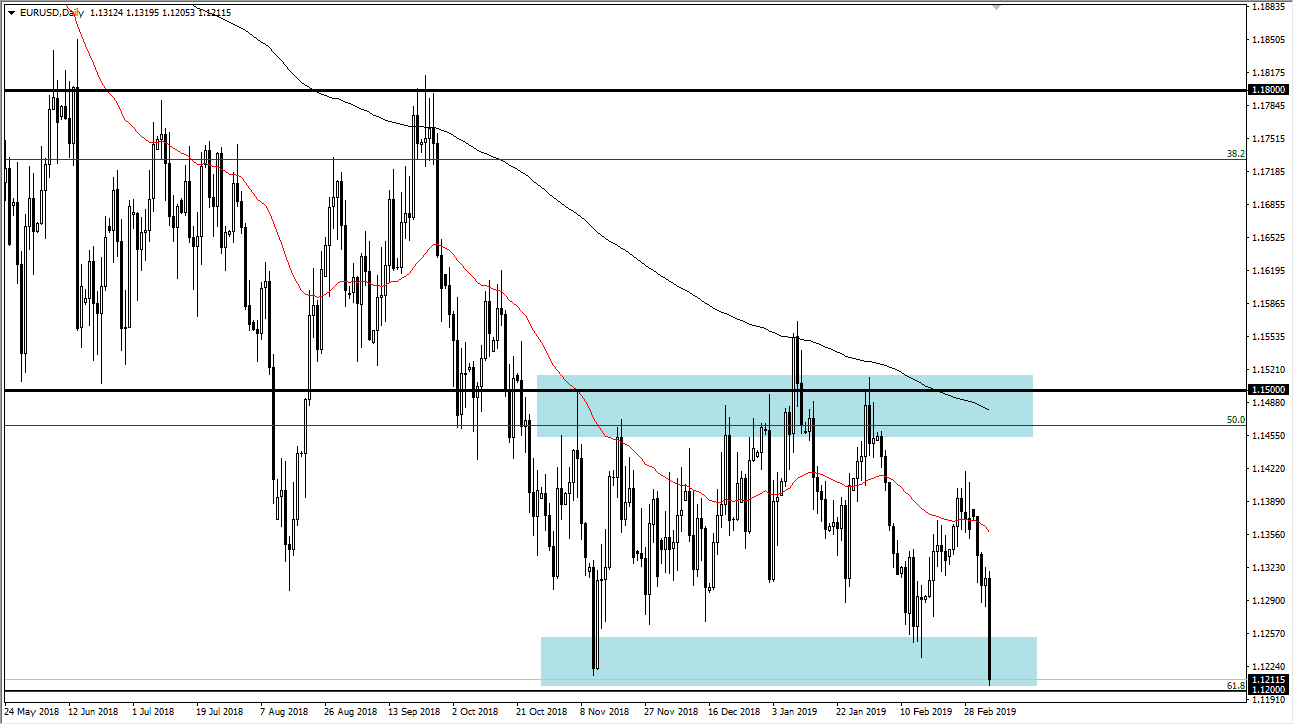

EUR/USD

The Euro fell apart during the trading session on Thursday as the ECB press conference was horribly negative when it comes to the outlook of global growth, and while Mario Draghi seem to point the finger outside of the European Union, the reality is that the EU has been slowing down. However, this seems to have been a bit more dovish than the market expected because traders came in and crushed the common currency. The 1.12 level was crucial in the form of support, and it also is where we see the 61.8% Fibonacci retracement level. While we have broken down, it will be crucial as to where we close on Friday. If we turn around and reverse this area, not much will have changed, and if there’s going to be a day at all that this can happen, it’s going to be Friday. According to the weekly chart, we just entered another major area.

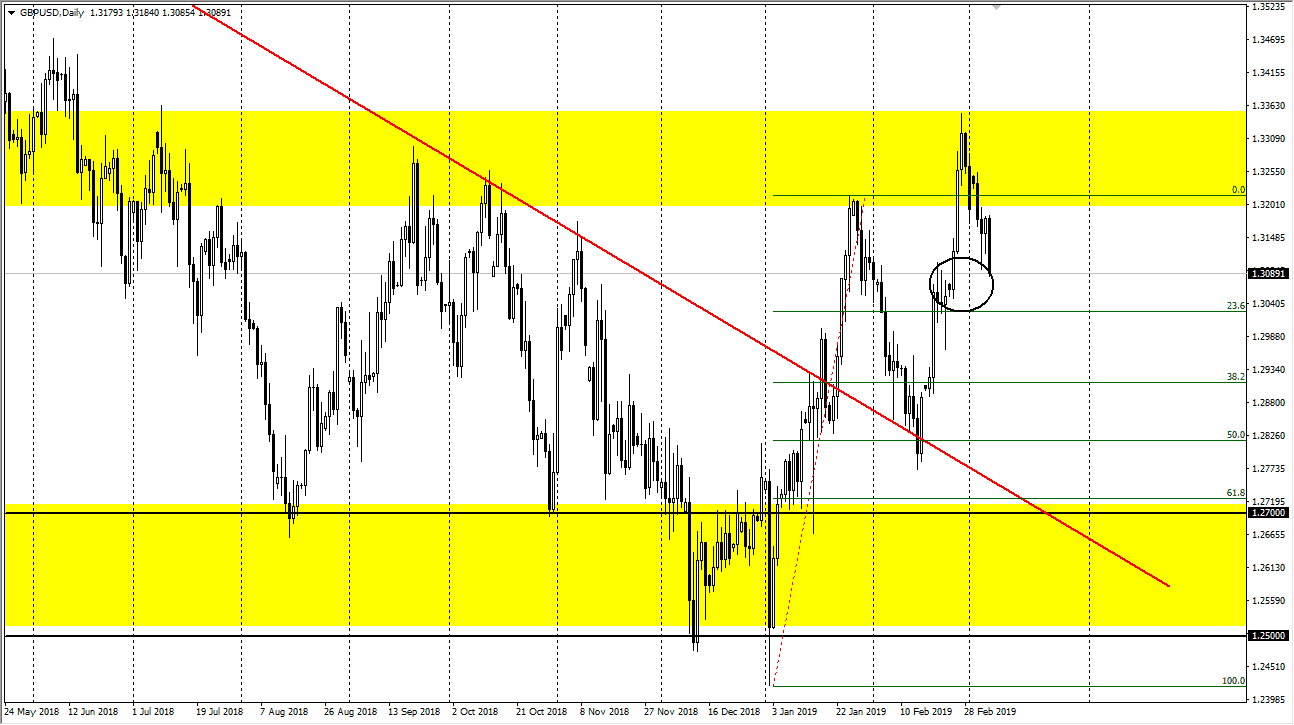

GBP/USD

The British pound broke down during the day as well, based again on the strength of the US dollar. The area that we are in right now looks very likely to be an area that is going to attract a lot of attention. I think there’s a lot of order flow at the 1.30 level, so it’ll be interesting to see if we bounce from there. The market continues to chop around overall, and it still makes higher highs, so under all of the classic definitions, we are still very much in and uptrend. That being said, I would not put a lot of money into the market in any one particular trade, but I would build up a core position over time, allowing you to ride out the potential volatility in this market.