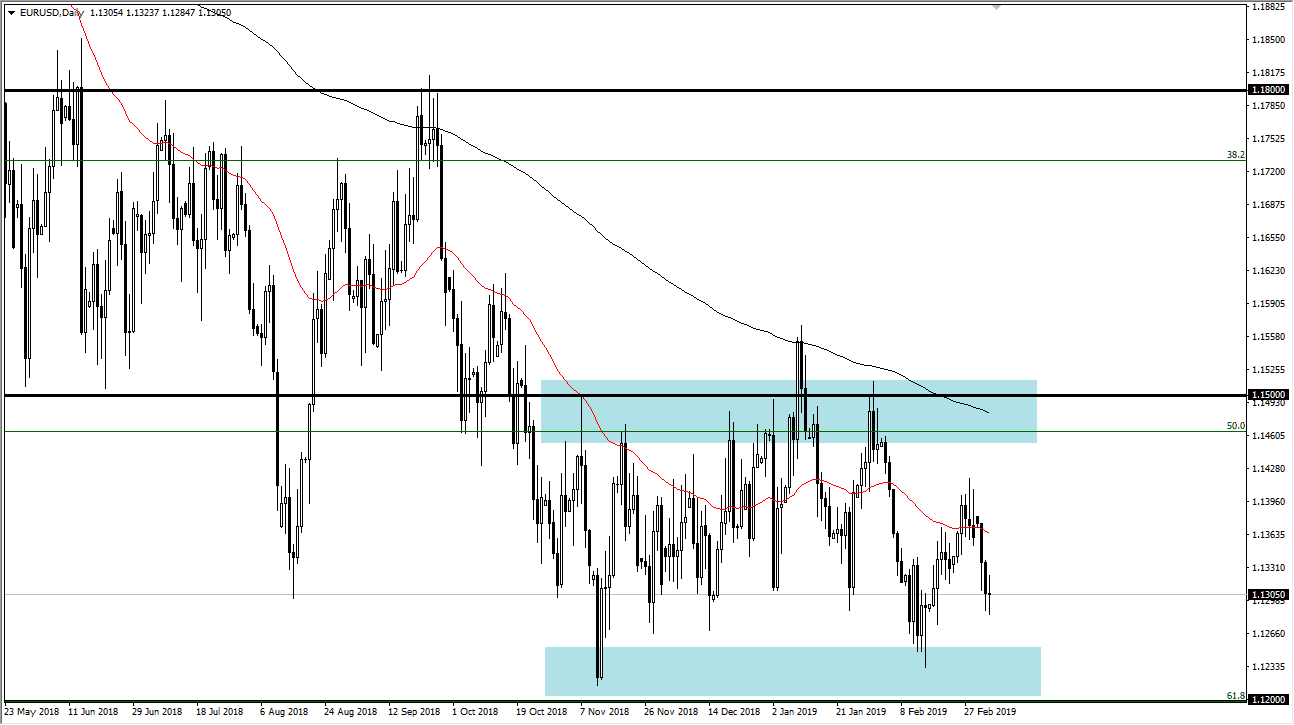

EUR/USD

The Euro has gone back and forth during the trading session in choppy action on Wednesday, as we simply have no directionality over the last 24 hours. Right now we are looking at a Federal Reserve that is stepping away from its hawkish stance, but at the same time we have the European Central Bank struggling with a weakening Germany, and a recession bound Italy. In other words, this is a fight between two central banks that are trying their best to keep their currencies soft. It is because of this that I think that the market continues to go back and forth, staying within the consolidation area that is bordered at the 1.12 level underneath, and the 1.15 level above. Until something changes drastically with the world economy, I think it’s going to be difficult to escape this overall range.

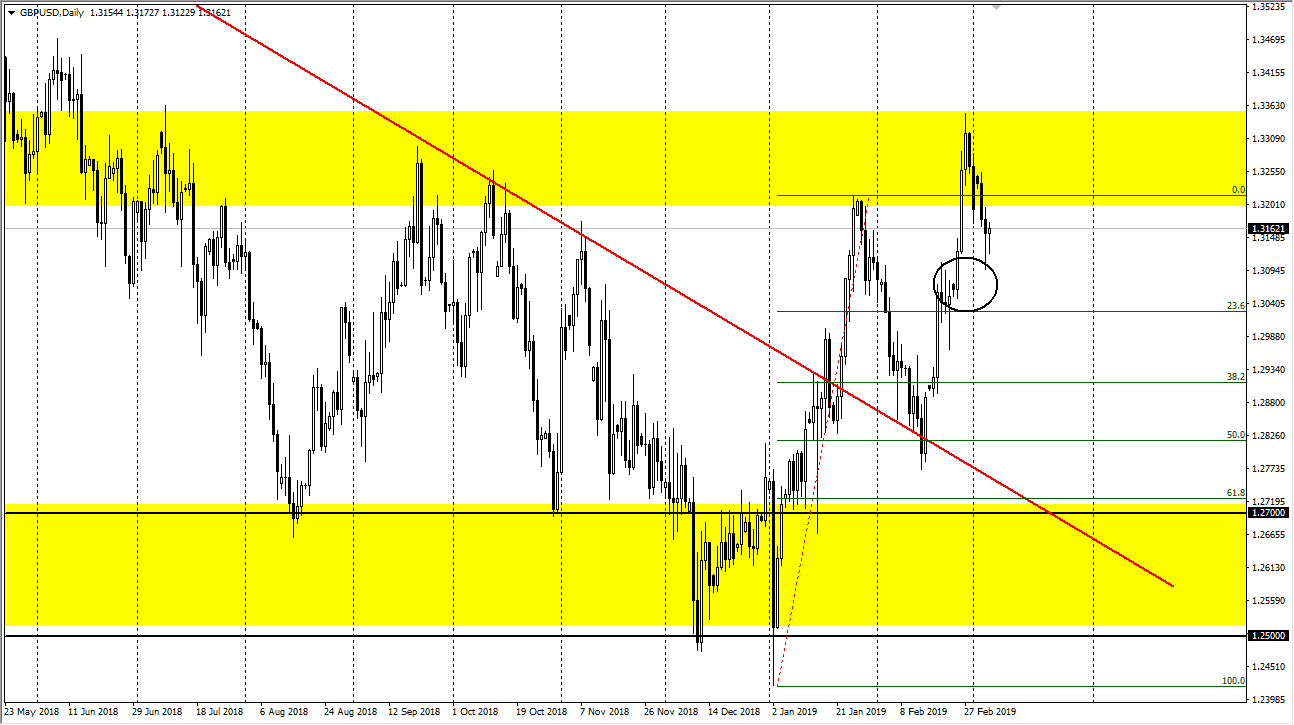

GBP/USD

The British pound initially fell a bit during the trading session on Wednesday, but then turned around to rally yet again. We ended up forming a bit of a hammer, just as we did during the previous session, so this is a good sign that the British pound continues to find support underneath. With that being the case, it looks as if we will continue to go higher over the longer-term, as traders are starting to price in the idea of either some type of Brexit deal, or at the very least a delay in the Brexit, which gives you more of an opportunity to escape a “no deal Brexit” scenario. I believe that the 1.30 level should be supportive, so there should be a certain amount of buying pressure there as well. I have no interest in shorting the British pound, I believe that we are in the process of changing the longer-term trend.