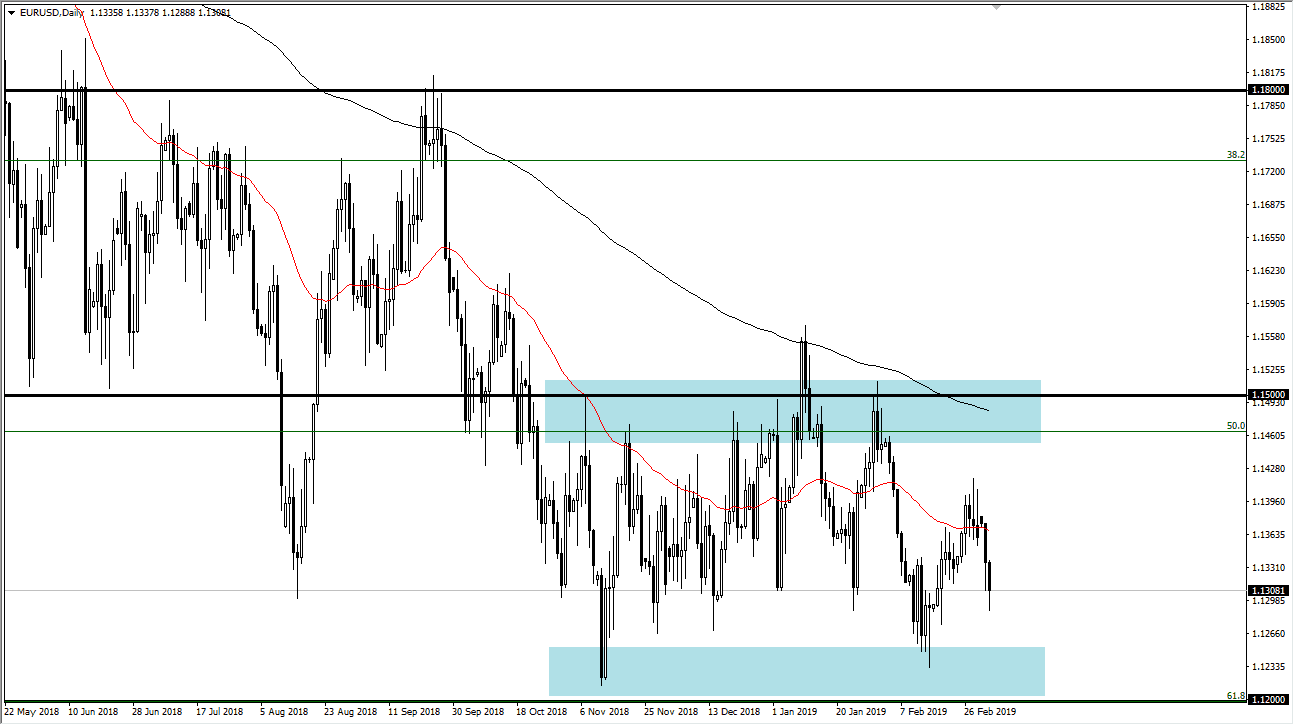

EUR/USD

The Euro fell during trading on Tuesday, as we continue to drift a little bit lower. However, we are in a major area of consolidation, and the US dollar is starting to show signs of weakness against many other currencies around the world. I believe it’s only a matter time before the pair rally as a result, but I’m not looking for some type of major move. Quite the contrary, I’m very comfortable with going back and forth in this range, with the 112.00 level underneath being the floor, and the 1.155 level above being the ceiling. Obviously, there will be the occasional headline that moves the market, but at the end of the day the biggest headline is going to be whatever the Federal Reserve looks to do, which at this point seems very dovish. That should be a bit of a catalyst for higher pricing.

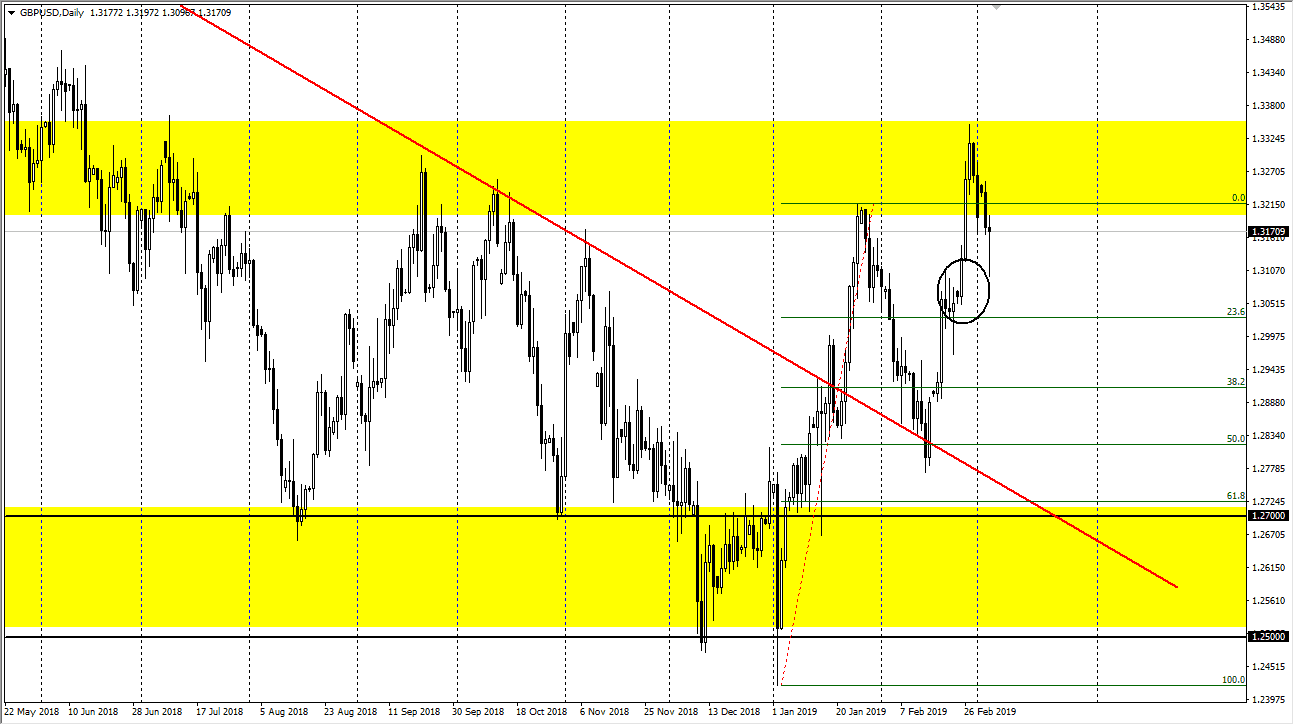

GBP/USD

The British pound initially pulled back during trading on Tuesday but found support at the ellipse that I have drawn from several days ago. The 1.3050 looks to be a demand area, and now that we have formed a nice-looking hammer, it appears that we are trying to break out to the upside. If we do, a move to the 1.35 level could be in order. I also like buying pullbacks so, because I think that the British pound is undervalued, and the closer we get to some type of deal or at least delay in the Brexit, the more likely we are to see buyers jump into this market. Remember, we have recently broken above a major downtrend line, came back to test it, and then have shot higher as a result. That’s the classic beginning of a trend change that is longer-term in nature.