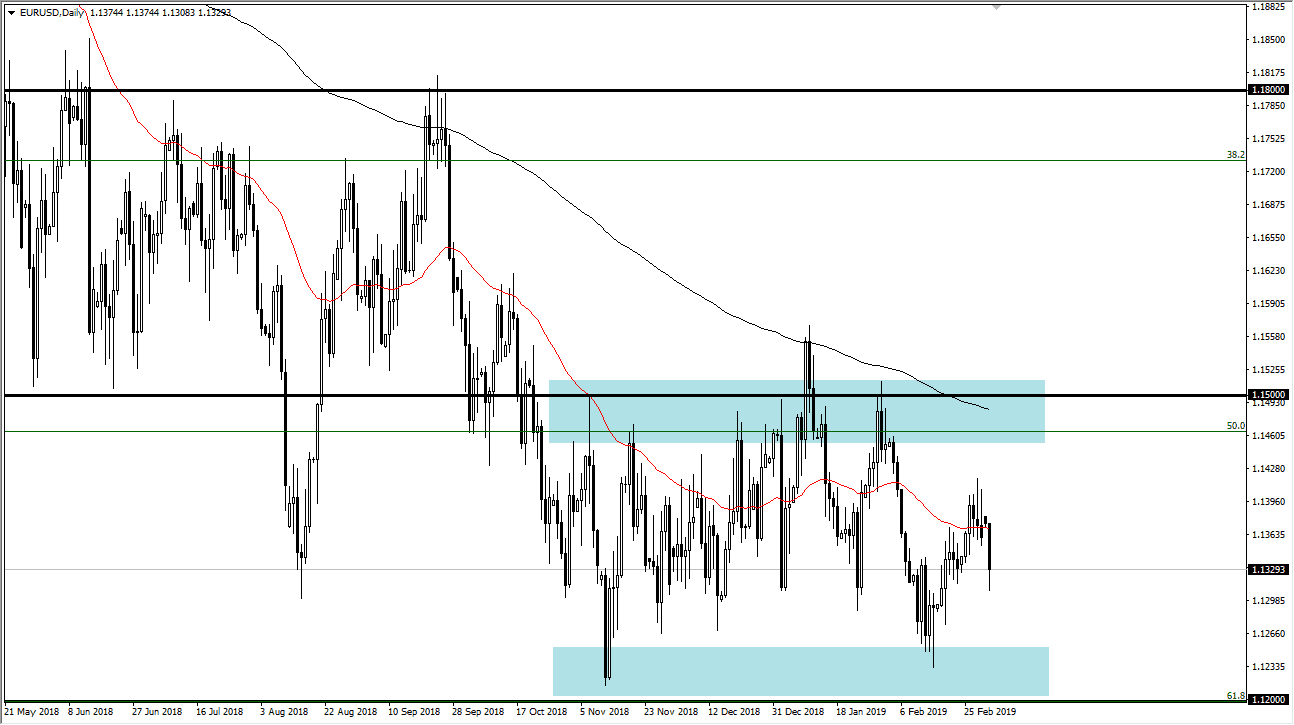

EUR/USD

The Euro tried to rally at the beginning of the Monday session but rolled right over, which should not have been a big surprise considering that the couple of previous candles have been shooting stars. Ultimately, it looks as if we ran into a bit of exhaustion, but when you look at the longer-term chart, we are still in a major consolidation area. The 1.12 level underneath is massive support, and I think it will be very difficult to break to the downside. In fact, I suspect somewhere closer to the 1.1250 level is a good area to start scaling into a long position, just as the 1.1450 level above is the beginning of significant resistance to the 1.15 handle. I think we are essentially in “no man’s land”, so it’s going to be difficult to take a position until we get to one of these outer areas.

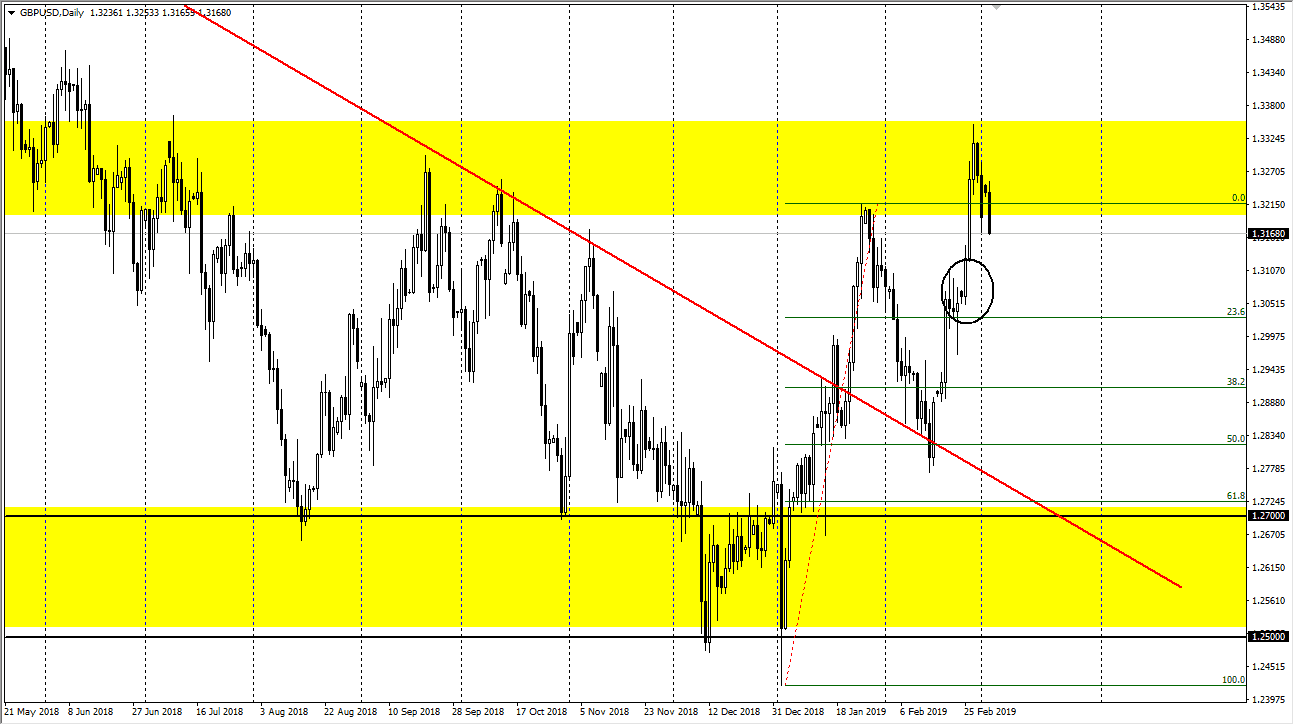

GBP/USD

The British pound fell hard during the trading session on Monday, as we may have gotten a bit overbought. However, look at this chart you can see I have an ellipse near the 1.3050 level, an area that has seen the lot of interests. At this point, I would be very interested in buying the British pound down at that level, because it gives us an opportunity to pick up the British pound “on the cheap.” The closer we get to some type of agreement with the Brexit or at the very least a delay, the better off the British pound is going to be behaving. Beyond that, the market has broken above the downtrend line, pulled back there, and then took off again to the upside. That’s the classic beginning to the end of the downtrend.