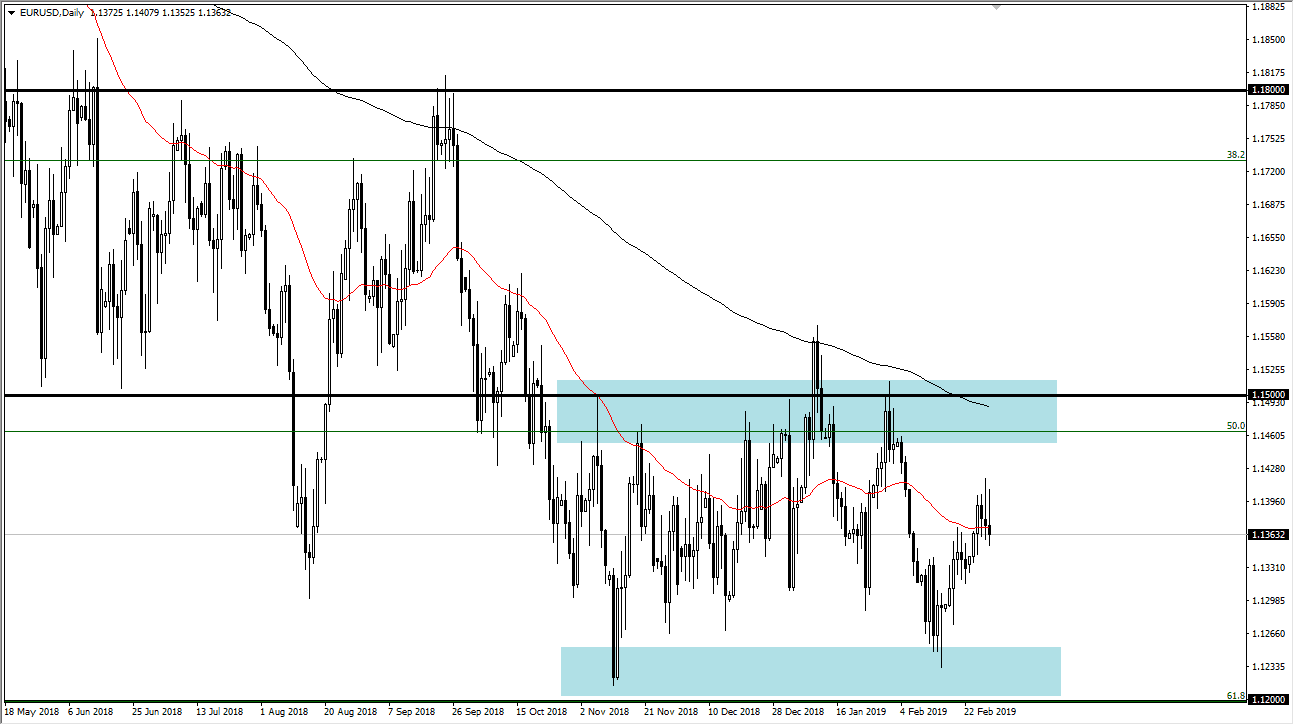

EUR/USD

The Euro rallied initially during the trading session on Friday but fell yet again to form a shooting star for the second day in a row. That of course is a negative sign, but ultimately when you look at this pair we are in a massive consolidation area, and nothing has changed. This might be a bit of a pullback to try to find value underneath, which is an argument that I can understand. On the other hand, if we can break above the highs from both Thursday and Friday, that’s a very bullish sign. We are essentially a “fair value” in this area, so I think we are looking at opportunities about two handles away. At this point, we are essentially in a “no touch zone.” If we find ourselves closer to the 1.12 level, I become more bullish, just as I become more bearish closer to the 1.15 level above as the 200 day EMA coincides there. At this point, I do think that we are trying to form a longer-term basing pattern, and that we will eventually break out to the upside.

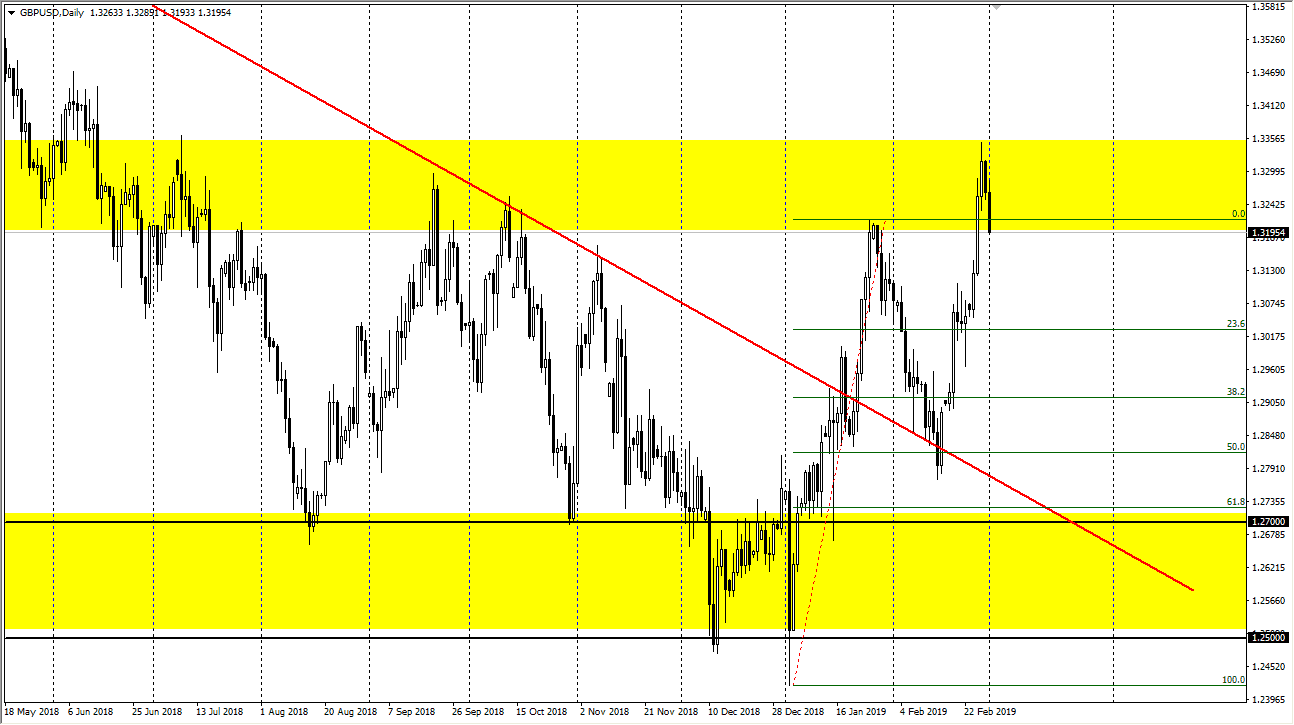

GBP/USD

The British pound pulled back a bit during the trading session on Friday, as the market has gotten a bit overdone. This is good though, because we have seen far too much in the way of bullish pressure to continue going higher. I think that the British pound has bottomed though, and at this point I am looking for value underneath. I believe that the 1.30 level underneath should be massive support, as it is a large, round, psychologically significant figure, and of course an area that we have seen a lot of clustering. Traders have recently started to warm up to the idea of the British pound as it looks like the Brexit will be delayed.