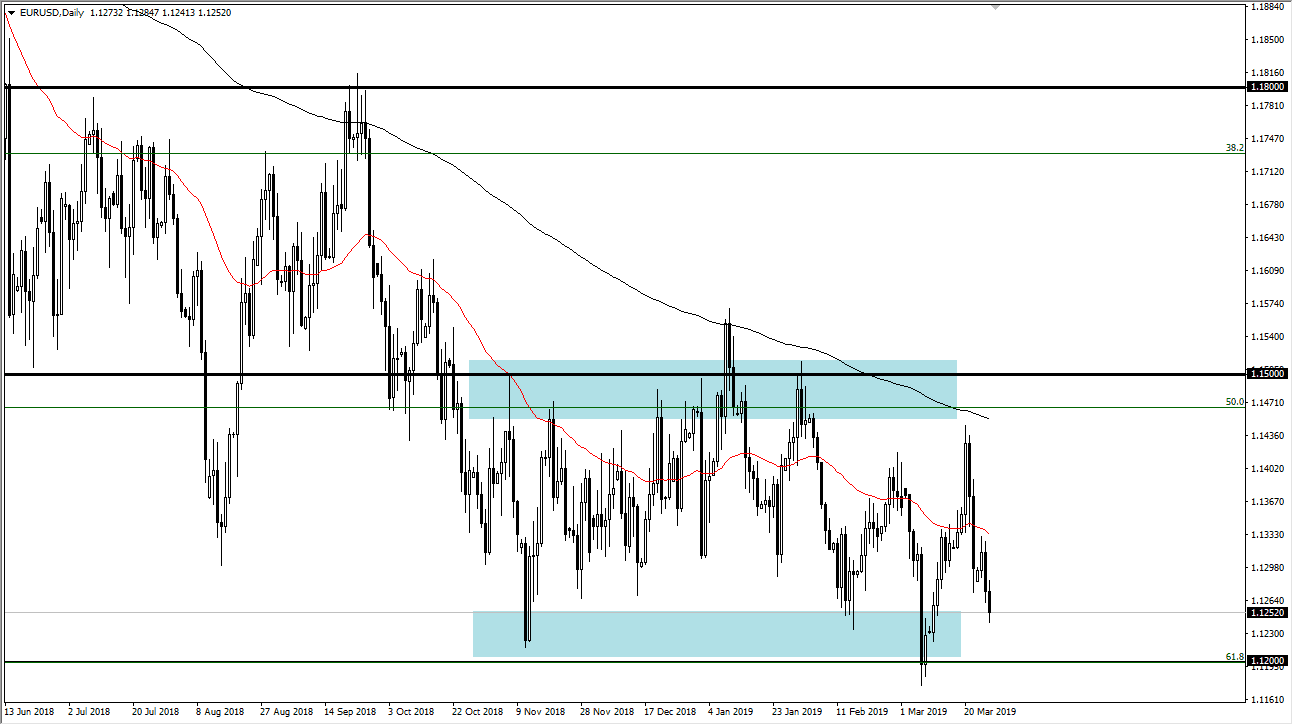

EUR/USD

The Euro fell relatively hard during trading on Wednesday but continues to find support near the 1.1250 level. This is the beginning of major support from what I see, so I’m more than willing to step in and start buying at this point. This is the bottom of the overall consolidation area, so therefore it makes sense that we are probably going to find buyers in that region again. I’m not looking for a “home run” here, I’m simply looking for some type of small bounce just as we have seen in the AUD/USD pair for some time. While I do recognize that we recently had a pretty serious attempt on the 1.12 handle, the reality is that the most recent high was higher than the one before it so I think we are simply trying to find our way into some type of equilibrium between the 1.12 and the 1.15 levels.

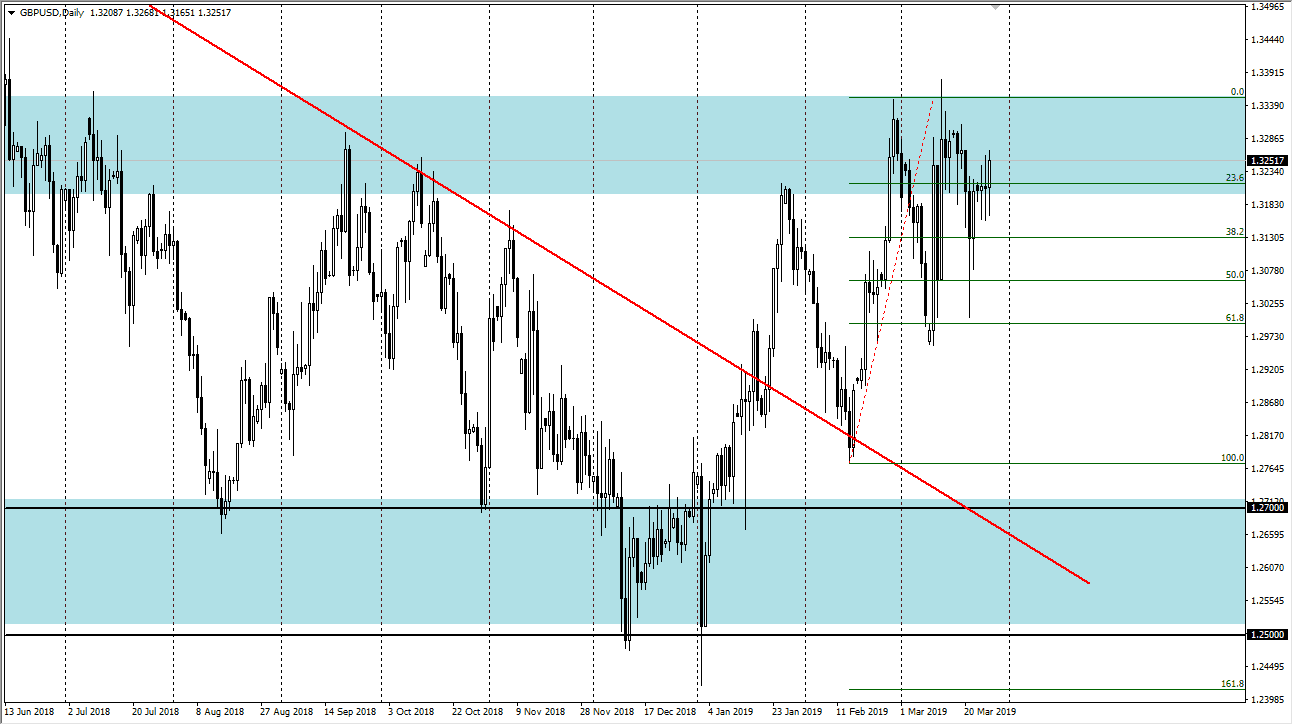

GBP/USD

The British pound went back and forth during trading on Wednesday as well, initially dipping but finding support near the 1.3150 level yet again. This is the third day in a row we have seen this, but unlike the previous two days we are closing towards the top of the candle. With that, it looks like the buyers are starting to step up the pressure and try to build up enough momentum to break above the 1.3350 level. Once we break above this handle clearly, we could find ourselves looking at the 1.35 handle next.

Although I believe the trend change has already started, by the time we break above the 1.35 level I would assume that the rest of the world would join me on that. That could lead to a longer-term trade, but in the meantime it’s obvious the buyers come in and pick up these dips, regardless of headlines.