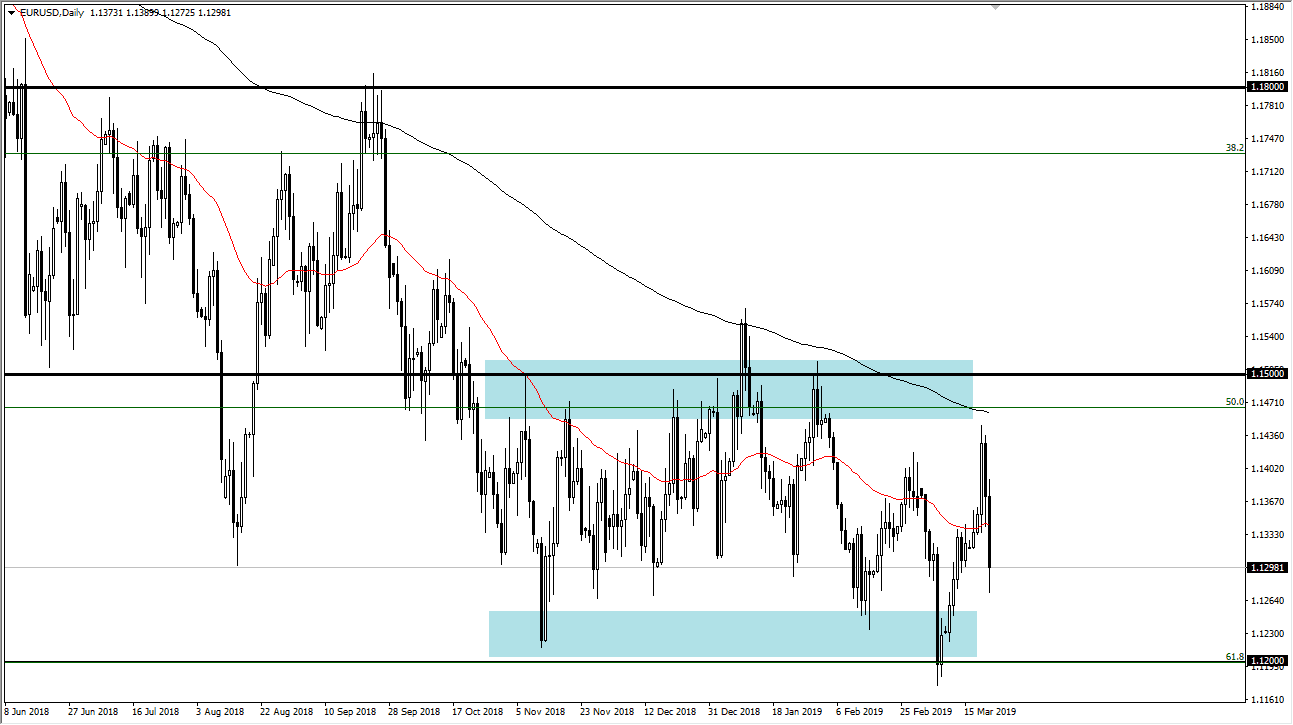

EUR/USD

The Euro initially tried to rally on Friday but then collapsed as German economic numbers disappointed. Beyond that, we then saw the US PMI numbers miss consensus, and that had money flowing into the treasury markets. This of course drove up demand for the US dollar overall, but there is significant support underneath near the 1.1250 level. With that in mind, I do believe that the buyers will probably return sooner rather than later as we are still very much in the middle of consolidation. The 61.8% Fibonacci retracement level is at roughly 1.12 as well, so that’s another reason why I think the buyers are waiting below. That being said, I don’t expect that the market is ready to break out of this range, and that’s essentially my thesis overall when it comes to trading the Euro.

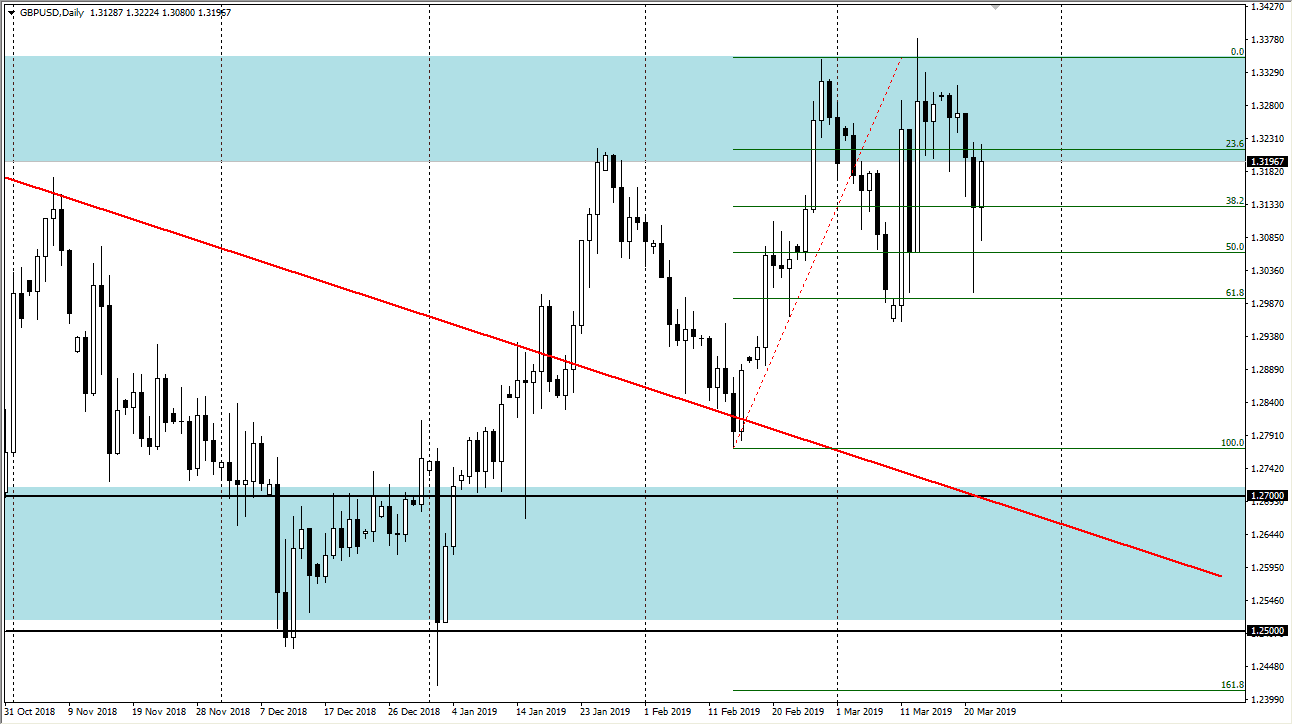

GBP/USD

The British pound initially tried to sell off during the day on Friday but then rallied significantly, reaching towards 1.32 handle. By doing so it shows just how likely we are to continue to see buyers jump in and take advantage of a cheap British pound. The 1.3350 level above has offered significant resistance more than once, so I think what we are doing right now is to try and build up enough momentum to finally make the breakout.

With the European Union offering an extension to the United Kingdom, that has given a bit of a reprieve for Sterling, but another bonus to this is that the Federal Reserve is looking to stay away from interest rate hikes for at least the rest of the year. That being the case, I think we continue to buy the dips but I also recognize that the market will still have the Brexit headlines and headaches making it very erratic. 1.30 underneath seems to be massive support from a longer-term perspective.