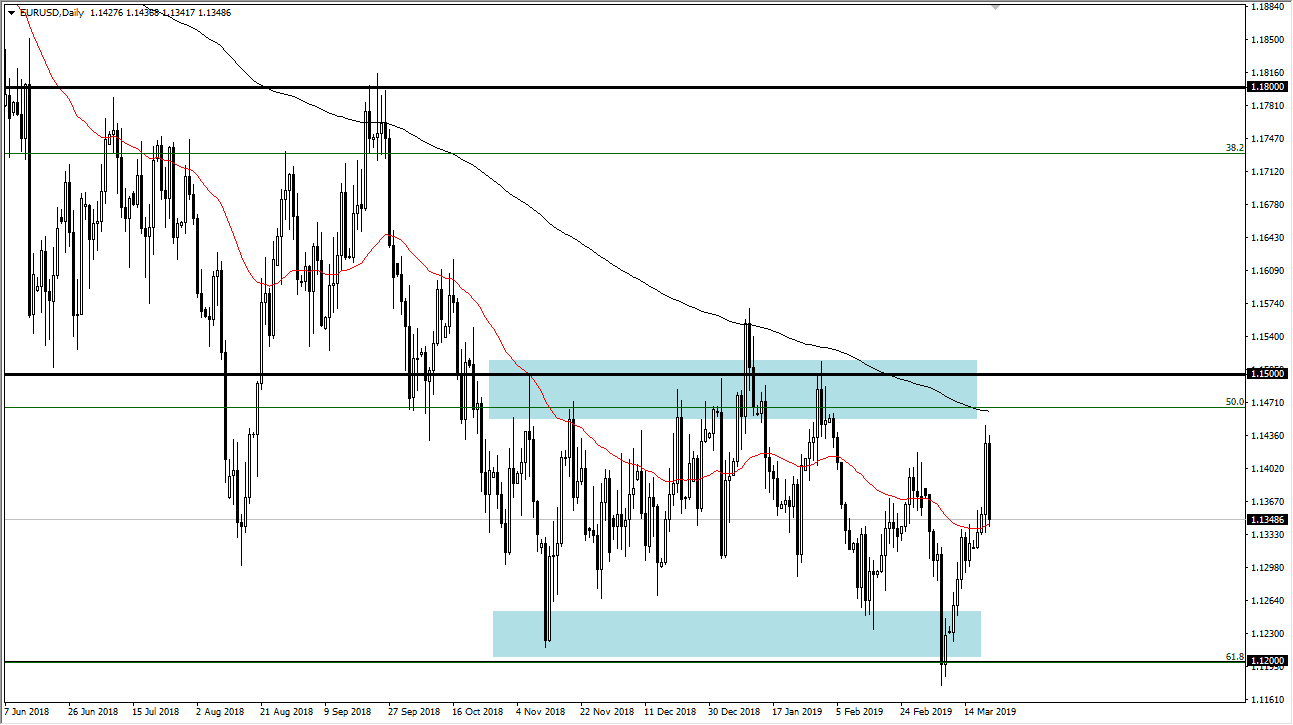

EUR/USD

The Euro fell rather significantly during the trading session on Thursday against the US dollar, which is a bit surprising considering how drastically bullish the pair had been during the previous session. This was due to the Federal Reserve stepping back and suggesting that there is no chance of an interest rate hike during 2019. This obviously is very bearish for the greenback, but then it seems the markets aren’t necessarily convinced. Perhaps it is a situation where the Federal Reserve knows a lot of things that markets don’t, so it’s difficult to get overly bullish about the economic conditions, or perhaps we are just simply looking at a couple of central banks that can’t do much, thereby keep in the market in a range. As we are in the middle of this 300 point range I have marked on the chart, there’s not much to do here.

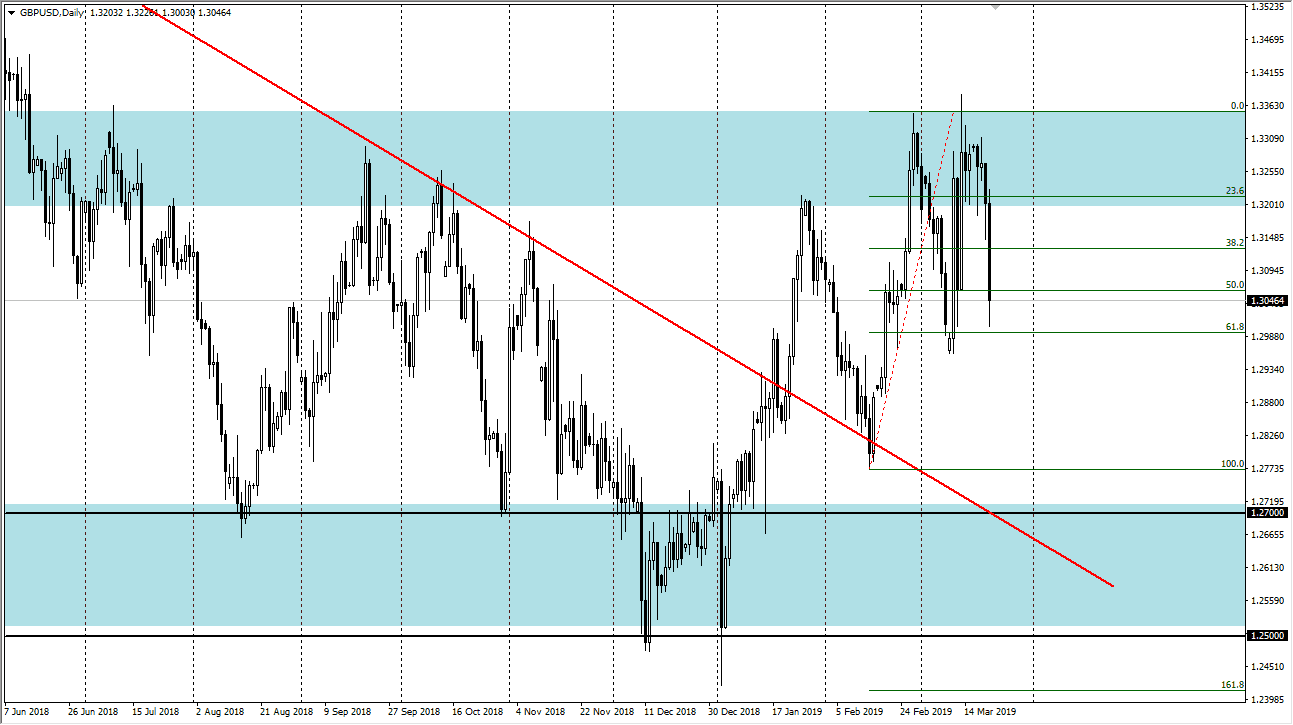

GBP/USD

The nonsense in the headlines coming out of the Brexit situation continues to cause issues with the British pound, as we reached towards the psychologically important 1.30 level. That’s an area that has attracted attention before, and it looks as if it is attracting a certain amount of attention towards the end of the day. I still believe that the British pound will go higher eventually, especially after we get some type of agreement with the Brexit. We have recently broken through a downtrend line, and that is typically a sign of a potential complete trend change. Overall, if we can break above the 1.3350 level, then the market could go looking towards 1.35 level which is my longer-term target. To the downside, I see a massive “floor” at the 1.27 level underneath.