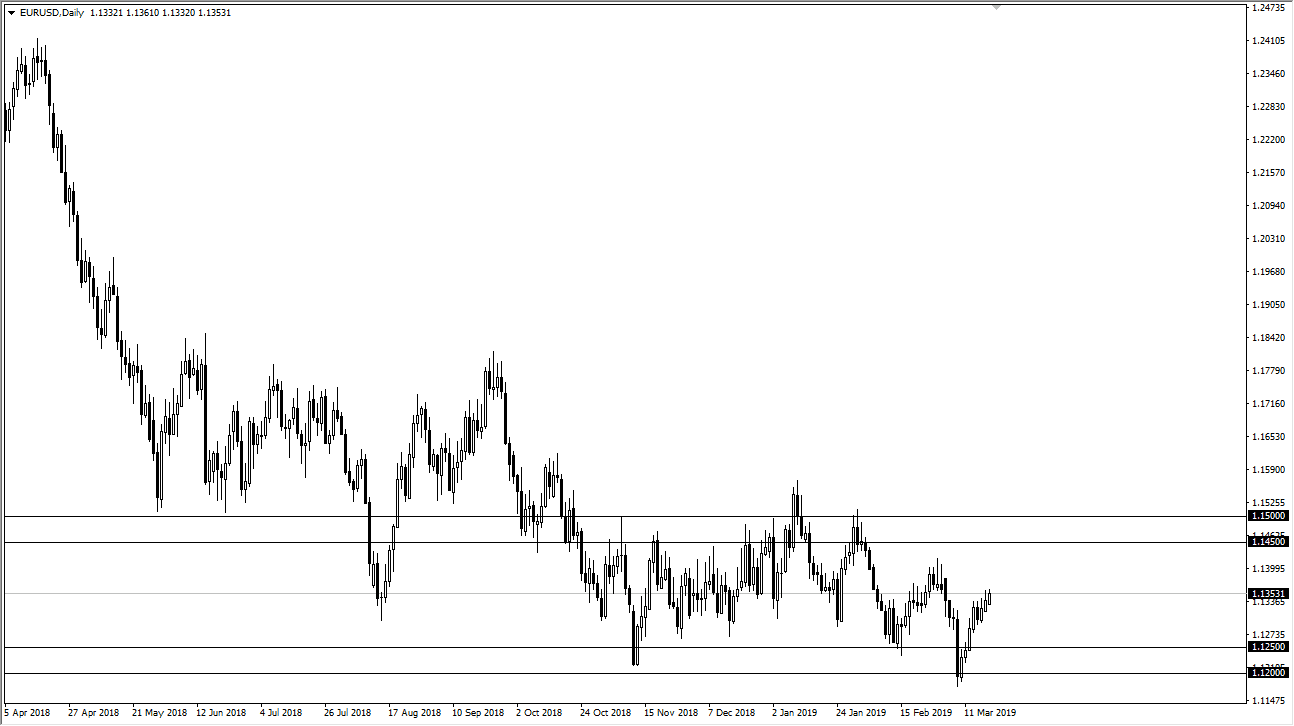

EUR/USD

The Euro rallied a bit during the trading session on Tuesday, reaching towards 1.1350 level. This is essentially in the middle of the overall consolidation area that we have been in, so therefore it’s essentially “fair value.” This makes sense of course considering that the Federal Reserve is going to come out with a statement during the day on Wednesday. With that being the case, traders will react and either buy or sell the greenback accordingly. Because of this and the fact that we don’t know what’s going to happen, I suspect at this point it’s probably best to leave this market alone. However, I am a buyer closer to the 1.1250 level, and the seller closer to the 1.1450 level, unless of course we were to break above the 1.15 level which would show a significant change in attitude.

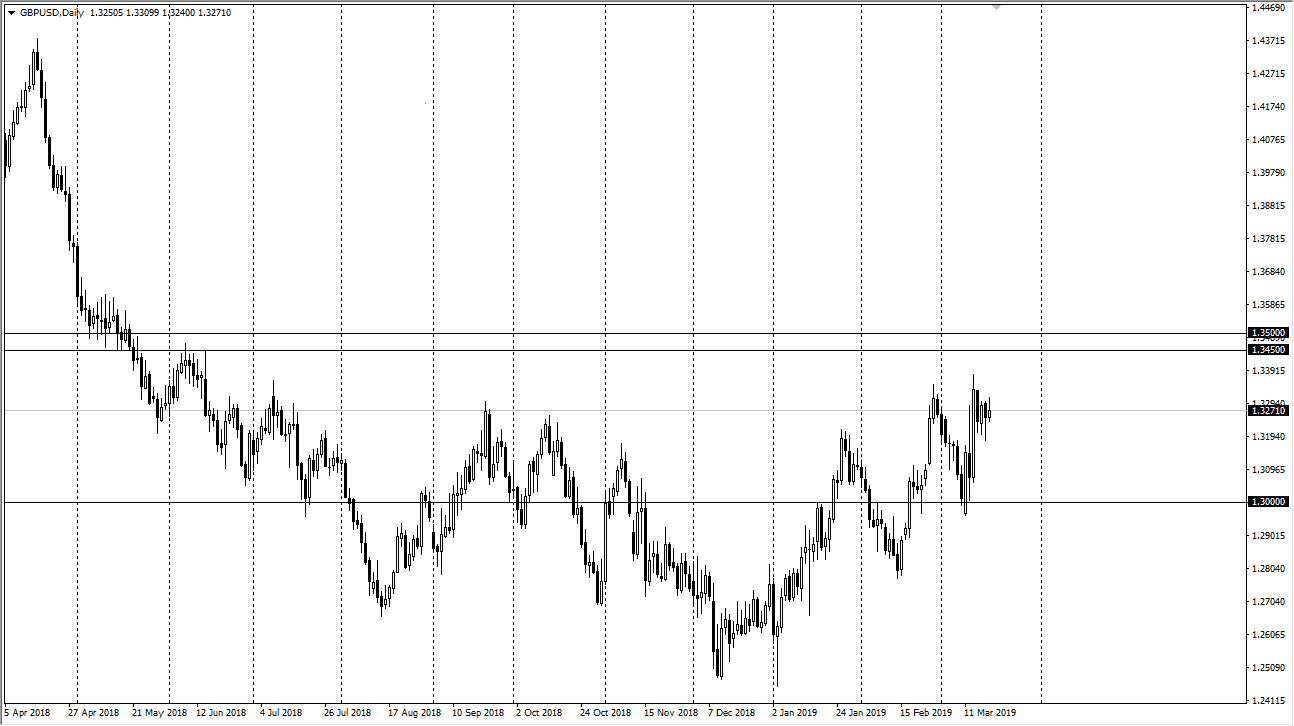

GBP/USD

The British pound tried to rally during the trading session on Wednesday but gave back quite a bit of the gains. What I do like though is that the Tuesday candle stick was a hammer, so that shows there’s a certain amount of resiliency to this market and that we will probably go looking for higher levels. With all that being the case, pay attention to the Federal Reserve statement because if it is dovish, that should give the British pound a bit of a lift as a delayed Brexit is all but assured at this point.

To the downside, if we were to clear the 1.32 handle, then we could go down to the 1.30 level underneath which was a major support level. Either way, I don’t look to short the British pound anytime soon, although we may get the occasional pullback.