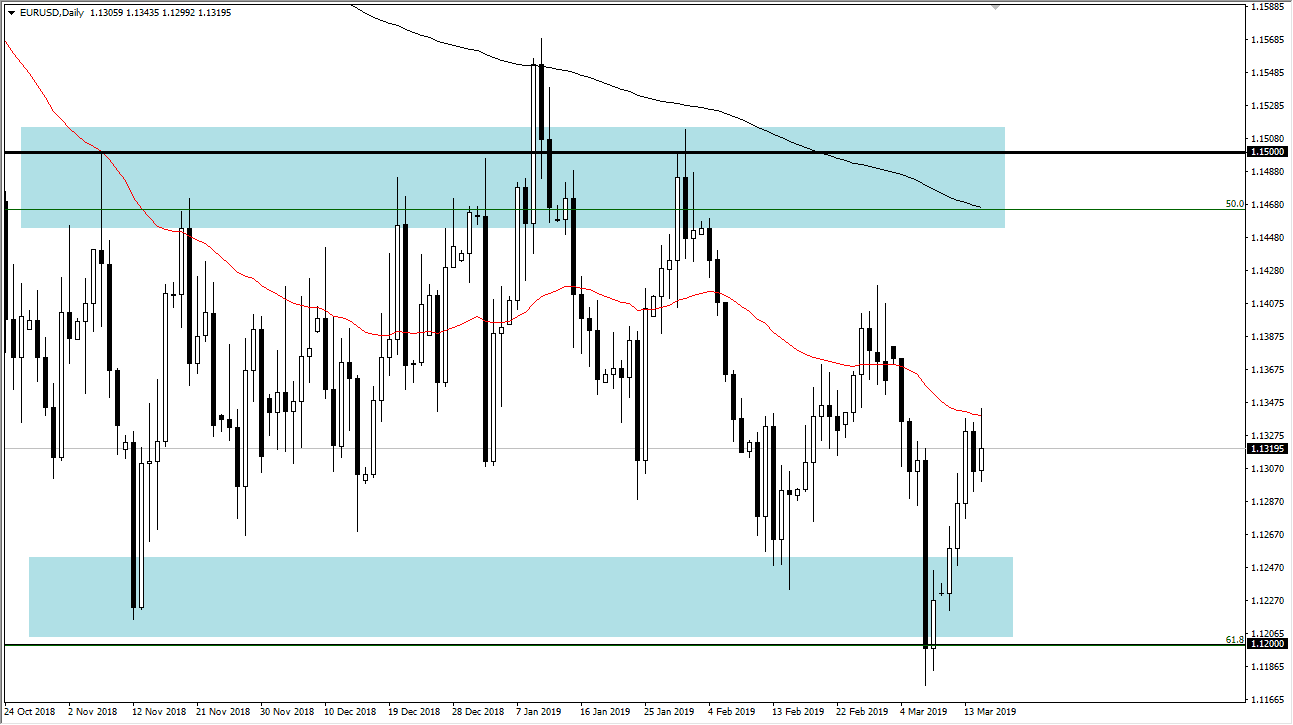

EUR/USD

The Euro rallied a bit during the trading session on Friday but gave back quite a bit of the gains at the 50 day EMA. We ended up forming a bit of a shooting star as well, so it does suggest in fact that we are going to continue to see this market roll over. That being said though, if we can break above the top of the candle stick for the trading session on Friday, that would be a very bullish sign. This is a market that continues to go back and forth, with the 1.12 level underneath offering massive support and the 1.15 level above offering a major resistance. This is a market that continues to be very choppy due to the fact that both central banks are on the sidelines when it comes to monetary policy. With that being the case we should get short-term softness, followed by buying near the 1.1250 level.

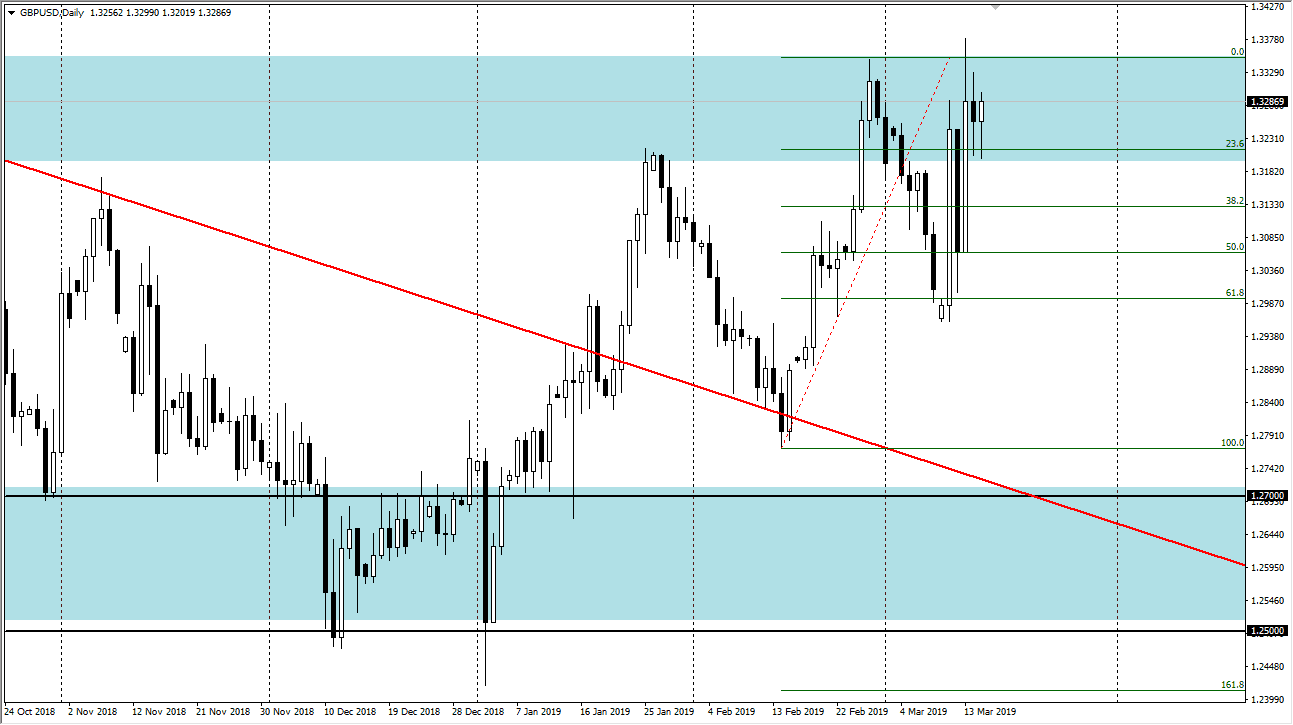

GBP/USD

The British pound initially pulled back during trading on Friday but then rallied a bit to show signs of life forming a hammer. That hammer is pressing against major resistance at the 1.3350 level, and if we can break above there the market will continue to go towards the 1.15 level. This is a market that has shown a lot of volatility as of late, and with this consolidation showing signs of strength, I do think that we will eventually break out. As the British have voted to delay the Brexit, that is good for Sterling in the short term at least, and I think at this time the Federal Reserve is staying on the sidelines, which of course will soften the greenback over the longer-term also. I like buying dips as well.