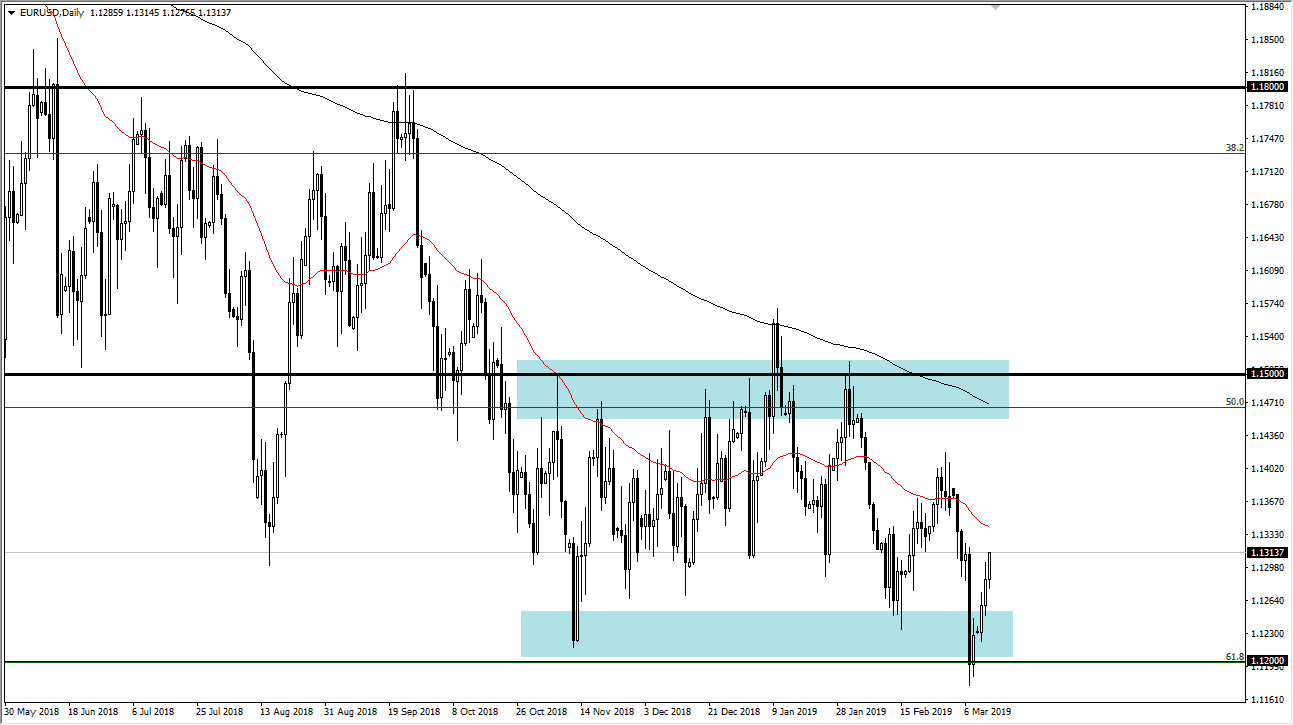

EUR/USD

The Euro initially pulled back during trading on Wednesday but then shot higher during the day as we have seen quite a bit of a bounce from the crash after the ECB press conference. In fact, as I record this video we are now wiping that entire negative candle stick out, and it looks as if we are ready to continue the overall consolidation that we had seen. With that in mind, it looks as if the Euro is very strong, at least in the short term, and therefore I think we are getting ready to continue the overall consolidation between the 1.12 level on the bottom and the 1.15 level on the top. With that in mind, I believe that short-term dips should offer buying opportunities and we will continue to grind higher. Keyword here of course is “grind.”

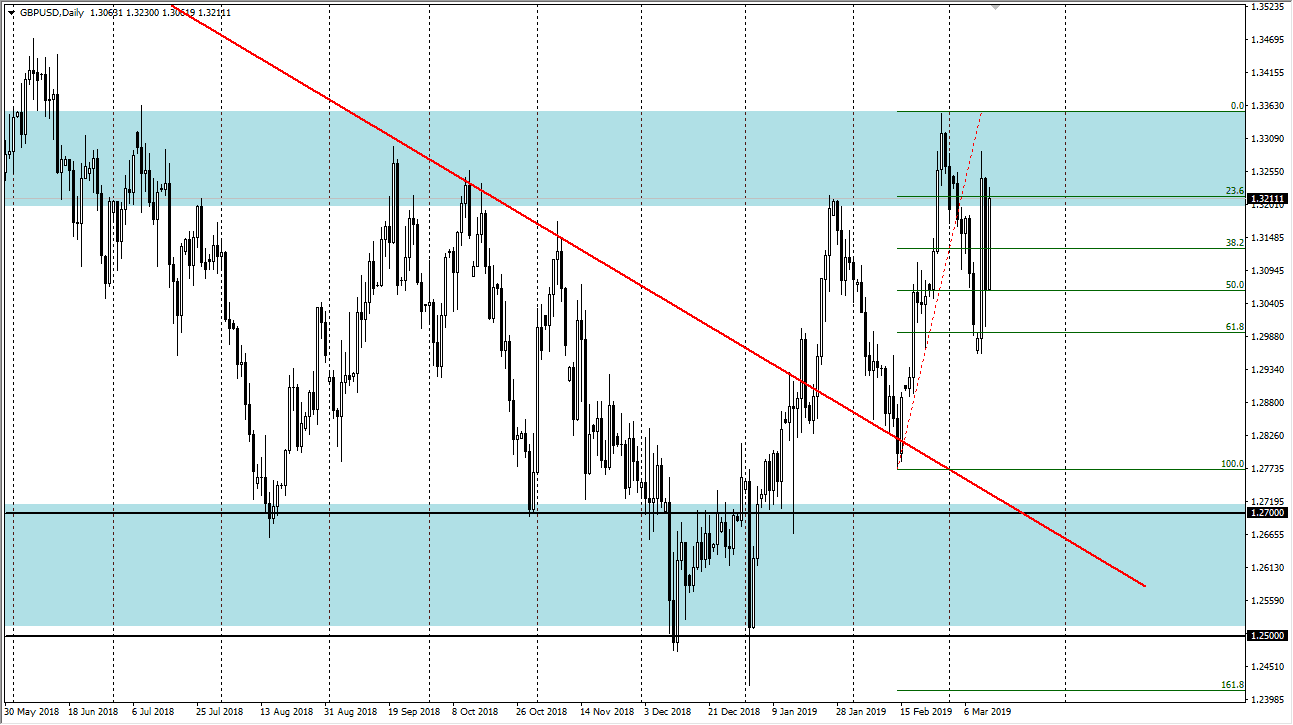

GBP/USD

The British pound rallied a bit during the trading session on Wednesday in preparation of the parliamentary vote, but at the end of the day we are simply consolidating overall. We have wiped out the selloff during the previous session, and we still have all of the same support and resistance levels to pay attention to. The 1.30 level underneath is supportive as it clusters around the 61.8% Fibonacci retracement level, but at the same time there is a significant amount of resistance at the 1.3375 handle. Ultimately, this is a “buy on the dips” scenario, unless of course for some reason the parliament votes to leave the European Union without any type of agreement. That seems to be very unlikely, but even if it does I suspect it will only be an opportunity to buy the British pound at much lower levels.