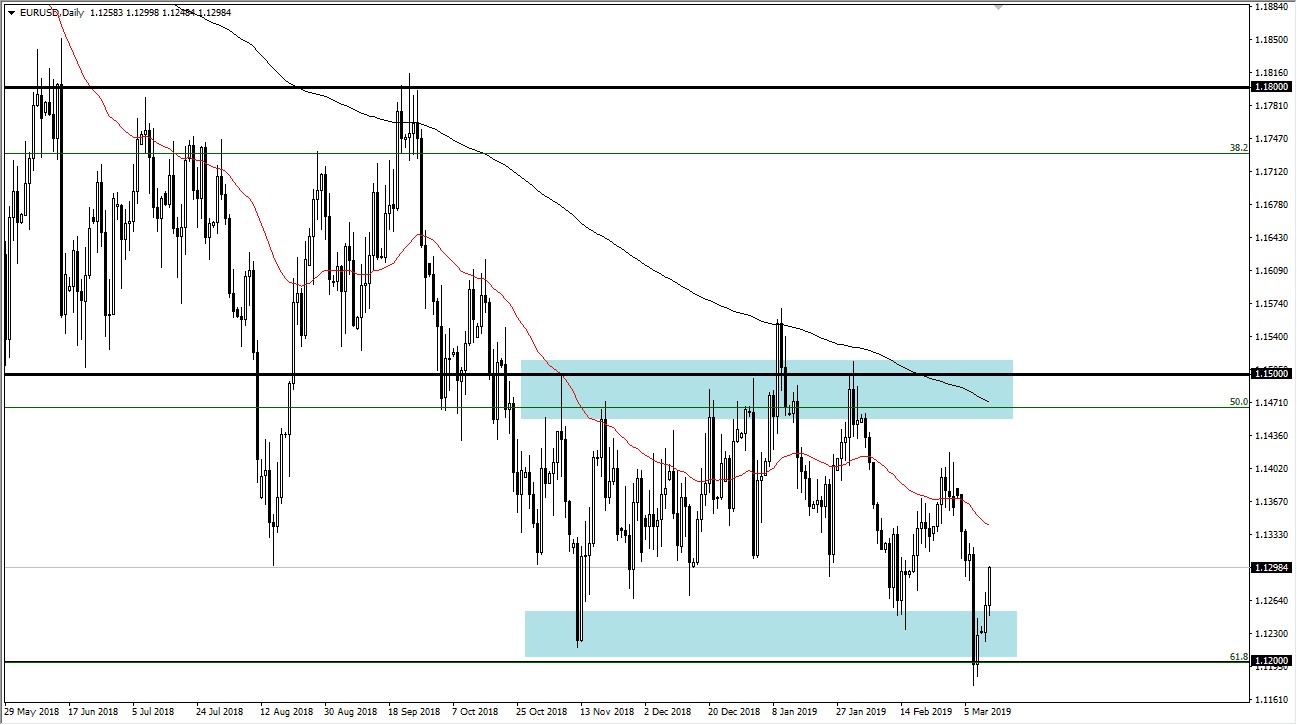

EUR/USD

The Euro rallied a bit during the trading session on Tuesday as we continue to see a bit of a recovery. In fact, by the end of the trading session on Tuesday, we were testing the 1.13 level. That’s an area that has a bit of selling attached to it, as it was the scene of the breakdown from the ECB press conference. Now that we have wiped that candlestick out, I think that a short-term pullback is likely but we should eventually go higher.

This is mainly because we are at the bottom of a larger consolidation area, as the 1.12 level has been so reliable, while the 1.15 level above has been so resistive. Because of this it’s very likely that the range has held, and as we are close to the lower part of the range, it makes sense to buy short-term pullbacks.

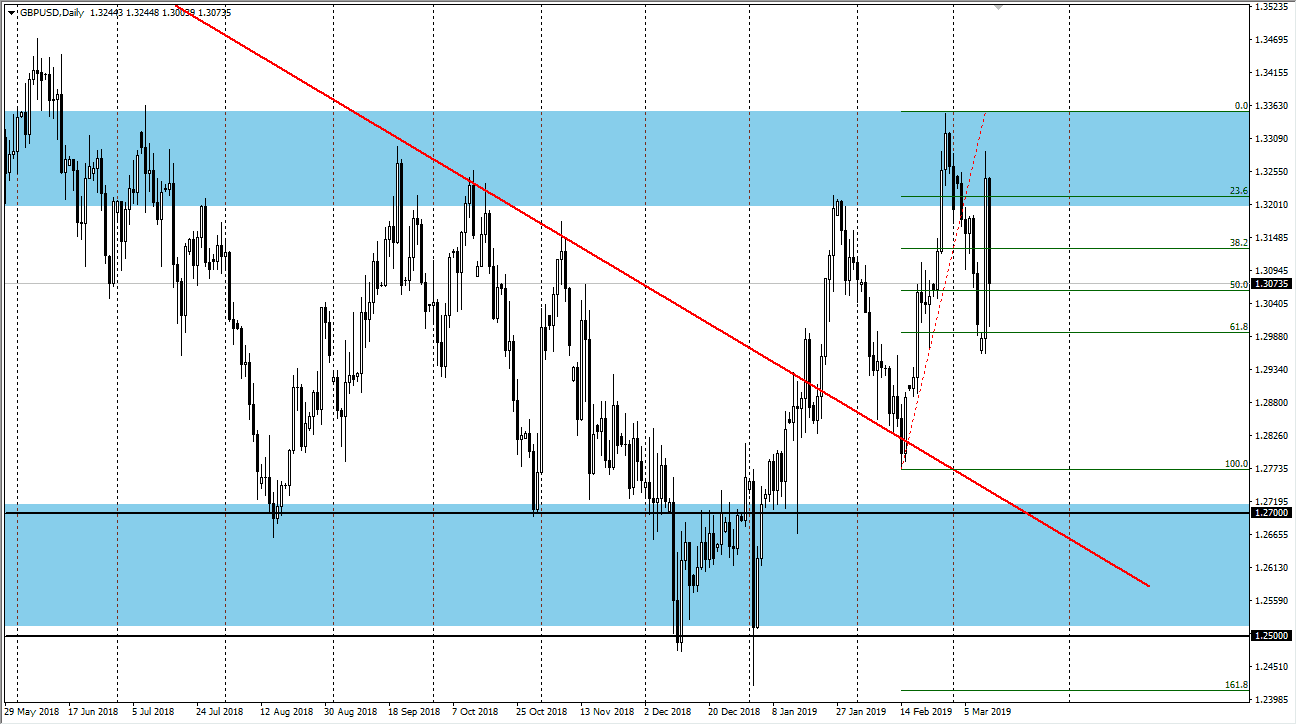

GBP/USD

The British pound fell hard during the trading session as we still await the UK parliamentary vote. It is anticipated to go poorly for Teresa May and therefore the question is whether or not there will be some type of delay in the Brexit. If there isn’t, then we could be looking at a very real “no deal Brexit” scenario. If we get that it’s likely that the British pound will fall, but as soon as it starts to stabilize all be a buyer.

From a technical analysis standpoint, we have found support at the 61.8% Fibonacci retracement level to bounce, only to give most of that back on Tuesday. I think a lot of this is simply traders being a bit cautious about owning anything ahead of the vote, so this point it’s probably best to leave this pair alone until we get some type of clarity.