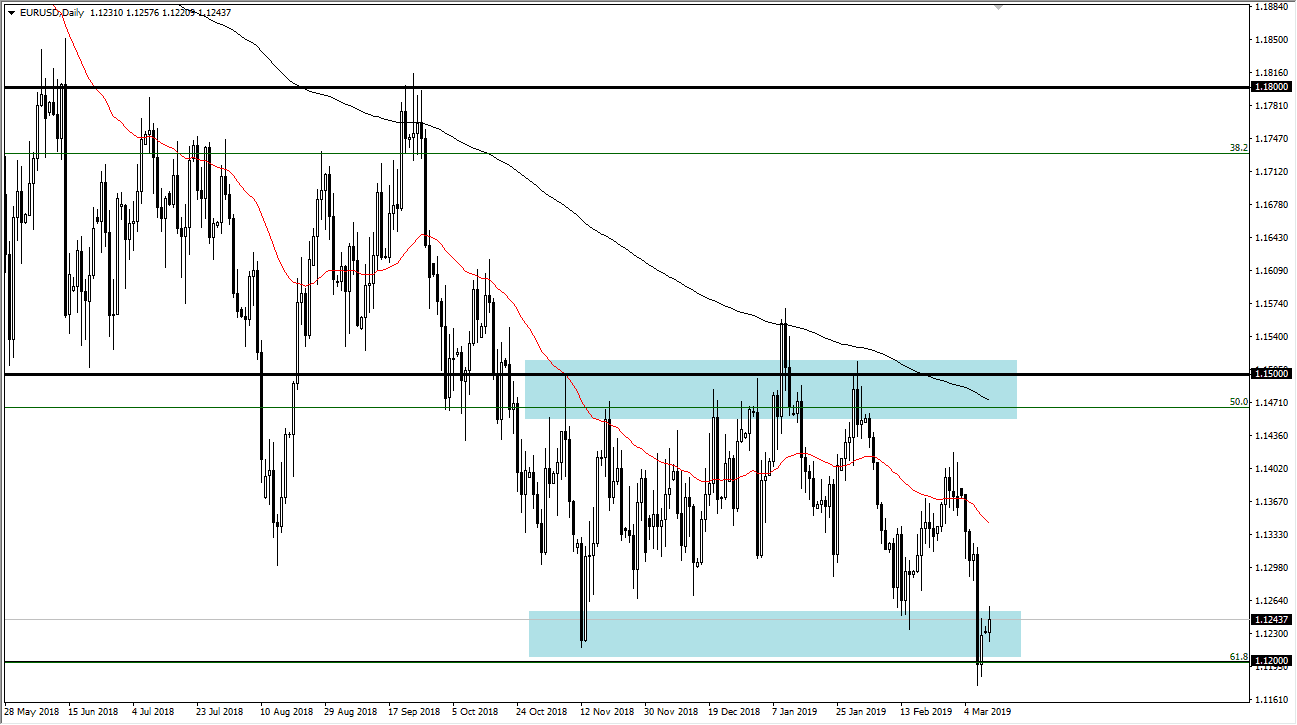

EUR/USD

The Euro rallied a bit during the trading session on Monday, as we continue to see a lot of support at the 1.12 handle. The market has recognize this is a major barrier, so it looks very likely that we are going to continue to see value hunters in this region. If we were to make a fresh, new low, then it could be a very negative sign, but until then I think we could be looking at a potential accumulation area. Even if we do have quite a bit of support though, that doesn’t mean it’s going to be easy to take out the massively negative candle from Thursday. However, I do think that given enough time we will see that happen. The alternate scenario of course is that we break down below the lows, and then at that point we probably go looking towards the 1.11 handle after that.

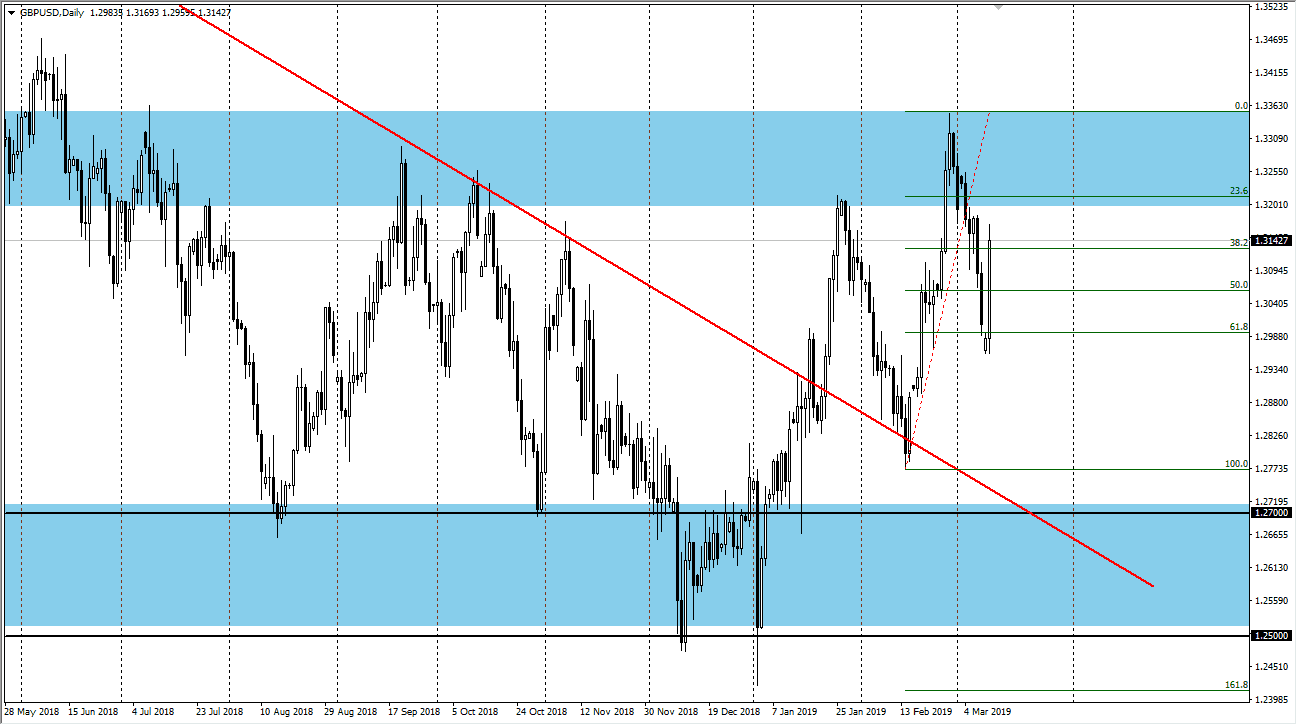

GBP/USD

The British pound took off to the upside during trading on Monday as traders came back to work. The 61.8% Fibonacci retracement level has offered a lot of support, and traitors are starting to jockey for position ahead of the crucial vote during the session on Tuesday when it comes to the UK parliament. That being said, this is not an easy trade to take but it certainly looks as if the British pound is going to continue to find buyers on dips. The only thing that’s going to be truly negative is if we get a “no deal Brexit.” Even if we get that, it’s only a matter of time before the buyers come back in, because there’s some certainty in that, something that the market simply has not had for ages. The bottom in the British pound has already been put in, and now pullbacks continue to be buying opportunities.