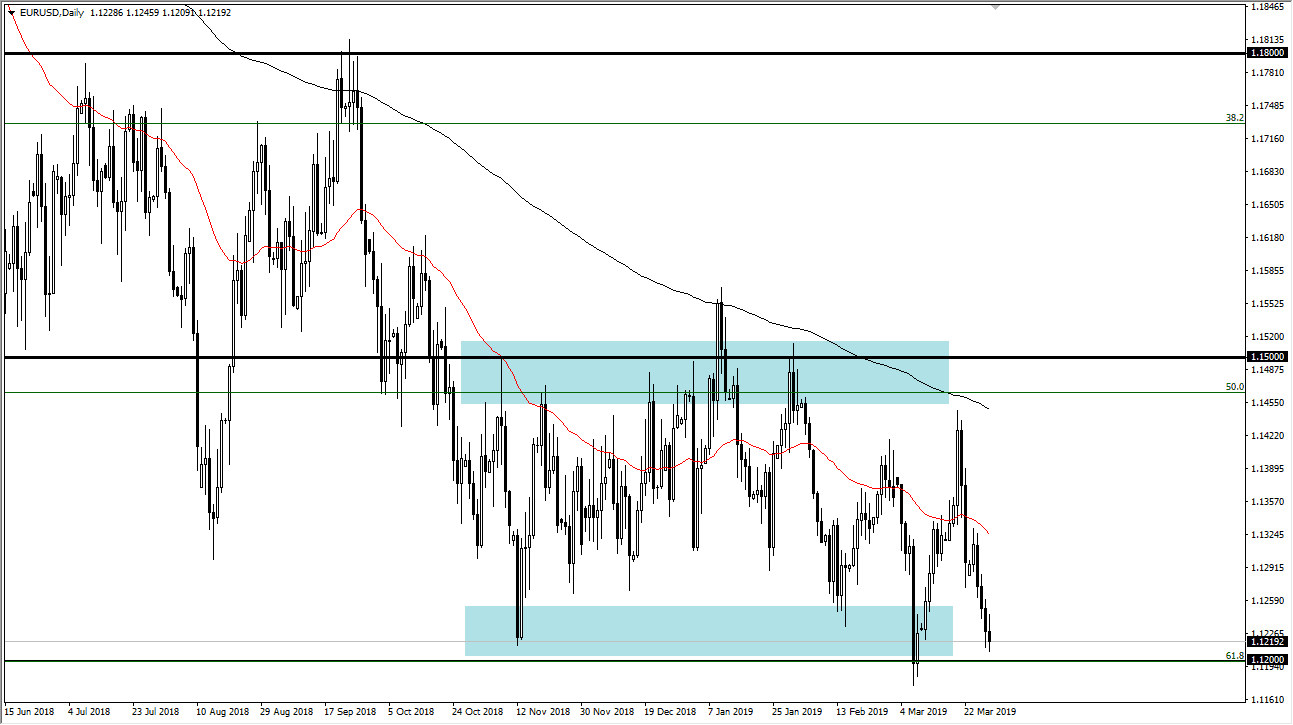

EUR/USD

The Euro initially tried to rally during the trading session on Friday, but then fell rather hard yet again. This is a market that struggles overall to define itself as we are still within the consolidation area. The market has been dancing around between the 1.12 level on the bottom and the 1.15 level above, and although things look rather dire, they have fallen like this before. The question now is whether or not we can hold here? Until things are proven otherwise, you have to assume that they will. That doesn’t mean that it will be easy to buy, but it does suggest that we are very likely entering a demand zone. To the upside, we have recently made a higher high, so that is a good sign that we could hold. If we did break down below to a fresh, new low we could go down to the 1.11 handle.

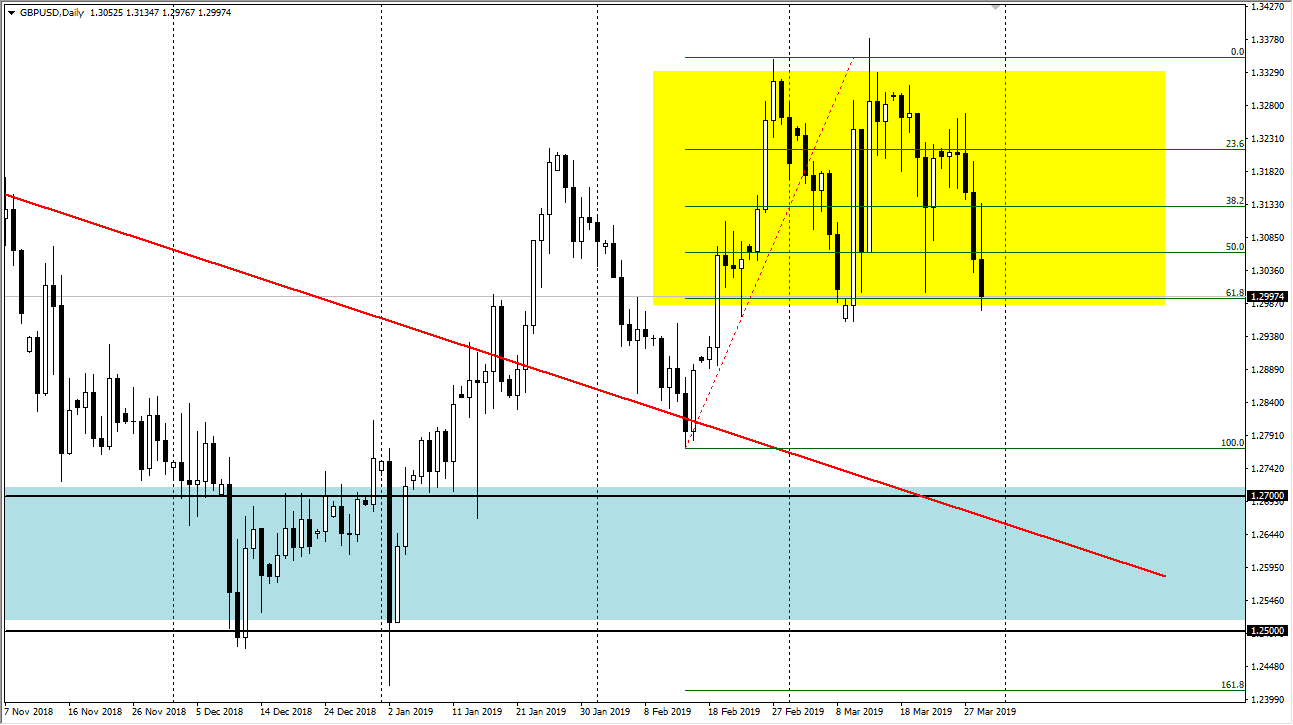

GBP/USD

The British pound continues to go back and forth overall, as we have no clarity when it comes to the Brexit yet, so therefore a volatile and violent moves are to be expected. The 1.30 level has been massive in its support, but then again we have seen the 1.3350 level offer massive resistance. I think it’s going to continue to be the same, and therefore I like playing back and forth. However, if we were to break down below the 1.30 level we could find this market going down to the 1.28 level to “reset.”

The Federal Reserve is stepping away from interest rate hikes for the rest of the year so there won’t be concerned about interest rate differential so much anymore and that could help lift this pair if we get any type of good news coming out of Great Britain.