AUD/USD

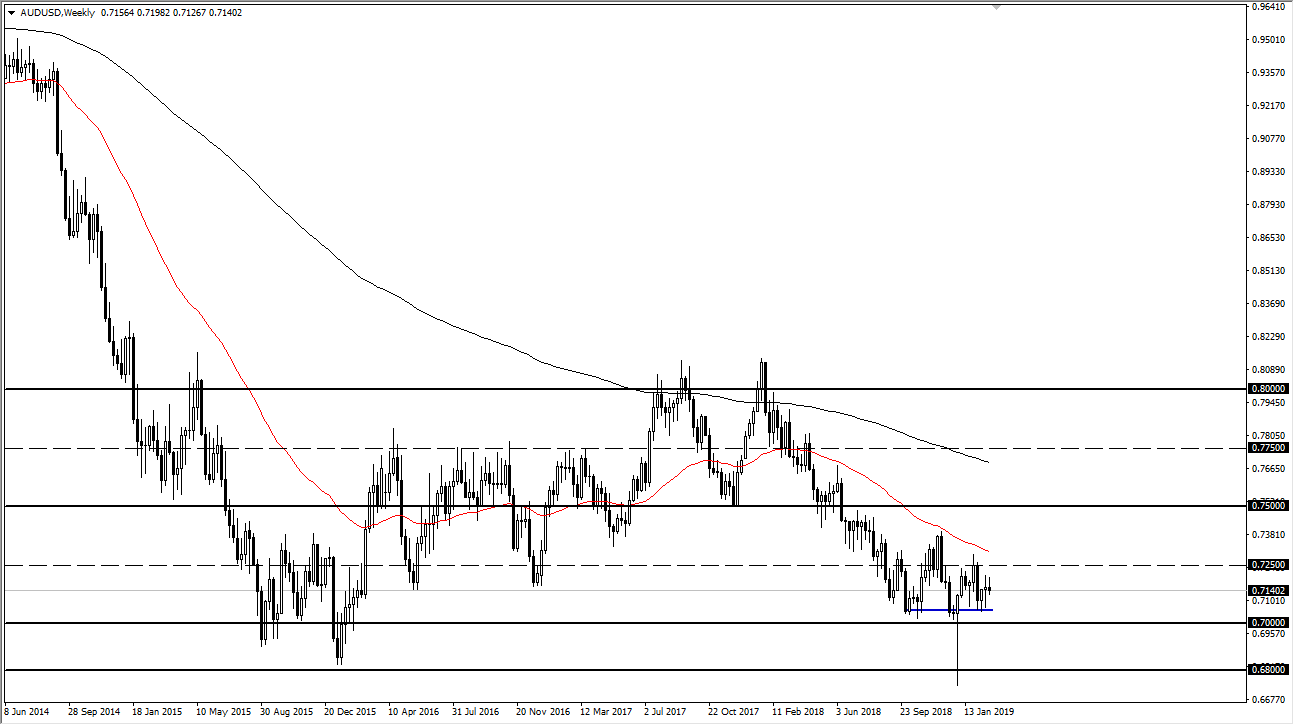

The Australian dollar has seen a lot of choppiness during the month of February after a very tumultuous January. During the month of January, if you remember, we had broken down below the 0.68 level momentarily and then shot straight back up in the air. Because of this, it brought my attention to the monthly charts. This is an area that is massive support on the monthly timeframe, so I think that March is going to feature much of the same trading action, a simple “buy on the dips” attitude.

Looking at this chart, I do think that it is going to be difficult for this market to break out to the upside as the 0.7250 level has offered a lot of resistance. However, once we get above that area then it opens the door to a move as high as 0.75 over the longer-term. I don’t know if it happens this month, but it’s obvious to me that it’s going to take something rather special to make a fresh, new low. Because of this, I believe that the Australian dollar will continue to levitate against the US dollar on pullbacks, and that short-term trading will probably be the best way to go.

A simple bit of patience will continue to offer plenty of value plays for the Aussie that you can take advantage of. If we can get some type of momentum built into the US/China trade talks, that could really get things going. We already know that the Federal Reserve is trying to soften the greenback.