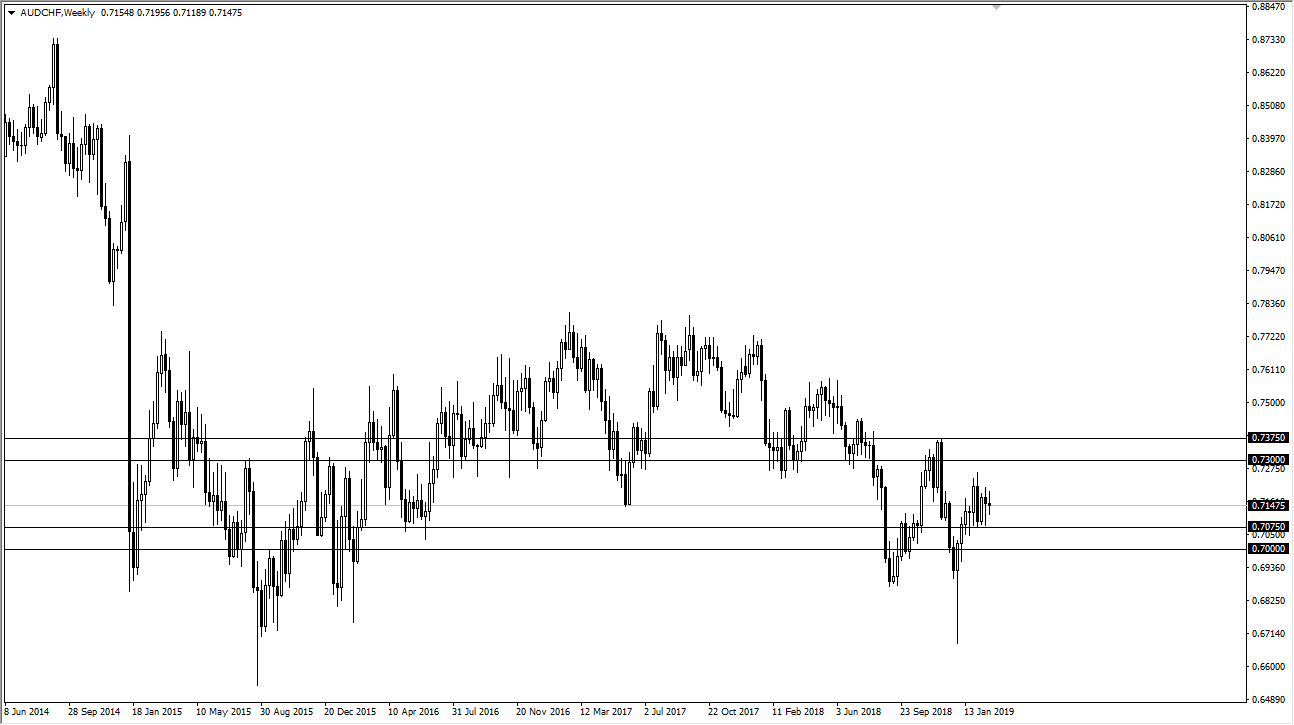

AUD/CHF

The Australian dollar has chop around against many of the world’s largest currencies, and the Swiss franc hasn’t been any different. When you look at this weekly chart, it looks identical to the US dollar, which makes quite a bit of sense considering that the US dollar is trading at parity with the franc. That being said, we have a major support level just below that should continue to contain this market and we are very likely to see a bit of a “double bottom” on the weekly, if not monthly charts.

With that being the case, I believe that the Australian dollar will also buyers against the Swiss franc, just as it will the US dollar. There is no reason to think that the Swiss franc is going to suddenly appreciate markedly, unless of course there is some type a huge run to safety, and then all bets would be off. Remember, Switzerland that since 85% of its exports into the European Union which looks a bit soft at the moment.

With that being the case, and if we can get some type of good news coming from the Chinese, which has been seen recently in stock market prices, this makes a logical place to start buying. Beyond that, this pair does tend to be very sensitive to the overall risk appetite, so pay attention to the world’s stock markets as they can give you a heads up. I believe that the market is a “buy on the dips” scenario, but I’m not looking for a home right here.