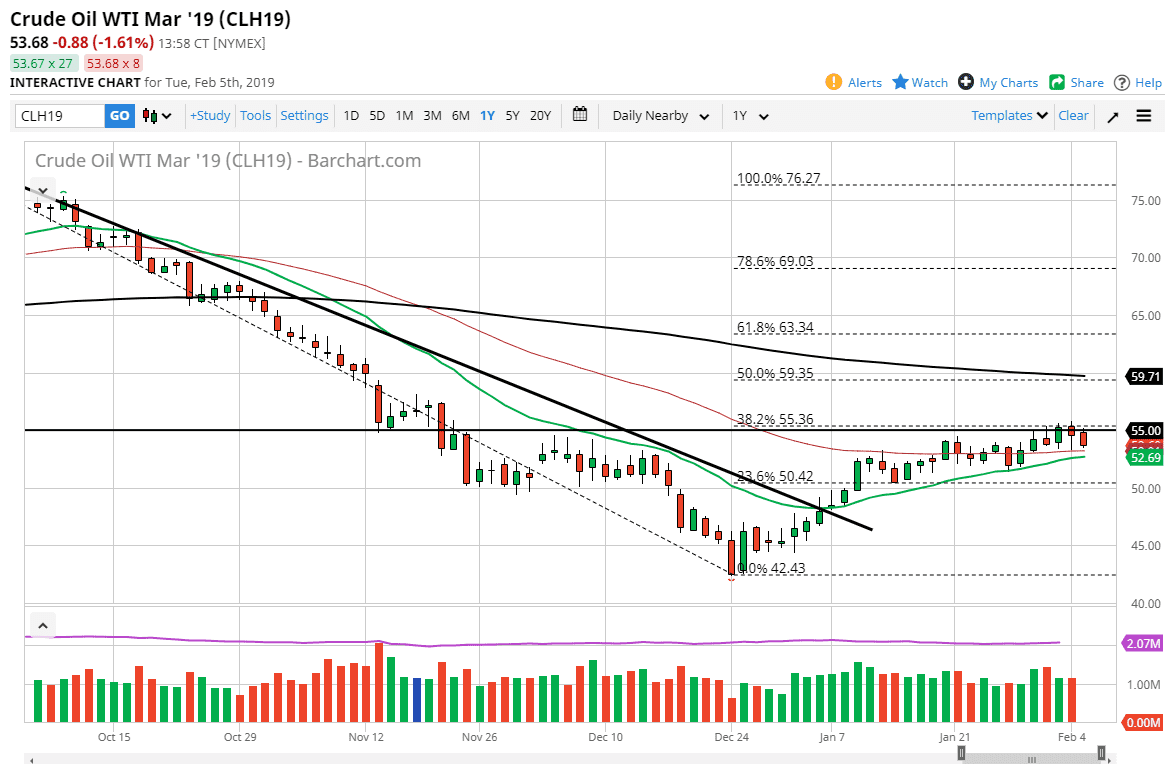

WTI Crude Oil

The WTI Crude Oil market fell during the trading session on Tuesday, reaching down towards the bottom of the hammer from the Monday session. That’s a very negative turn of events, but at this point as long as we can stay above the 50 day EMA, pictured in maroon on the chart, then we could possibly rally again, perhaps reaching towards the $55 level. That’s an area that is massive resistance though, so it’s going to take some work to get above there. Ultimately, we will making an impulsive decision as to which direction were going to go, but right now we are still essentially banging on the door of resistance and waiting to see whether or not we can finally overcome it. A daily close below the 20 day EMA, the green EMA on the chart, then we could break down to the $50 level.

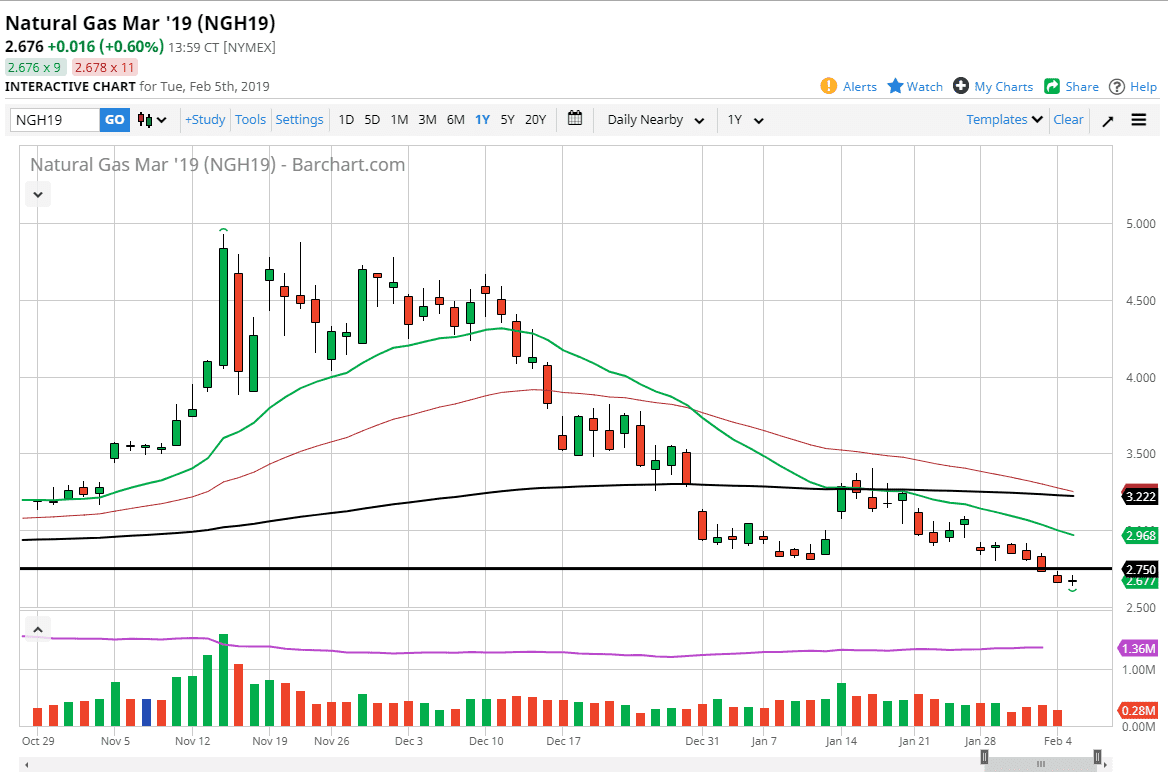

Natural Gas

Natural gas markets did very little during the trading session on Tuesday, reaching towards the $2.75 level but giving back again. This is a choppy candle and it looks likely that we are going to continue to see quite a bit of chop. Quite frankly, I think that the market needs to rally it a bit of a “dead cat bounce”, as we have fallen too far. The 20 day EMA above should offer resistance, but regardless I think it’s only a matter of time before we see some type of exhaustive candle that we can start shorting yet again. I have no interest in buying natural gas, the oversupply continues to be a major issue. Below, the $2.50 level is a hard floor in the market.